Question: please answer as clear as possible thank you 4. (Ch. 5) Basis Risk. A Japanese investor has owed AUD 3M as the Australian debt. We

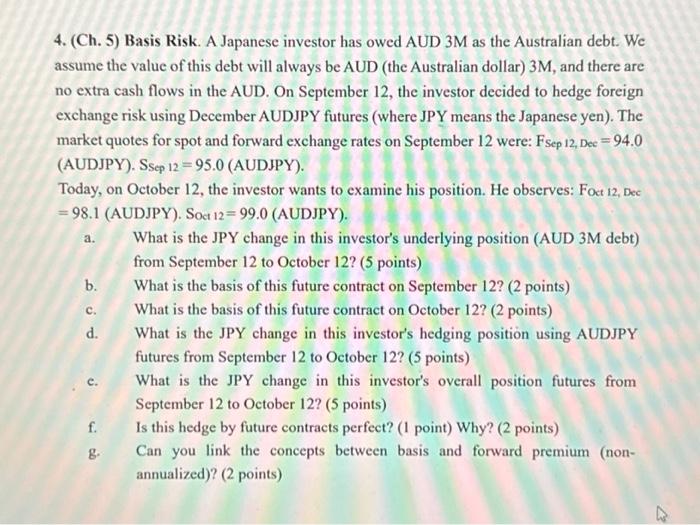

4. (Ch. 5) Basis Risk. A Japanese investor has owed AUD 3M as the Australian debt. We assume the value of this debt will always be AUD (the Australian dollar) 3M, and there are no extra cash flows in the AUD. On September 12, the investor decided to hedge foreign exchange risk using December AUDJPY futures (where JPY means the Japanese yen). The market quotes for spot and forward exchange rates on September 12 were: Fsep 12, Dec =94.0 (AUDJPY). SSep12=95.0 (AUDJPY). Today, on October 12, the investor wants to examine his position. He observes: Fot 12, Dee =98.1 (AUDJPY). SOet 12=99.0 (AUDJPY). a. What is the JPY change in this investor's underlying position (AUD 3M debt) from September 12 to October 12? (5 points) b. What is the basis of this future contract on September 12? (2 points) c. What is the basis of this future contract on October 12 ? (2 points) d. What is the JPY change in this investor's hedging position using AUDJPY futures from September 12 to October 12? (5 points) e. What is the JPY change in this investor's overall position futures from September 12 to October 12 ? ( 5 points) f. Is this hedge by future contracts perfect? (1 point) Why? ( 2 points) g. Can you link the concepts between basis and forward premium (nonannualized)? ( 2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts