Question: Please answer and explain. Thank you! File Home Insert Data ReviewView Tell me what you want to do Arial General ab Paste Conditionr 9 6090

Please answer and explain. Thank you!

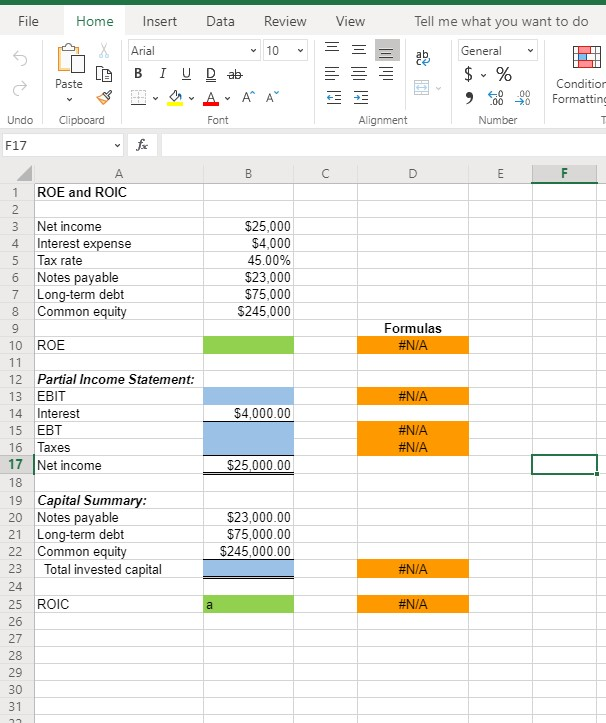

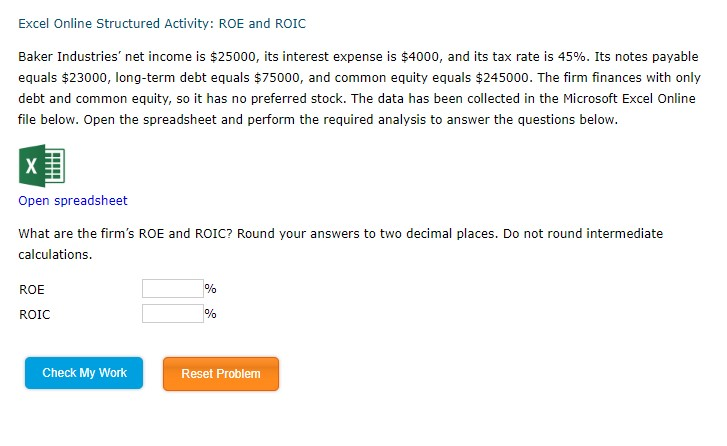

File Home Insert Data ReviewView Tell me what you want to do Arial General ab Paste Conditionr 9 6090 Formatting Undo Clipboard Font Alignment Number F17 1 ROE and ROIC 3 Net income 4 Interest expense 5 Tax rate 6 Notes payable 7 Long-term debt 8 Common equity $25,000 $4,000 45.00% $23,000 $75,000 $245,000 Formulas 10 ROE 12 Partial Income Statement: 13 EBIT 14 Interest 15 EBT 16 Taxes 17 Net income 18 19 Capital Summary 20 Notes payable 21 Long-term debt 22 Common equity 23 Total invested capital $4,000.00 $25,000.00 $23,000.00 $75,000.00 $245,000.00 25 ROIO 27 28 29 30 31 Excel Online Structured Activity: ROE and ROIC Baker Industries, net income is $25000, its interest expense is $4000, and its tax rate is 45%. Its notes payable equals $23000, long-term debt equals $75000, and common equity equals $245000. The firm finances with only debt and common equity, so it has no preferred stock. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet What are the firm's ROE and ROIC? Round your answers to two decimal places. Do not round intermediate calculations ROE ROIC Check My Work Reset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts