Question: PLEASE ANSWER AND SHOW SOLUTION FOR EACH NUMBER. WILL GIVE YOU THUMBS UP! A taxpayer earned the following incomes (gross amounts) in 2020: (assume source

PLEASE ANSWER AND SHOW SOLUTION FOR EACH NUMBER. WILL GIVE YOU THUMBS UP!

- A taxpayer earned the following incomes (gross amounts) in 2020: (assume source is Phils unless stated)

Dividends from ABC Corp. a domestic corp - Php 1,000,000

Dividends from XYZ corp, a foreign corp (dominant income is abroad) - Php 1,000,000

Interest income from long term investments (6th year) - Php 1,000,000

Interest income from short term deposits - Php 1,000,000

Raffle prize (car) - Php 1,000,000

Royalty - Php 1,000,000

Assuming tax treaty is 10%

Compute the ordinary or active income if taxpayer is a resident citizen:

a. 1,000,000

b. 6,000,000

c. 2,000,000

d. 3,000,000

2.A taxpayer earned the following incomes (gross amounts) in 2020: (assume source is Phils unless stated)

Dividends from ABC Corp. a domestic corp - Php 1,000,000

Dividends from XYZ corp, a foreign corp (dominant income is abroad) - Php 1,000,000

Interest income from long term investments (6th year) - Php 1,000,000

Interest income from short term deposits - Php 1,000,000

Raffle prize (car) - Php 1,000,000

Royalty - Php 1,000,000

Assuming tax treaty is 10%

Compute the ordinary or active income if taxpayer is a domestic corporation:

a.5M

b.6M

c. 3M

d. 4M

3.A taxpayer registered in 2010 made available the following financial information for TY2021:

Balance sheet:

Asset- Php 50,000,000

Liability - Php 30,000,000

Stockholder's equity - Php 20,000,000

Income Statement:

Gross sales - Php 10,000,000

Cost of sales - Php 6,000,000

Operating expenses - Php 2,000,000

How much is the income tax due under create law if the taxpayer is a domestic corporation and uses itemized deduction as a method of deduction?

a. 500k

b. 600k

c. 400k

d. 480k

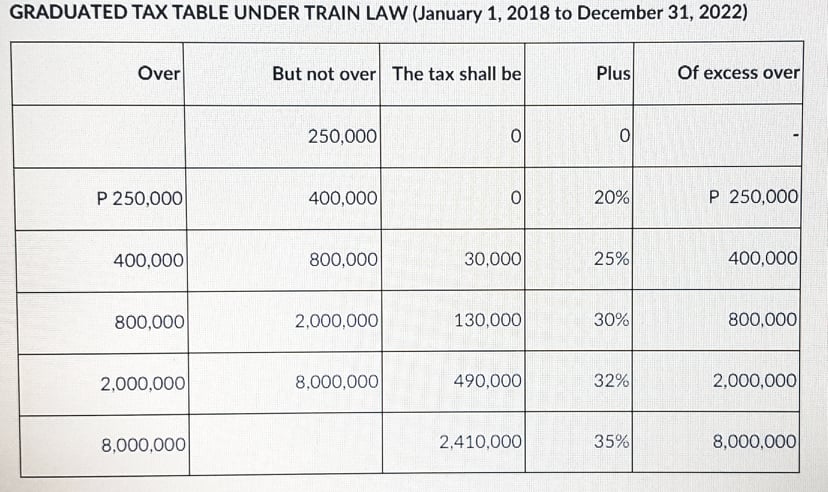

USE THIS TABLE:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts