Question: please answer and show work Problem 4 (20 points): James Howells, a British man who in 2013 accidentally threw out a hard drive with a

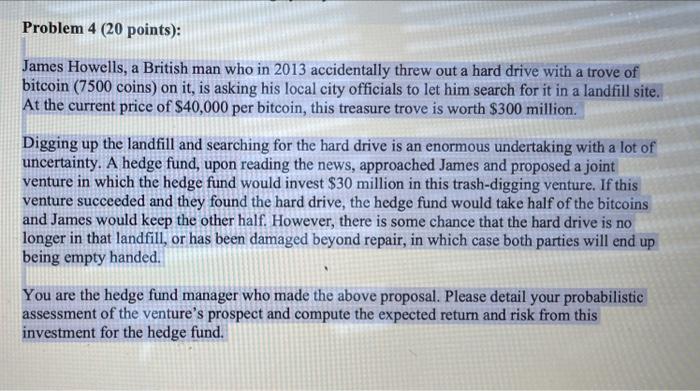

Problem 4 (20 points): James Howells, a British man who in 2013 accidentally threw out a hard drive with a trove of bitcoin (7500 coins) on it, is asking his local city officials to let him search for it in a landfill site. At the current price of $40,000 per bitcoin, this treasure trove is worth $300 million. Digging up the landfill and searching for the hard drive is an enormous undertaking with a lot of uncertainty. A hedge fund, upon reading the news, approached James and proposed a joint venture in which the hedge fund would invest $30 million in this trash-digging venture. If this venture succeeded and they found the hard drive, the hedge fund would take half of the bitcoins and James would keep the other half. However, there is some chance that the hard drive is no longer in that landfill, or has been damaged beyond repair, in which case both parties will end up being empty handed. You are the hedge fund manager who made the above proposal. Please detail your probabilistic assessment of the venture's prospect and compute the expected return and risk from this investment for the hedge fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts