Question: Please answer and provide complete and simple explanation for this will be a class reporting LONG-TERM FINANCING NEEDED Atyear-end 2015, total assets for Ambrose Inc.

Please answer and provide complete and simple explanation for this will be a class reporting

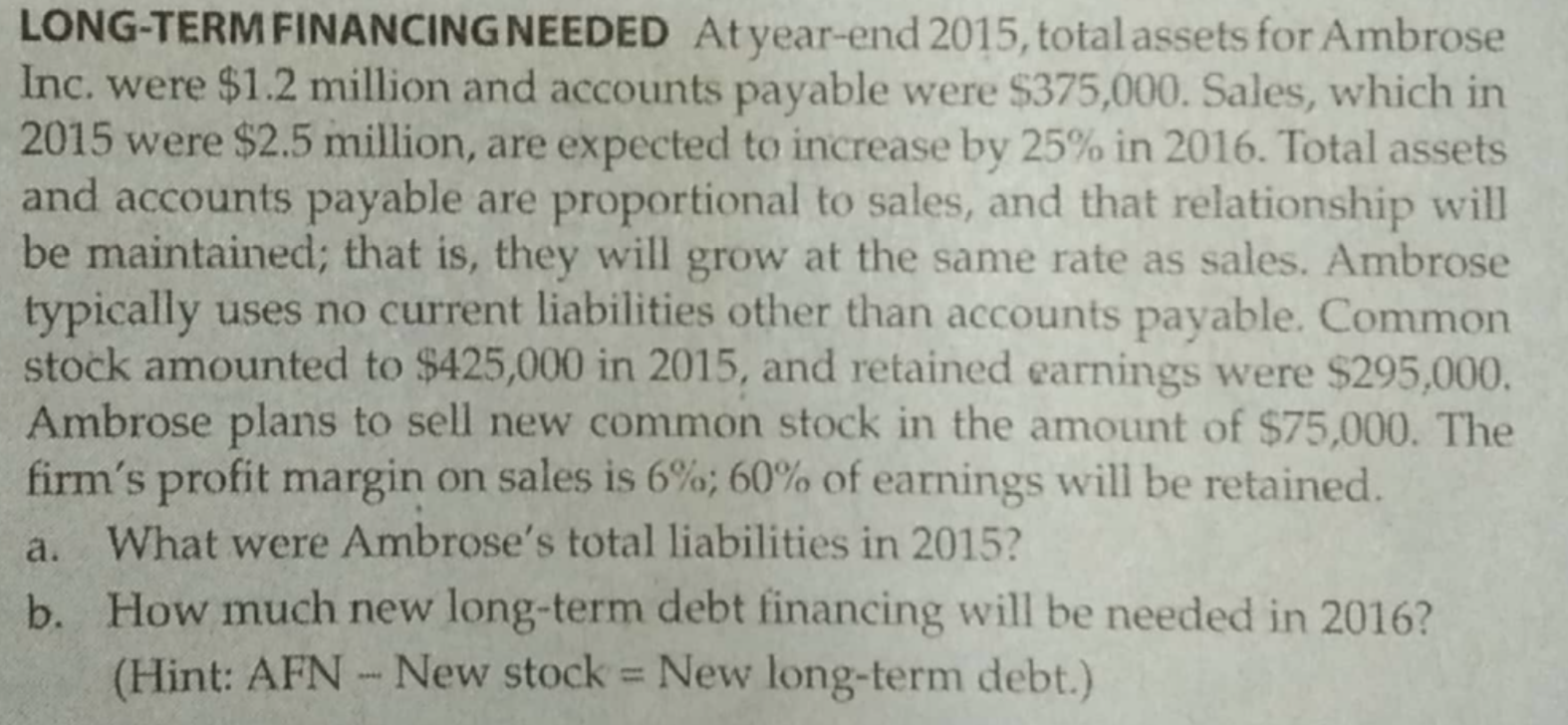

LONG-TERM FINANCING NEEDED Atyear-end 2015, total assets for Ambrose Inc. were $1.2 million and accounts payable were $375,000. Sales, which in 2015 were $2.5 million, are expected to increase by 25% in 2016. Total assets and accounts payable are proportional to sales, and that relationship will be maintained; that is, they will grow at the same rate as sales. Ambrose typically uses no current liabilities other than accounts payable. Common stock amounted to $425,000 in 2015, and retained earnings were $295,000, Ambrose plans to sell new common stock in the amount of $75,000. The firm's profit margin on sales is 6%; 60% of earnings will be retained. a. What were Ambrose's total liabilities in 2015? b. How much new long-term debt financing will be needed in 2016? (Hint: AFN - New stock = New long-term debt.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts