Question: please answer as fast as you can to 7 ted our of Answer all parts of the question Question 1 Quiz Vodafone LLC (US) and

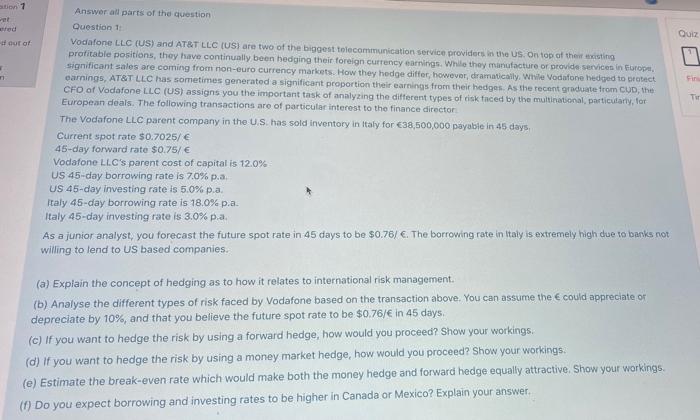

to 7 ted our of Answer all parts of the question Question 1 Quiz Vodafone LLC (US) and AT&T LLC (US) are two of the biggest telecommunication service providers in the US. On top of the disting profitable positions, they have continually been hedging their foreign currency earnings. While they manufacture or provide services in Boop significant sales are coming from non-euro currency markets. How they hedge differ, however, dramatically. While Vodafone hedged to protect Fin earnings, AT&T LLC has sometimes generated a significant proportion their earnings from their hedges. As the recent graduate from CUD, the CFO of Vodafone LLC (US) assigns you the important task of analyzing the different types of risk faced by the multinational, particularly, tot Tu European deals. The following transactions are of particular interest to the finance director The Vodafone LLC parent company in the US has sold inventory in Italy for 38,500,000 payable in 45 days Current spot rate 50.7025/ 45-day forward rate $0.75/ Vodafone LLC's parent cost of capital is 12.0% US 45-day borrowing rate is 7.0% p.a US 45-day investing rate is 5.0% p.a. Italy 45-day borrowing rate is 18.0% p.a. Italy 45-day investing rate is 3.0%p.a. As a junior analyst, you forecast the future spot rate in 45 days to be $0.76/ . The borrowing rate in Italy is extremely high due to banks not willing to lend to US based companies. (a) Explain the concept of hedging as to how it relates to international risk management. (b) Analyse the different types of risk faced by Vodafone based on the transaction above. You can assume the could appreciate or depreciate by 10%, and that you believe the future spot rate to be $0.76/ in 45 days (c) If you want to hedge the risk by using a forward hedge, how would you proceed? Show your workings. (d) If you want to hedge the risk by using a money market hedge, how would you proceed? Show your workings. (e) Estimate the break-even rate which would make both the money hedge and forward hedge equally attractive. Show your workings. (1) Do you expect borrowing and investing rates to be higher in Canada or Mexico? Explain your answer. to 7 ted our of Answer all parts of the question Question 1 Quiz Vodafone LLC (US) and AT&T LLC (US) are two of the biggest telecommunication service providers in the US. On top of the disting profitable positions, they have continually been hedging their foreign currency earnings. While they manufacture or provide services in Boop significant sales are coming from non-euro currency markets. How they hedge differ, however, dramatically. While Vodafone hedged to protect Fin earnings, AT&T LLC has sometimes generated a significant proportion their earnings from their hedges. As the recent graduate from CUD, the CFO of Vodafone LLC (US) assigns you the important task of analyzing the different types of risk faced by the multinational, particularly, tot Tu European deals. The following transactions are of particular interest to the finance director The Vodafone LLC parent company in the US has sold inventory in Italy for 38,500,000 payable in 45 days Current spot rate 50.7025/ 45-day forward rate $0.75/ Vodafone LLC's parent cost of capital is 12.0% US 45-day borrowing rate is 7.0% p.a US 45-day investing rate is 5.0% p.a. Italy 45-day borrowing rate is 18.0% p.a. Italy 45-day investing rate is 3.0%p.a. As a junior analyst, you forecast the future spot rate in 45 days to be $0.76/ . The borrowing rate in Italy is extremely high due to banks not willing to lend to US based companies. (a) Explain the concept of hedging as to how it relates to international risk management. (b) Analyse the different types of risk faced by Vodafone based on the transaction above. You can assume the could appreciate or depreciate by 10%, and that you believe the future spot rate to be $0.76/ in 45 days (c) If you want to hedge the risk by using a forward hedge, how would you proceed? Show your workings. (d) If you want to hedge the risk by using a money market hedge, how would you proceed? Show your workings. (e) Estimate the break-even rate which would make both the money hedge and forward hedge equally attractive. Show your workings. (1) Do you expect borrowing and investing rates to be higher in Canada or Mexico? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts