Question: Please answer and show all the work on calculator not on excel. Thank you Please answer question 10,11,12,13,14,15,16 10. Calculating Portfolio Betas You own a

Please answer and show all the work on calculator not on excel. Thank you

Please answer question 10,11,12,13,14,15,16

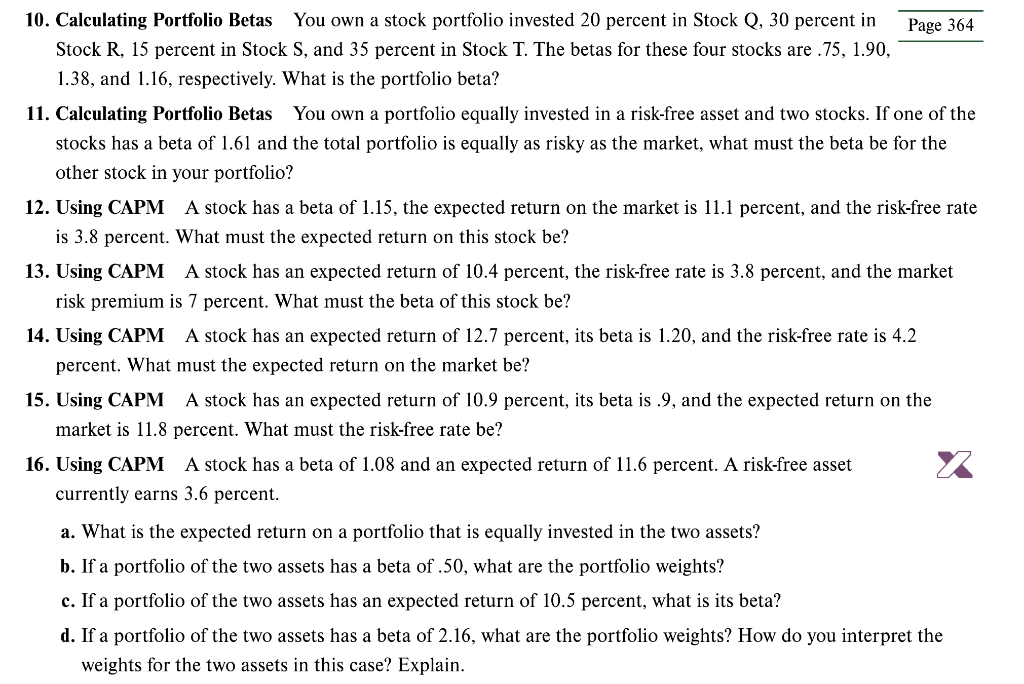

10. Calculating Portfolio Betas You own a stock portfolio invested 20 percent in Stock Q, 30 percent in Stock R, 15 percent in Stock S, and 35 percent in Stock T. The betas for these four stocks are .75, 1.90, 1.38 , and 1.16 , respectively. What is the portfolio beta? 11. Calculating Portfolio Betas You own a portfolio equally invested in a risk-free asset and two stocks. If one of the stocks has a beta of 1.61 and the total portfolio is equally as risky as the market, what must the beta be for the other stock in your portfolio? 12. Using CAPM A stock has a beta of 1.15 , the expected return on the market is 11.1 percent, and the risk-free rate is 3.8 percent. What must the expected return on this stock be? 13. Using CAPM A stock has an expected return of 10.4 percent, the risk-free rate is 3.8 percent, and the market risk premium is 7 percent. What must the beta of this stock be? 14. Using CAPM A stock has an expected return of 12.7 percent, its beta is 1.20 , and the risk-free rate is 4.2 percent. What must the expected return on the market be? 15. Using CAPM A stock has an expected return of 10.9 percent, its beta is .9 , and the expected return on the market is 11.8 percent. What must the risk-free rate be? 16. Using CAPM A stock has a beta of 1.08 and an expected return of 11.6 percent. A risk-free asset currently earns 3.6 percent. a. What is the expected return on a portfolio that is equally invested in the two assets? b. If a portfolio of the two assets has a beta of . 50 , what are the portfolio weights? c. If a portfolio of the two assets has an expected return of 10.5 percent, what is its beta? d. If a portfolio of the two assets has a beta of 2.16 , what are the portfolio weights? How do you interpret the weights for the two assets in this case? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts