Question: please answer and explane , thank you in advance , 11) All of the following statements regarding self-employment income/tax are true except 11) A) independent

please answer and explane , thank you in advance ,

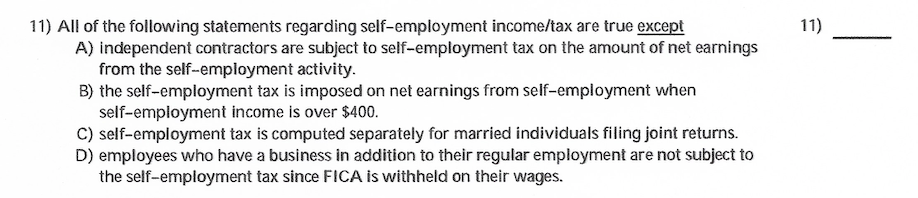

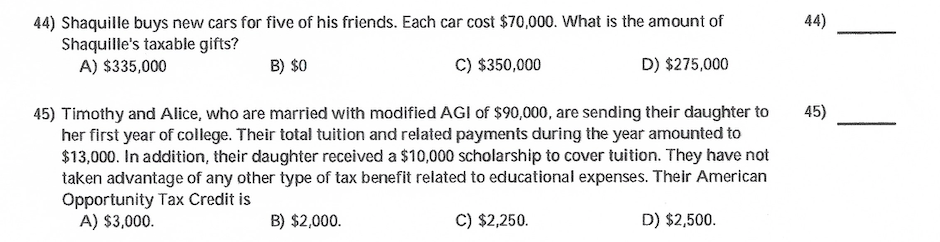

11) All of the following statements regarding self-employment income/tax are true except 11) A) independent contractors are subject to self-employment tax on the amount of net earnings from the self-employment activity. B) the self-employment tax is imposed on net earnings from self-employment when self-employment income is over $400. C) self-employment tax is computed separately for married individuals filing joint returns. D) employees who have a business in addition to their regular employment are not subject to the self-employment tax since FICA is withheld on their wages.44) Shaquille buys new cars for five of his friends. Each car cost $70,000. What is the amount of 44) Shaquille's taxable gifts? A) $335,000 B) $0 C) $350,000 D) $275,000 45) Timothy and Alice, who are married with modified AGI of $90,000, are sending their daughter to 45) her first year of college. Their total tuition and related payments during the year amounted to $13,000. In addition, their daughter received a $10,000 scholarship to cover tuition. They have not taken advantage of any other type of tax benefit related to educational expenses. Their American Opportunity Tax Credit is A) $3,000. B) $2,000. C) $2,250. D) $2,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts