Question: please answer and explane , thank you in advance , MULTIPLE CHOICE. Choose the one attemative that best completes the statement or answers the question.

please answer and explane , thank you in advance ,

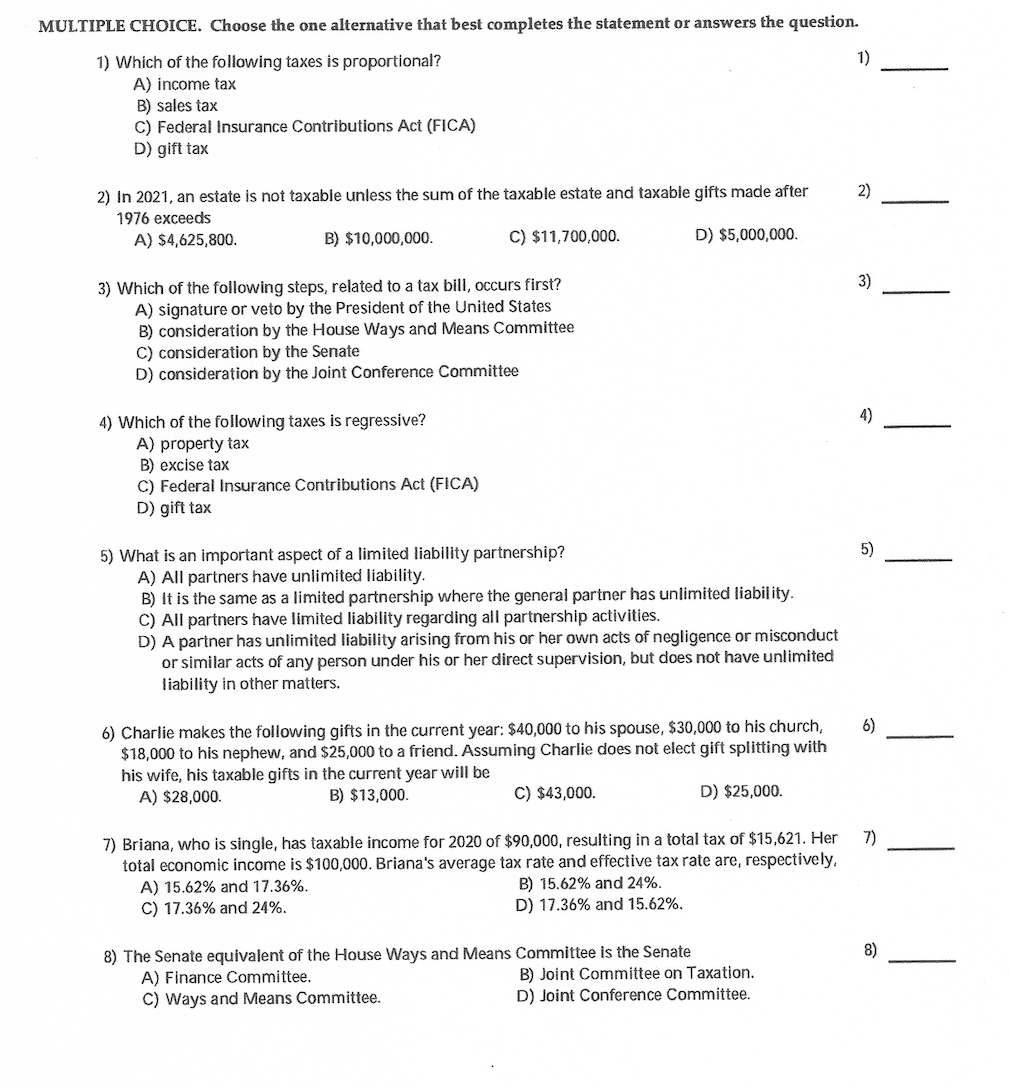

MULTIPLE CHOICE. Choose the one attemative that best completes the statement or answers the question. 1) Which oflhe following taxes is proportional? 1) A} income tax ' B) sales tax C) Federal insurance Contributions Act {FICA} D} gift tax 2) In 2021. an estate is not taxable unless the sum of the taxable estate and taxable gifts made after 2) 1916 exceeds A) 54.625300. 0) $10,000,000. C) $1 1.700.000. D) 35.000.000. 3] Which of the following steps. related to a tax bill. occurs first? 3) A) signature or veto by the President of the United States 3) consideration by the House Ways and Means Committee C) consideration by the Senate D) consideration by the Joint Conference Committee 4} Which of the following taxes is regressive? 4) A) property tax B} excise tax C) Federal insurance Contributions Act (FICA) D) gift tax 5) What Is an Important aspect of a limited liability partnership? 5] A) All partners have unlimited liability. B) it is the same as a limited pa rtnershlp where the general partner has unlimited liability. C) All partners have limited liability regarding all partnership activities. D} A partner has unlimited liability arising from his or her own acts of negligence or misconduct or similar acts of any person under his or her direct supervision. but does not have unlimited Itabl lily In other matters. 6) Charlie makes the following gifts in the wrrent year: $40.00!] to his spouse. 530.000 to his church. 6) $18,000 to his nephew. and $25,000 to a friend. Assuming Charlie does not elect gift splitting with his wife, his taxable gifts in the current year will be A) $28,000. B} $13,000. 6) 343.000. D} $25,000. 7} Briana. who is single. has taxable income for 2020 of $90,000. resulting in a total tax of $15,621. Her 1) total eclmomlc income is $100,000. Briana's average tax rate and effective tax rate are, respectively. A) 15.62% and 17.36%. B} 15.02% and 24%. C) 17.36% and 24%. D) 17.36% and 15.62%. 8) The Senate equivalent of the House Ways and Means Committee Is the Senate 8) A) Finance Committee. 3} Joint Committee on Taxation. C} Ways and Means Committee. D) Joint Conference Committee

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts