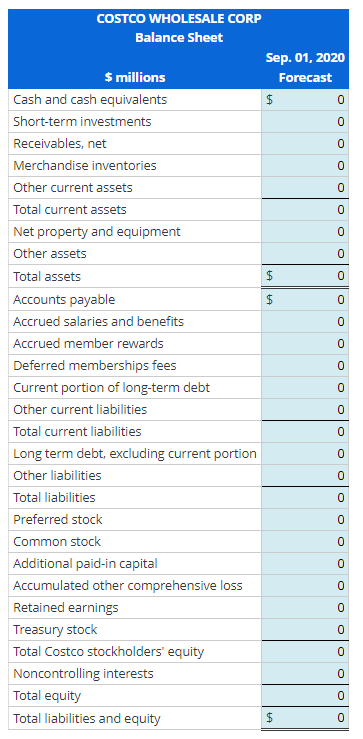

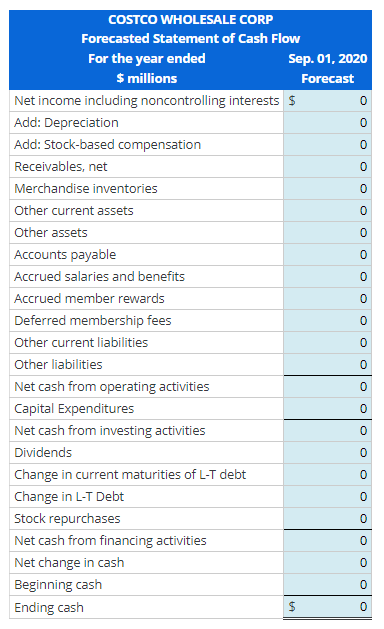

Question: Please answer and show work for all parts that are marked 0. Thank you. Forecast the Income Statement, Balance Sheet, and Statement of Cash Flows

Please answer and show work for all parts that are marked 0. Thank you.

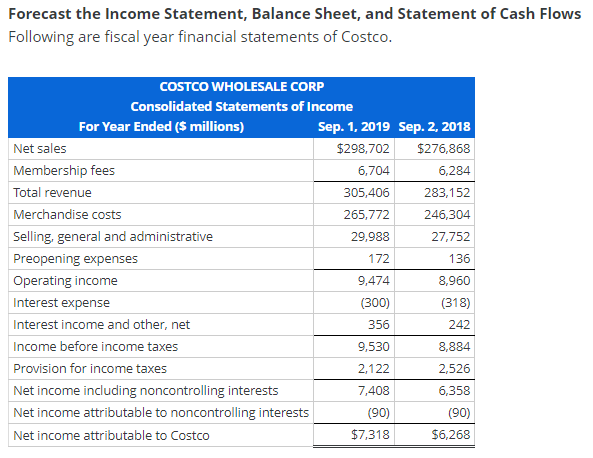

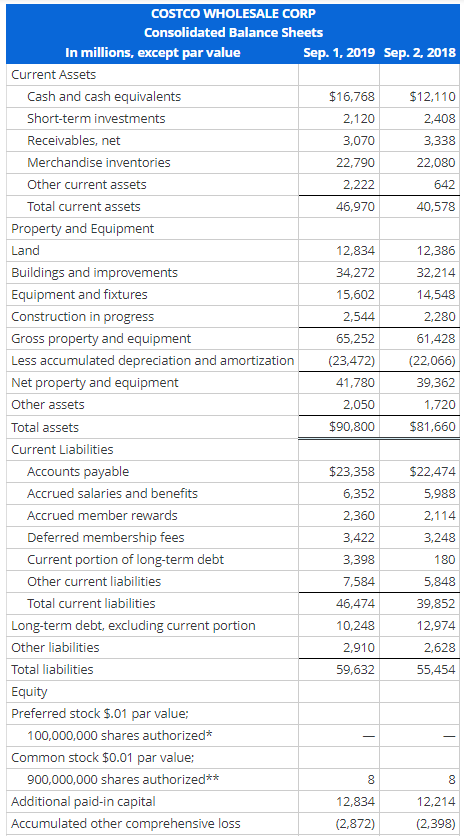

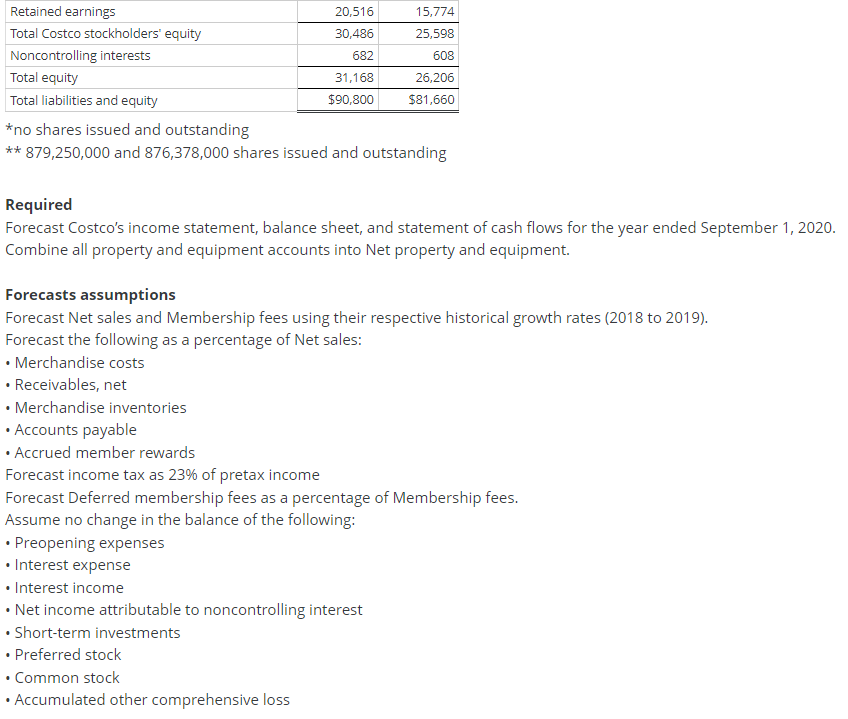

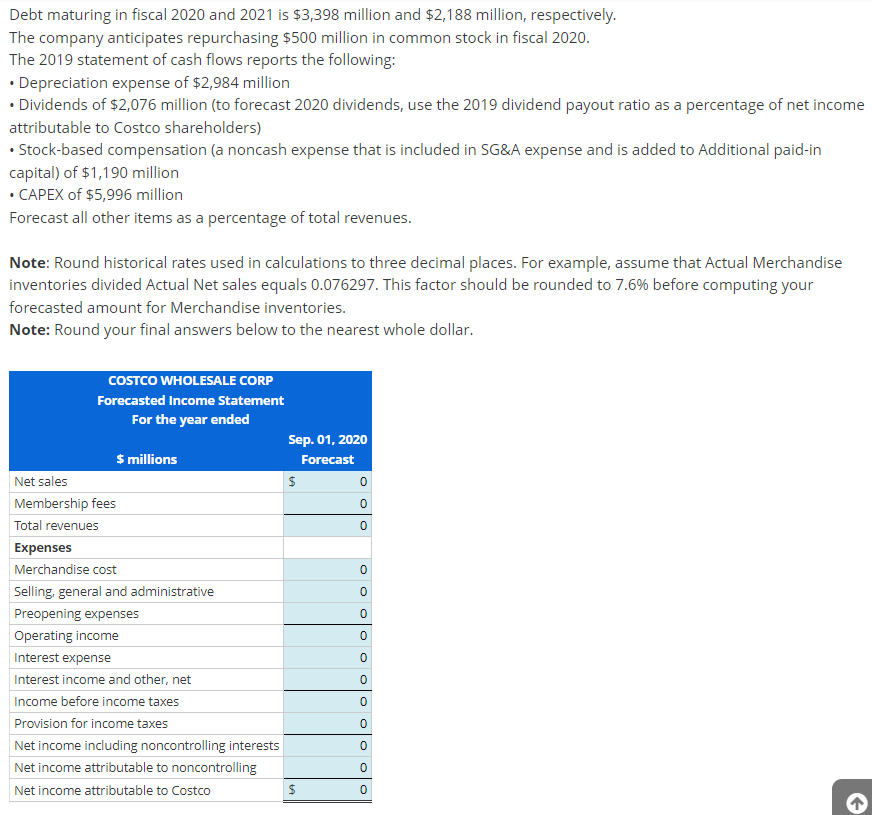

Forecast the Income Statement, Balance Sheet, and Statement of Cash Flows Following are fiscal year financial statements of Costco. COSTCO WHOLESALE CORP Consolidated Balance Sheets In millions, except par value Sep. 1, 2019 Sep. 2, 2018 Current Assets * no shares issued and outstanding ** 879,250,000 and 876,378,000 shares issued and outstanding Required Forecast Costco's income statement, balance sheet, and statement of cash flows for the year ended September 1,2020. Combine all property and equipment accounts into Net property and equipment. Forecasts assumptions Forecast Net sales and Membership fees using their respective historical growth rates (2018 to 2019). Forecast the following as a percentage of Net sales: - Merchandise costs - Receivables, net - Merchandise inventories - Accounts payable - Accrued member rewards Forecast income tax as 23% of pretax income Forecast Deferred membership fees as a percentage of Membership fees. Assume no change in the balance of the following: - Preopening expenses - Interest expense - Interest income - Net income attributable to noncontrolling interest - Short-term investments - Preferred stock - Common stock - Accumulated other comprehensive loss Debt maturing in fiscal 2020 and 2021 is $3,398 million and $2,188 million, respectively. The company anticipates repurchasing $500 million in common stock in fiscal 2020. The 2019 statement of cash flows reports the following: - Depreciation expense of $2,984 million - Dividends of $2,076 million (to forecast 2020 dividends, use the 2019 dividend payout ratio as a percentage of net income attributable to Costco shareholders) - Stock-based compensation (a noncash expense that is included in SG\&A expense and is added to Additional paid-in capital) of $1,190 million - CAPEX of $5,996 milion Forecast all other items as a percentage of total revenues. Note: Round historical rates used in calculations to three decimal places. For example, assume that Actual Merchandise inventories divided Actual Net sales equals 0.076297 . This factor should be rounded to 7.6% before computing your forecasted amount for Merchandise inventories. Note: Round your final answers below to the nearest whole dollar. Forecast the Income Statement, Balance Sheet, and Statement of Cash Flows Following are fiscal year financial statements of Costco. COSTCO WHOLESALE CORP Consolidated Balance Sheets In millions, except par value Sep. 1, 2019 Sep. 2, 2018 Current Assets * no shares issued and outstanding ** 879,250,000 and 876,378,000 shares issued and outstanding Required Forecast Costco's income statement, balance sheet, and statement of cash flows for the year ended September 1,2020. Combine all property and equipment accounts into Net property and equipment. Forecasts assumptions Forecast Net sales and Membership fees using their respective historical growth rates (2018 to 2019). Forecast the following as a percentage of Net sales: - Merchandise costs - Receivables, net - Merchandise inventories - Accounts payable - Accrued member rewards Forecast income tax as 23% of pretax income Forecast Deferred membership fees as a percentage of Membership fees. Assume no change in the balance of the following: - Preopening expenses - Interest expense - Interest income - Net income attributable to noncontrolling interest - Short-term investments - Preferred stock - Common stock - Accumulated other comprehensive loss Debt maturing in fiscal 2020 and 2021 is $3,398 million and $2,188 million, respectively. The company anticipates repurchasing $500 million in common stock in fiscal 2020. The 2019 statement of cash flows reports the following: - Depreciation expense of $2,984 million - Dividends of $2,076 million (to forecast 2020 dividends, use the 2019 dividend payout ratio as a percentage of net income attributable to Costco shareholders) - Stock-based compensation (a noncash expense that is included in SG\&A expense and is added to Additional paid-in capital) of $1,190 million - CAPEX of $5,996 milion Forecast all other items as a percentage of total revenues. Note: Round historical rates used in calculations to three decimal places. For example, assume that Actual Merchandise inventories divided Actual Net sales equals 0.076297 . This factor should be rounded to 7.6% before computing your forecasted amount for Merchandise inventories. Note: Round your final answers below to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts