Question: Please answer and solve all the questions Question 1 25 pts On the first day of the fiscal year, Lisbon Co. issued $1,000,000 of 10-year,

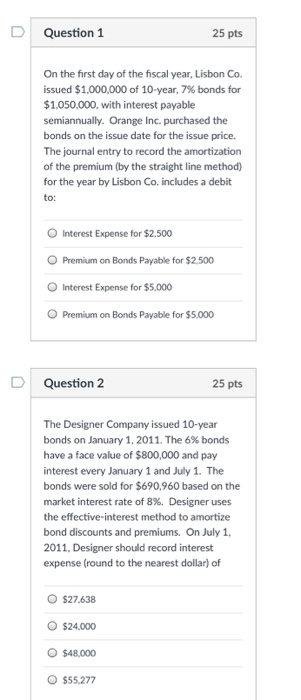

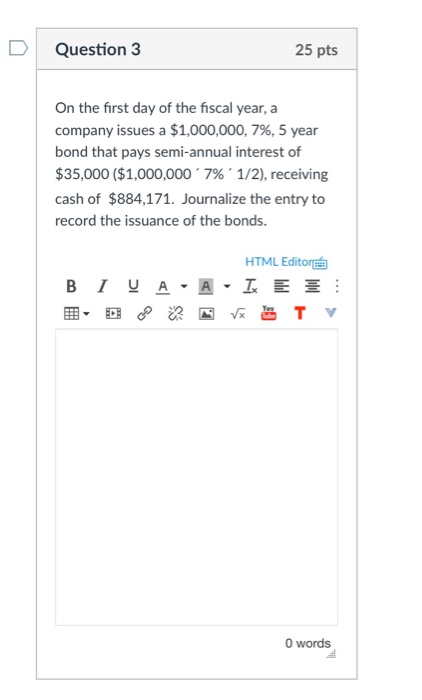

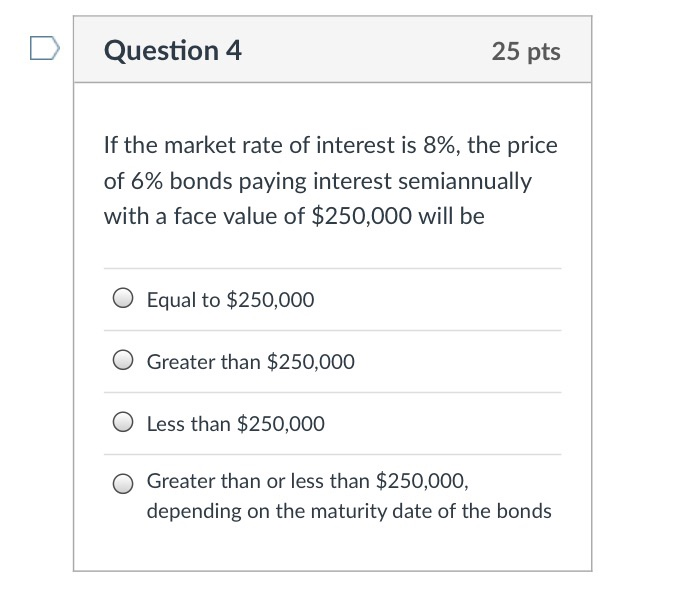

Question 1 25 pts On the first day of the fiscal year, Lisbon Co. issued $1,000,000 of 10-year, 7% bonds for $1,050,000, with interest payable semiannually. Orange Inc. purchased the bonds on the issue date for the issue price The journal entry to record the amortization of the premium (by the straight line method for the year by Lisbon Co. includes a debit O Interest Expense for $2.500 OPremium on Bonds Payable for $2.500 O Interest Expense for $5,000 O Premium on Bonds Payable for $5.000 D Question 2 25 pts The Designer Company issued 10-year bonds on January 1, 2011, The 6% bonds have a face value of $800,000 and pay interest every January 1 and July 1. The bonds were sold for $690,960 based on the market interest rate of 8%. Designer uses the effective-interest method to amortize bond discounts and premiums. On July 1, 2011, Designer should record interest expense (round to the nearest dollar) of $27.638 $24,000 O $48,000 $55.277 D Question 3 25 pts On the first day of the fiscal year, a company issues a $1,000,000, 7%, 5 year bond that pays semi-annual interest of $35,000 ($1,000,000 . 7961/2), receiving cash of $884,171. Journalize the entry to record the issuance of the bonds. HTML Editor 0 words DI Question 4 25 pts If the market rate of interest is 8%, the price of 6% bonds paying interest semiannually with a face value of $250,000 will be O Equal to $250,000 O Greater than $250,000 O Less than $250,000 O Greater than or less than $250,000, depending on the maturity date of the bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts