Question: Please answer and explain how you got it 10 Our portfolio consists of $50,000 invested in Stock x and S50,000 invested in Stock Y. Both

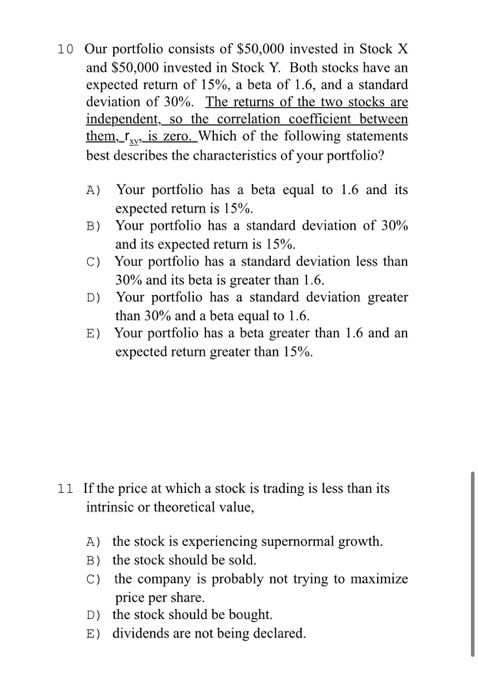

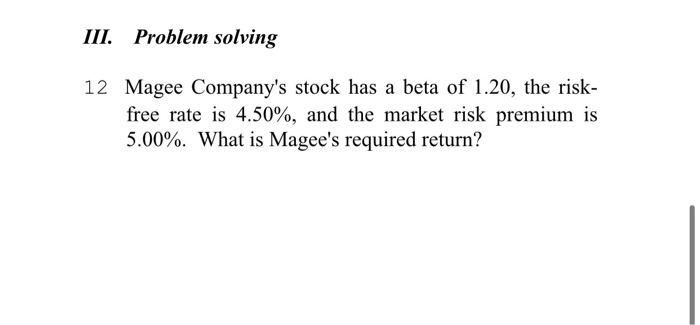

10 Our portfolio consists of $50,000 invested in Stock x and S50,000 invested in Stock Y. Both stocks have an expected return of 15%, a beta of 1.6, and a standard deviation of 30%. The returns of the two stocks are independent, so the correlation coefficient between them r is zero Which of the following statements best describes the characteristics of your portfolio? A) Your portfolio has a beta equal to 1.6 and its expected return is 15% B) Your portfolio has a standard deviation of 30% and its expected return is 15%. C) Your portfolio has a standard deviation less than 30% and its beta is greater than 1.6 D) Your portfolio has a standard deviation greater than 30% and a beta equal to 1.6. E) Your portfolio has a beta greater than 1.6 and an expected return greater than 15% 11 If the price at which a stock is trading is less than its intrinsic or theoretical value, the stock is experiencing supernormal growth. A) the stock should be sold. B) C) the company is probably not trying to maximize price per share. D) the stock should be bought. E) dividends are not being declared. III. Problem solving 12 Magee Company's stock has a beta of 1.20, the risk- free rate is 4.50%, and the market risk premium is 5.00%. What is Magee's required return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts