Question: please answer and round to what i need exactly AFN equation Broussard Skateboard's sales are expected to increase by 25% from $7.0 million in 2018

please answer and round to what i need exactly

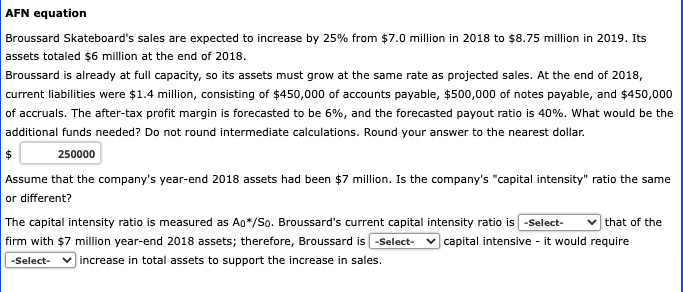

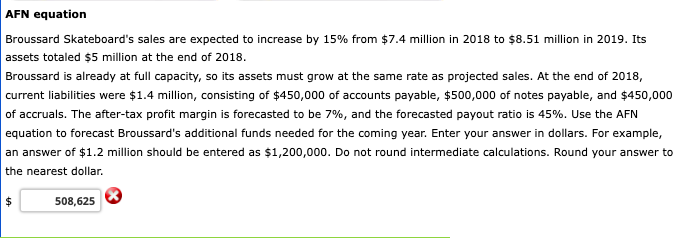

AFN equation Broussard Skateboard's sales are expected to increase by 25% from $7.0 million in 2018 to $8.75 million in 2019 . Its assets totaled $6 million at the end of 2018. Broussard is already at full capacity, so its assets must grow at the same rate as projected sales. At the end of 2018 , current liabilities were $1.4 million, consisting of $450,000 of accounts payable, $500,000 of notes payable, and $450,000 of accruals. The after-tax profit margin is forecasted to be 6%, and the forecasted payout ratio is 40%. What would be the additional funds needed? Do not round intermediate calculations. Round your answer to the nearest dollar. $ Assume that the company's year-end 2018 assets had been \$7 million. Is the company's "capital intensity" ratio the same or different? The capital intensity ratio is measured as A0/S0. Broussard's current capital intensity ratio is that of the firm with $7 million year-end 2018 assets; therefore, Broussard is capital intensive - it would require increase in total assets to support the increase in sales. Broussard Skateboard's sales are expected to increase by 15% from $7.4 million in 2018 to $8.51 million in 2019 . Its assets totaled $5 million at the end of 2018 . Broussard is already at full capacity, so its assets must grow at the same rate as projected sales. At the end of 2018 , current liabilities were $1.4 million, consisting of $450,000 of accounts payable, $500,000 of notes payable, and $450,000 of accruals. The after-tax profit margin is forecasted to be 7%, and the forecasted payout ratio is 45%. Use the AFN equation to forecast Broussard's additional funds needed for the coming year. Enter your answer in dollars. For example, an answer of $1.2 million should be entered as $1,200,000. Do not round intermediate calculations. Round your answer to the nearest dollar. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts