Question: Please answer and show work, thanks! Bruce & Co. expects its cash flow to be $130,350 every year forever. The company currently has no debt

Please answer and show work, thanks!

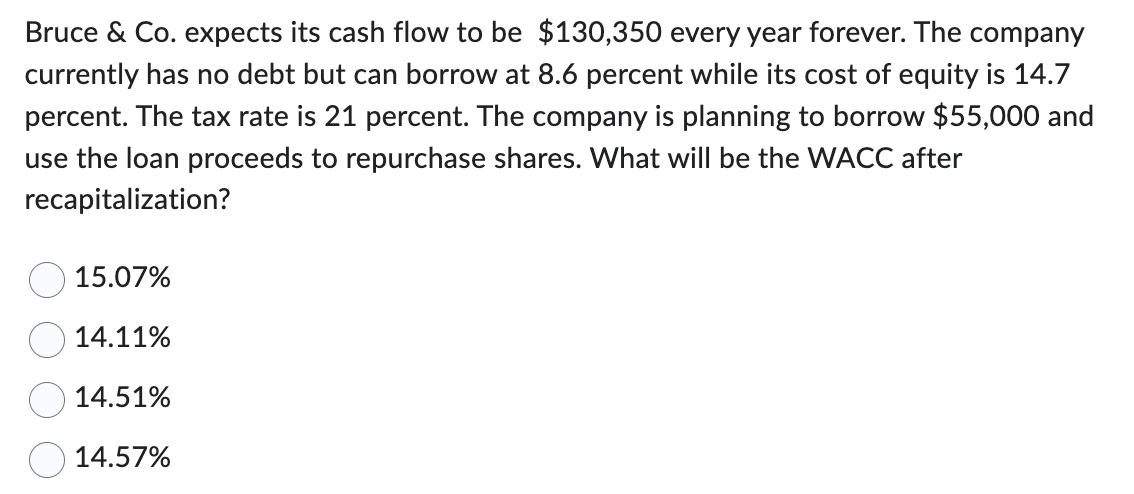

Bruce \& Co. expects its cash flow to be $130,350 every year forever. The company currently has no debt but can borrow at 8.6 percent while its cost of equity is 14.7 percent. The tax rate is 21 percent. The company is planning to borrow $55,000 and use the loan proceeds to repurchase shares. What will be the WACC after recapitalization? 15.07% 14.11% 14.51% 14.57%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts