Question: Please answer and Explain, Thankyou!!! I. Consider a risky portfolio. The end of year cash flow derived from the portfolio will be either $100,000 or

Please answer and Explain, Thankyou!!!

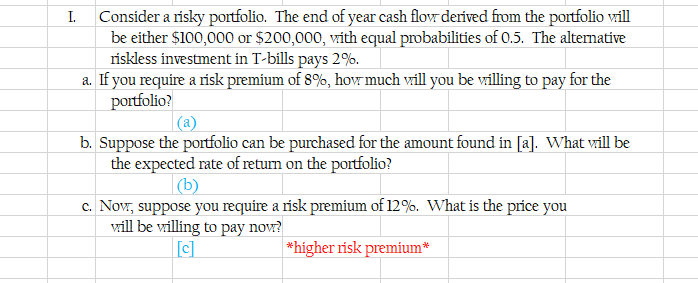

I. Consider a risky portfolio. The end of year cash flow derived from the portfolio will be either $100,000 or $200,000, with equal probabilities of 0.5. The alternative riskless investment in T-bills pays 2%. a. If you require a risk premium of 8%, how much will you be willing to pay for the portfolio? (a) b. Suppose the portfolio can be purchased for the amount found in [a]. What will be the expected rate of return on the portfolio? c. Now, suppose you require a risk premium of 12%. What is the price you will be willing to pay now? [c *higher risk premium*

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock