Question: Please answer and show all steps for me will give thumbs up thanks Question Ellicottville Inc. has identified the following overhead activities, costs, and activity

Please answer and show all steps for me will give thumbs up thanks

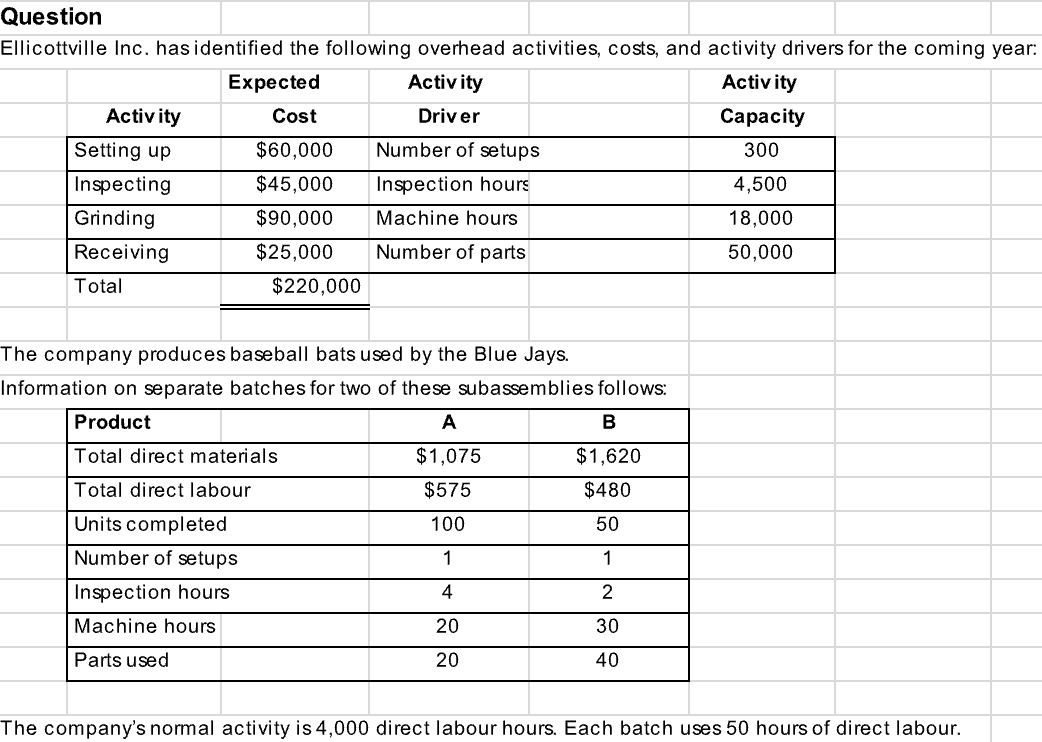

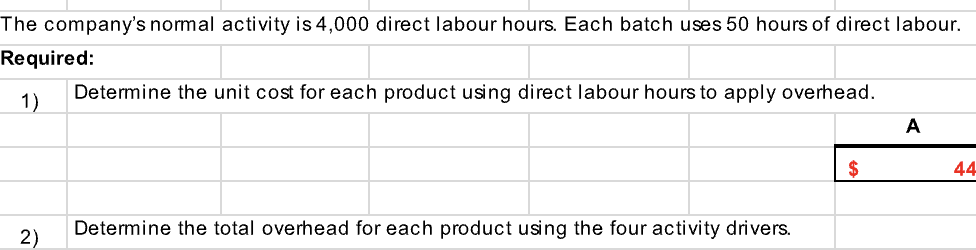

Question Ellicottville Inc. has identified the following overhead activities, costs, and activity drivers for the coming year: \begin{tabular}{|l|c|c|c|} \hline \multicolumn{1}{|c|}{ Activity } & Expected & Activity & Activity \\ \hline Setting up & $60,000 & Dumber of setups & Capacity \\ \hline Inspecting & $45,000 & Inspection hours & 300 \\ \hline Grinding & $90,000 & Machine hours & 4,500 \\ \hline Receiving & $25,000 & Number of parts & 18,000 \\ \hline Total & $220,000 & 50,000 \\ \hline \hline \end{tabular} The company produces baseball bats used by the Blue Jays. Information on separate batches for two of these subassemblies follows: \begin{tabular}{|l|c|c|} \hline Product & A & B \\ \hline Total direct materials & $1,075 & $1,620 \\ \hline Total direct labour & $575 & $480 \\ \hline Units completed & 100 & 50 \\ \hline Number of setups & 1 & 1 \\ \hline Inspection hours & 4 & 2 \\ \hline Machine hours & 20 & 30 \\ \hline Parts used & 20 & 40 \\ \hline \end{tabular} The company's normal activity is 4,000 direct labour hours. Each batch uses 50 hours of direct labour. The company's normal activity is 4,000 direct labour hours. Each batch uses 50 hours of direct labour. Required: 1) Determine the unit cost for each product using direct labour hours to apply overhead. 2) Determine the total overhead for each product using the four activity drivers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts