Question: please answer and explain the D question Skinny Dippers, Inc. produces nonfat frozen yogurt. The product is sold in five-gallon containers, which have the following

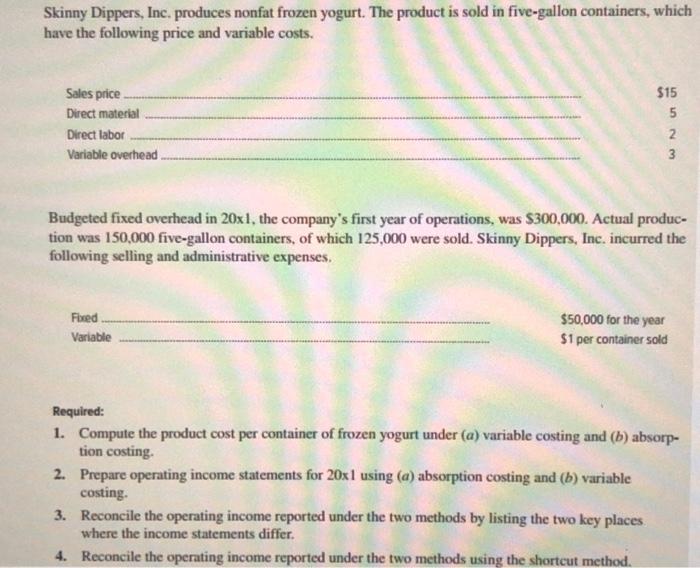

Skinny Dippers, Inc. produces nonfat frozen yogurt. The product is sold in five-gallon containers, which have the following price and variable costs. Sales price Direct material Direct labor Variable overhead $15 5 2 3 w Non Budgeted fixed overhead in 20x1, the company's first year of operations, was $300,000. Actual produc- tion was 150,000 five-gallon containers, of which 125,000 were sold. Skinny Dippers, Inc. incurred the following selling and administrative expenses. Fixed Variable $50,000 for the year $1 per container sold Required: 1. Compute the product cost per container of frozen yogurt under (a) variable costing and (b) absorp- tion costing. 2. Prepare operating income statements for 20x 1 using (a) absorption costing and (b) variable costing. 3. Reconcile the operating income reported under the two methods by listing the two key places where the income statements differ, 4. Reconcile the operating income reported under the two methods using the shortcut method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts