Question: Please answer and explain why Required information The following information applies to the guestions displayed below 1 This year Jack intends to file a married

Please answer and explain why

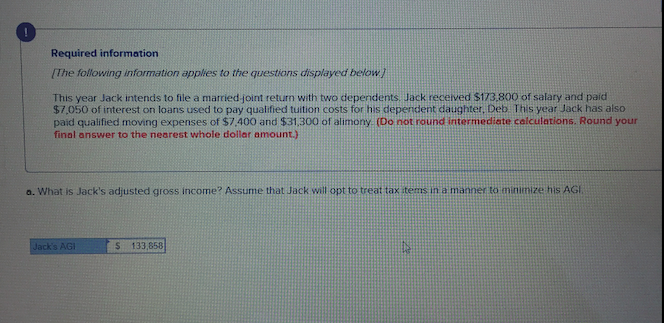

Required information The following information applies to the guestions displayed below 1 This year Jack intends to file a married joint return with two dependents. Jack received $173,800 of salary and paid $7.050 of interest on loans used to pay qualified tuition costs for his dependent daughter. Deb This year Jack has also paid qualified moving expenses of $7400 and $31,300 of alimony. (Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.) a. What is Jack's adjusted gross income? Assume that Jack will opt to treat tax tems in a manner to minimize his AGI S 133,858

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts