Question: Please answer and why ! Take me to the text On April 1, 2013, Bob's Restaurant and Brewery purchased a new bottle-sealing machine for $120,000.

Please answer and why !

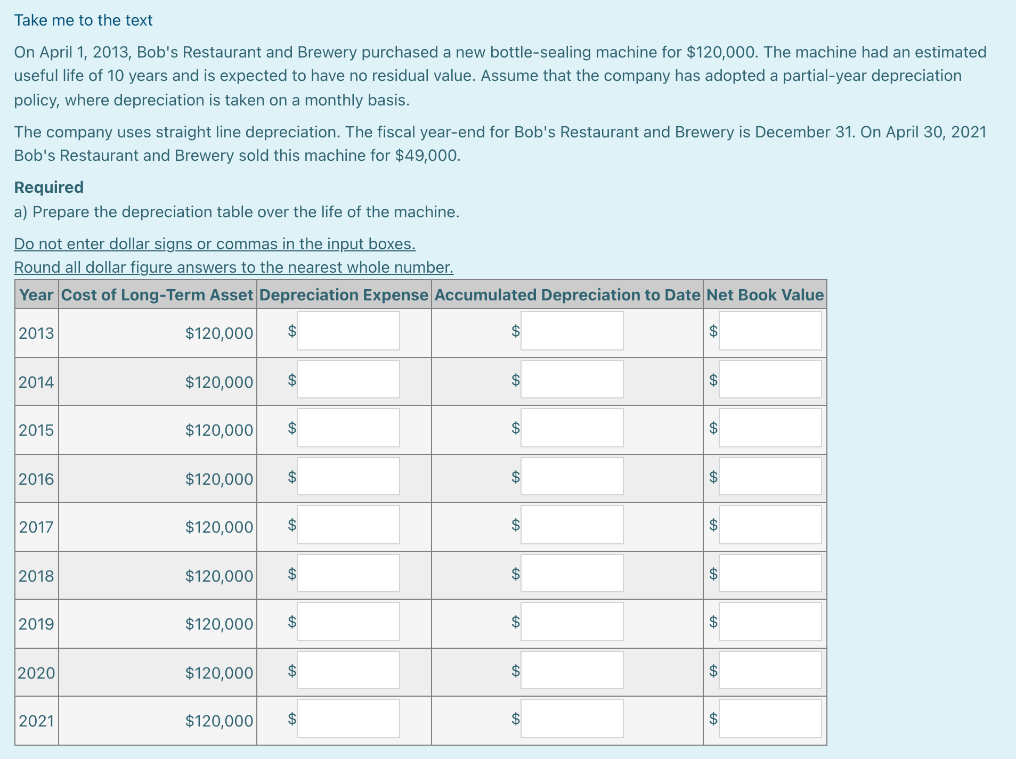

Take me to the text On April 1, 2013, Bob's Restaurant and Brewery purchased a new bottle-sealing machine for $120,000. The machine had an estimated useful life of 10 years and is expected to have no residual value. Assume that the company has adopted a partial-year depreciation policy, where depreciation is taken on a monthly basis. The company uses straight line depreciation. The fiscal year-end for Bob's Restaurant and Brewery is December 31. On April 30, 2021 Bob's Restaurant and Brewery sold this machine for $49,000. Required a) Prepare the depreciation table over the life of the machine. Do not enter dollar signs or commas in the input boxes. Round all dollar figure answers to the nearest whole number. Year Cost of Long-Term Asset Depreciation Expense Accumulated Depreciation to Date Net Book Value 2013 $120,000 $ 2014 $120,000 $ $ 2015 $120,000 $ $ $ 2016 $120,000 $ $ 2017 $120,000 $ $ 2018 $120,000 $ $ $ 2019 $120,000 $ $ $ $ $ 2020 $120,000 $ $ 2021 $120,000 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts