Question: Please Answer and show work neatly for a better understanding Thank you Based on the Income Statement and Balance sheet below calculate the After-Tax Profit

Please Answer and show work neatly for a better understanding Thank you

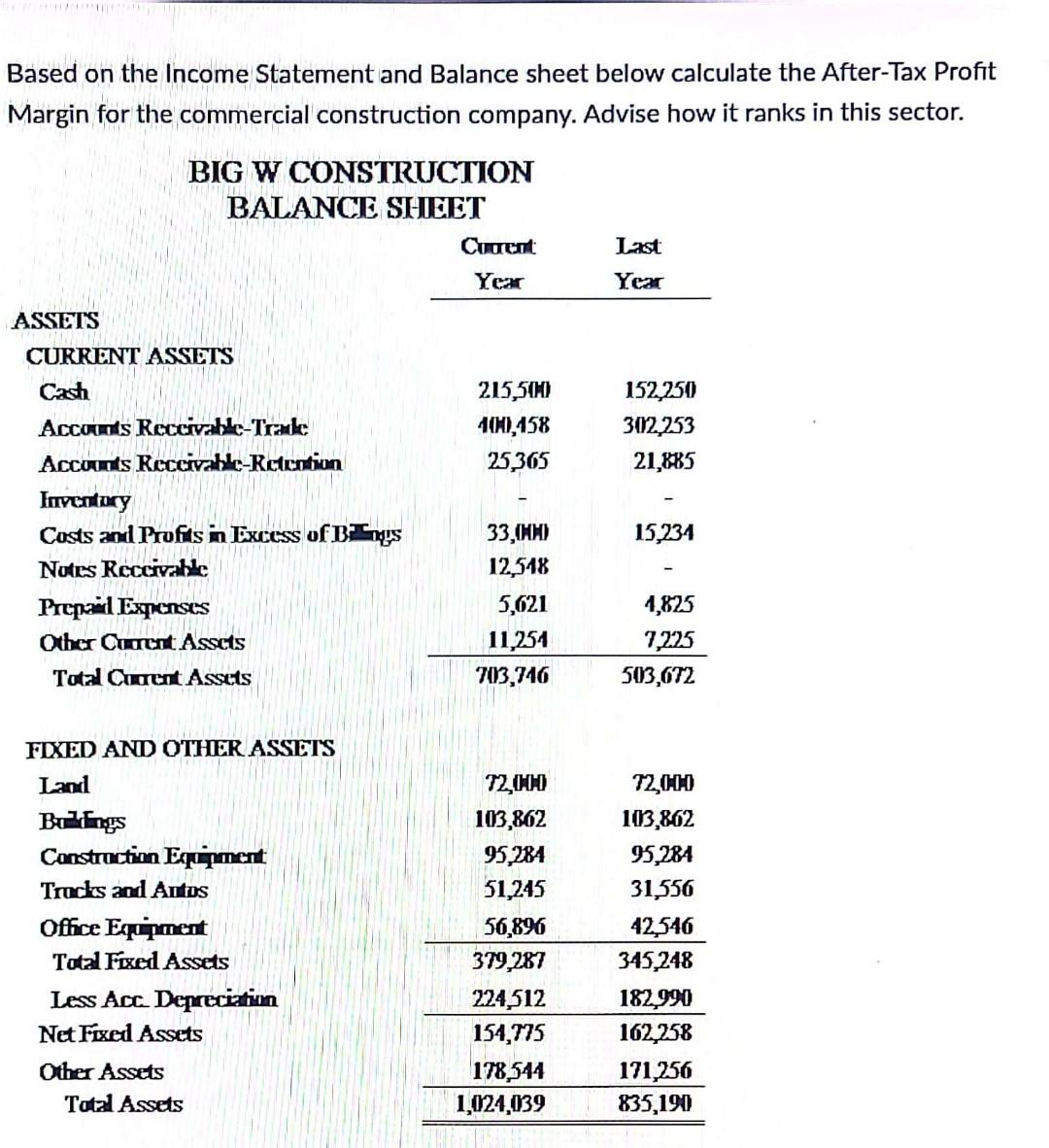

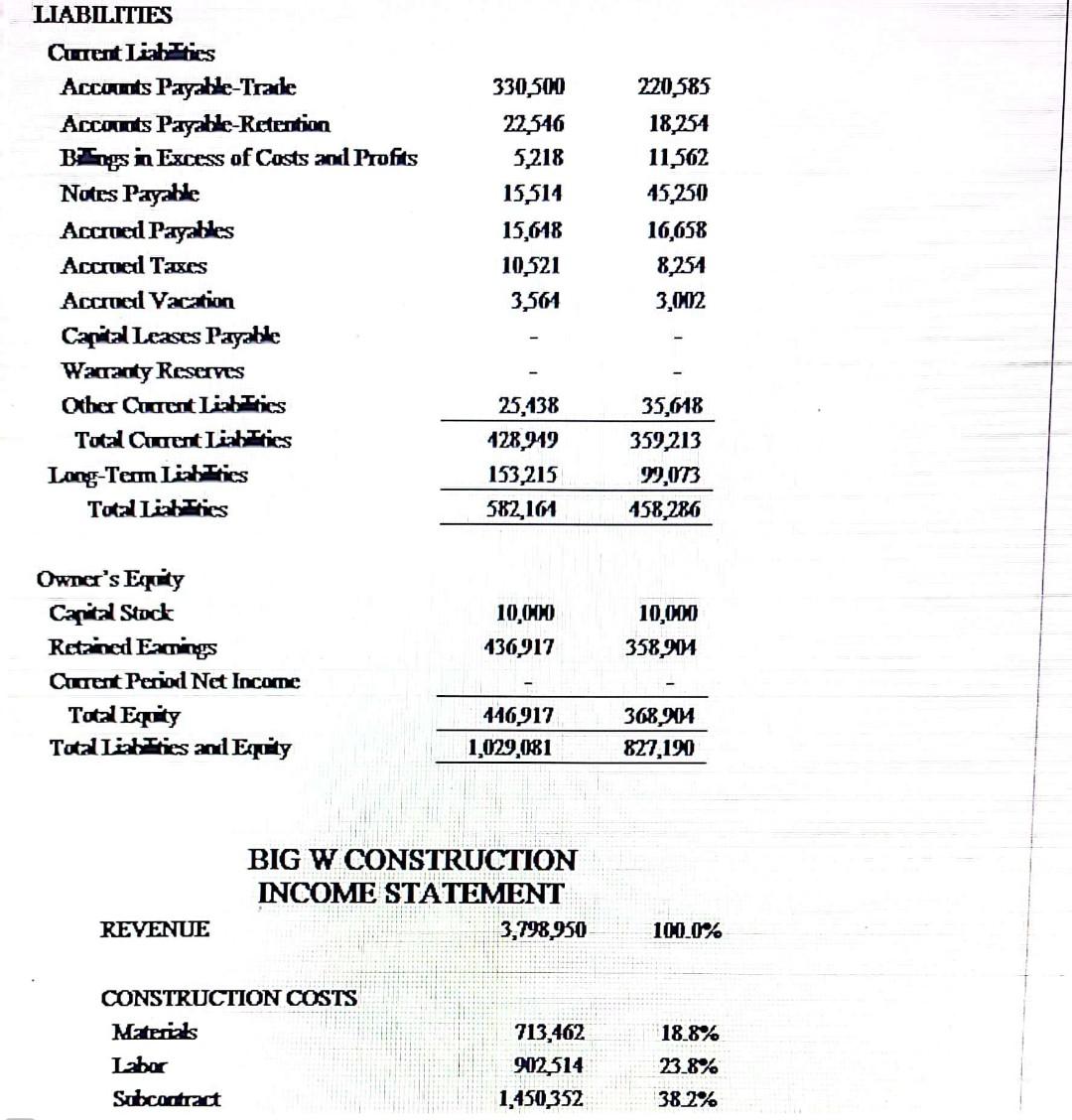

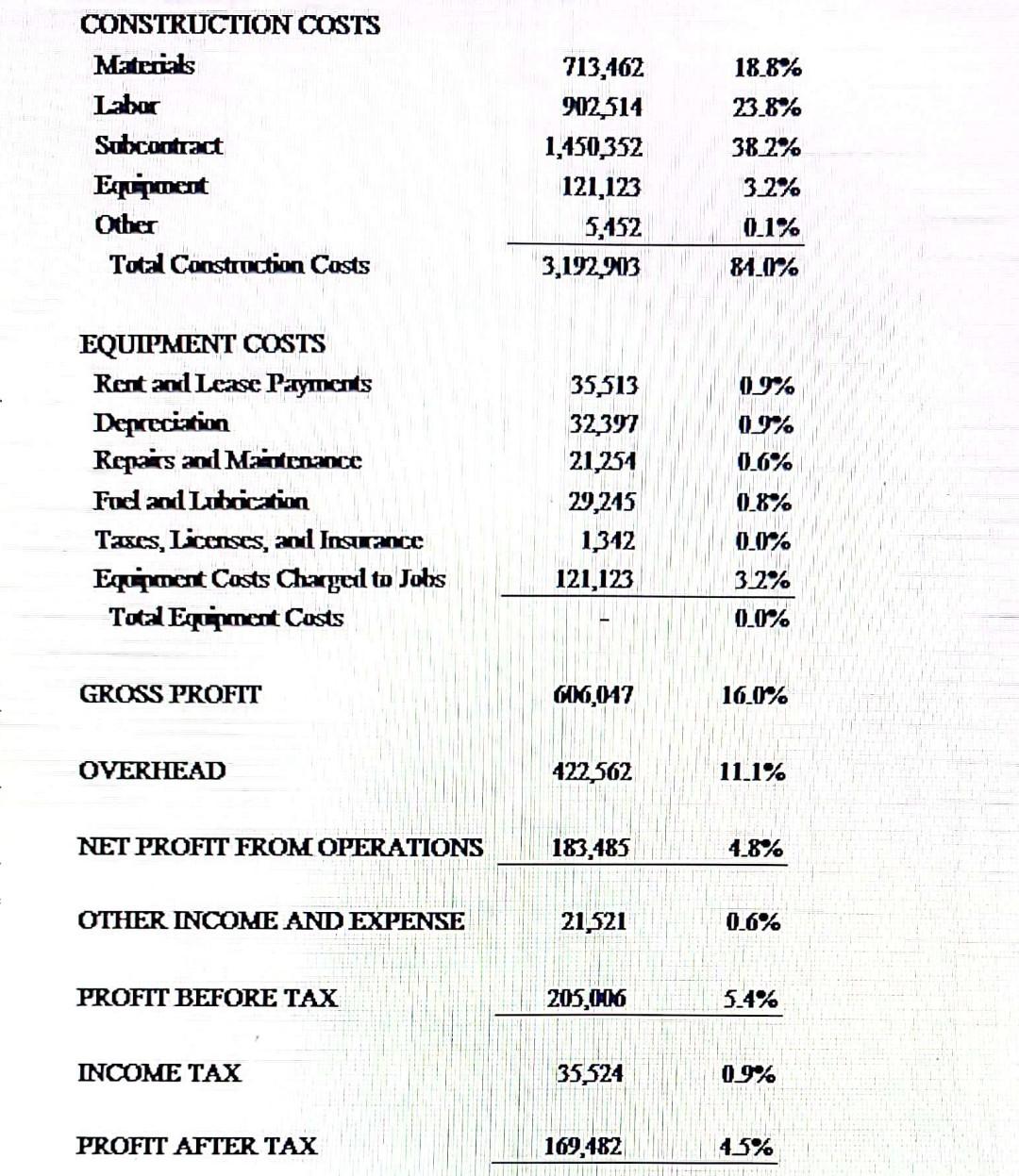

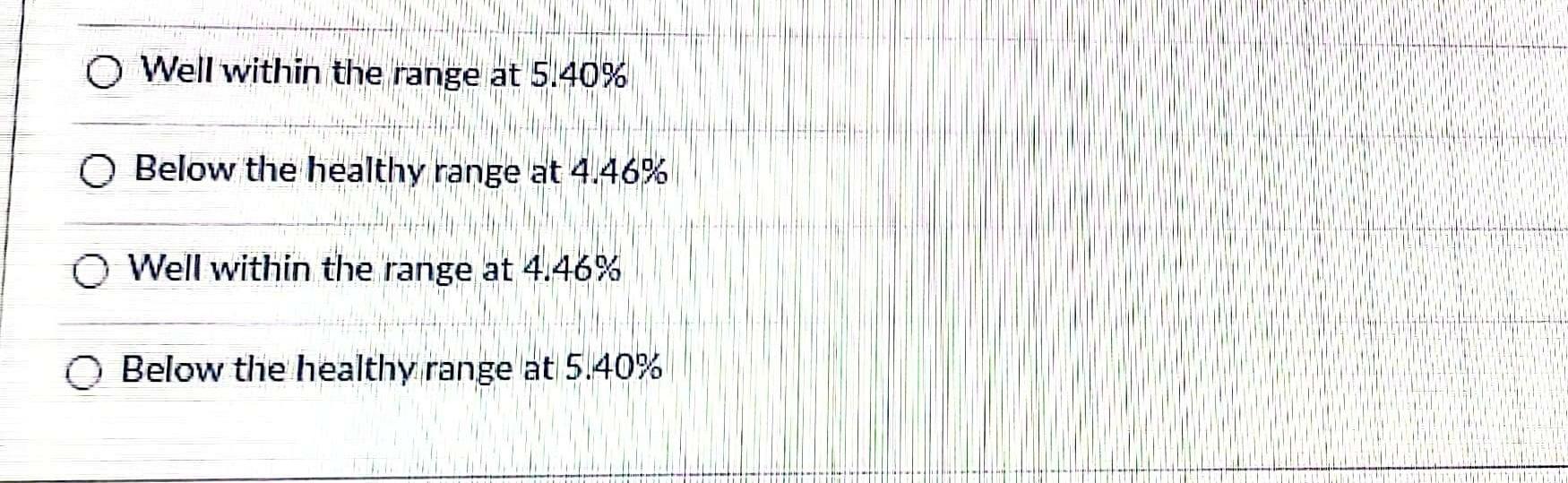

Based on the Income Statement and Balance sheet below calculate the After-Tax Profit Margin for the commercial construction company. Advise how it ranks in this sector. LABLTES Owner's Exiily Canital Stock Retaned Earings Carent Period Net Income Total Equity Total I itzies and Equily \begin{tabular}{rr} \hline 116,917 & 368,94 \\ \hline 1,029,081 & 827,190 \\ \hline \end{tabular} BIG W CONSTRUCTION INCOME STATEMENT REVENUE 3,798,950 100.0% CONSTRUCTION COSTS MaterialsIabarSubcantract713,462902,5141,450,35218.8%23.8%382% CONSTRUCIION COSTS Materiats Iabar Sabcontract Eqment Ohher Total Construction Casts \begin{tabular}{rr} 713,462 & 18.8% \\ 902,514 & 23.8% \\ 1,450,352 & 38.2% \\ 121,123 & 32% \\ 5,152 & 0.1% \\ \hline 3,192,903 & 81.1% \end{tabular} EQUIPMENT COSTS \begin{tabular}{l|r|r} Rent and Lease Payments & 35,513 & 09% \\ Denceciation & 32,397 & 09% \\ Repais and Maidenance & 21,251 & 0.6% \\ Fud and lubcication & 29,215 & 0.8% \\ Taxes, Licenses, and Insurance & 1,312 & 0.0% \\ Eqiqment Costs Charged to Jobs & 121,123 & 32% \\ \hline Total Eqitment Custs & - & 0.0% \end{tabular} GROSS PROFTT GX, 16.0% OVERHEAD 422,56211.1% NET PROFIT FROM OPERATIONS 183,485 4.8% OTHER INCOME AND EXPENSE 21,5210.6% PROFTT BEFORE TAX \begin{tabular}{r|r} 205,1116 & 5.4% \\ \hline \end{tabular} INCOME TAX 35,52409% PROFIT AFTER TAX \begin{tabular}{lll} 169,482 & 45% \\ \hline \end{tabular} Well within the range at 5.40% Below the healthy range at 4.46% Well within the range at 4.46% Below the healthy range at 5.40% Based on the Income Statement and Balance sheet below calculate the After-Tax Profit Margin for the commercial construction company. Advise how it ranks in this sector. LABLTES Owner's Exiily Canital Stock Retaned Earings Carent Period Net Income Total Equity Total I itzies and Equily \begin{tabular}{rr} \hline 116,917 & 368,94 \\ \hline 1,029,081 & 827,190 \\ \hline \end{tabular} BIG W CONSTRUCTION INCOME STATEMENT REVENUE 3,798,950 100.0% CONSTRUCTION COSTS MaterialsIabarSubcantract713,462902,5141,450,35218.8%23.8%382% CONSTRUCIION COSTS Materiats Iabar Sabcontract Eqment Ohher Total Construction Casts \begin{tabular}{rr} 713,462 & 18.8% \\ 902,514 & 23.8% \\ 1,450,352 & 38.2% \\ 121,123 & 32% \\ 5,152 & 0.1% \\ \hline 3,192,903 & 81.1% \end{tabular} EQUIPMENT COSTS \begin{tabular}{l|r|r} Rent and Lease Payments & 35,513 & 09% \\ Denceciation & 32,397 & 09% \\ Repais and Maidenance & 21,251 & 0.6% \\ Fud and lubcication & 29,215 & 0.8% \\ Taxes, Licenses, and Insurance & 1,312 & 0.0% \\ Eqiqment Costs Charged to Jobs & 121,123 & 32% \\ \hline Total Eqitment Custs & - & 0.0% \end{tabular} GROSS PROFTT GX, 16.0% OVERHEAD 422,56211.1% NET PROFIT FROM OPERATIONS 183,485 4.8% OTHER INCOME AND EXPENSE 21,5210.6% PROFTT BEFORE TAX \begin{tabular}{r|r} 205,1116 & 5.4% \\ \hline \end{tabular} INCOME TAX 35,52409% PROFIT AFTER TAX \begin{tabular}{lll} 169,482 & 45% \\ \hline \end{tabular} Well within the range at 5.40% Below the healthy range at 4.46% Well within the range at 4.46% Below the healthy range at 5.40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts