Question: Please answer and explain. Pt. A Pt.B Pt. C Thanks!! Entries for bad debt expense under the direct write-off and allowance methods ournal Final Question

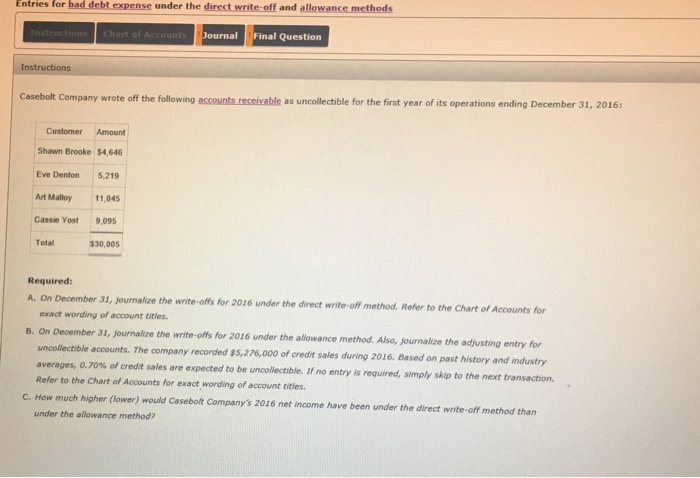

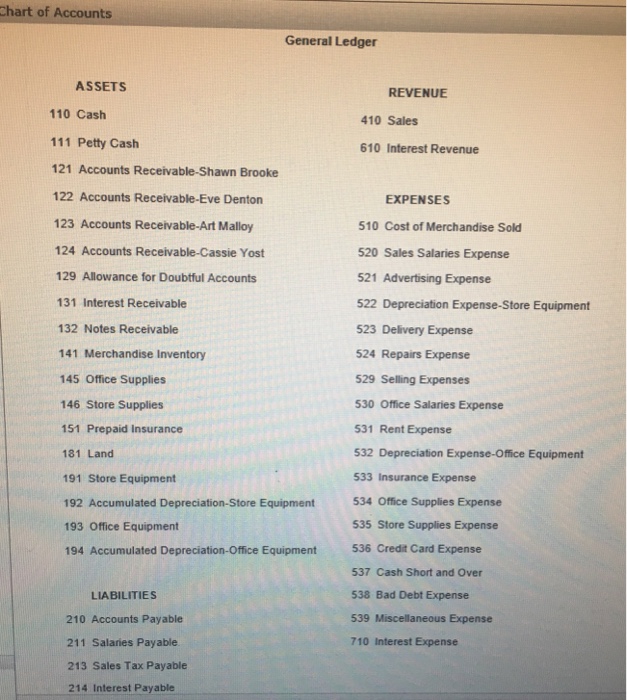

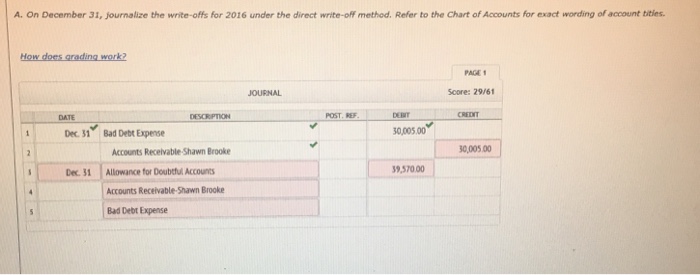

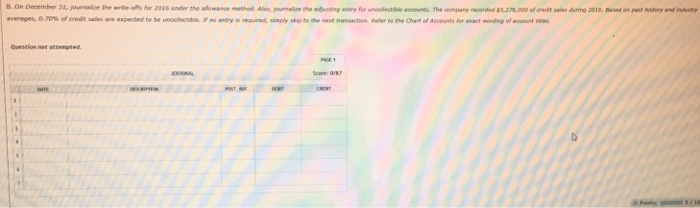

Entries for bad debt expense under the direct write-off and allowance methods ournal Final Question Casebolt Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31, 2016: Customer Amount Shawn Brooke $4,646 Eve Denton $,219 Art Malloy 11,045 Cassie Yost 9,095 $30,005 Tetal Required: A. On December 31, journalize the write-offs for 2016 under the direct write-off method. Refer to the Chart of Accounts for exact wording of account titles. On December 31, journalize the write-offs for 2016 under the allowance method. Also, journalize the adjusting entry for uncollectible accounts. The company recorded ss,276,000 of credit sales during 2016. Based on past history and industry averages, 0.70% of credit sales are expected to be uncollectible. If no entry is required, singly skip to the net transaction. Refer to the Chart of Accounts for exact wording of account titles c. How much higher (lower) would Casebolt Company's 2016 net income have been under the direct write-off method than under the allowance method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts