Question: Please Answer as many as possible! Thanks The date is April 24, 2022. Which of the following July call options is most likely to be

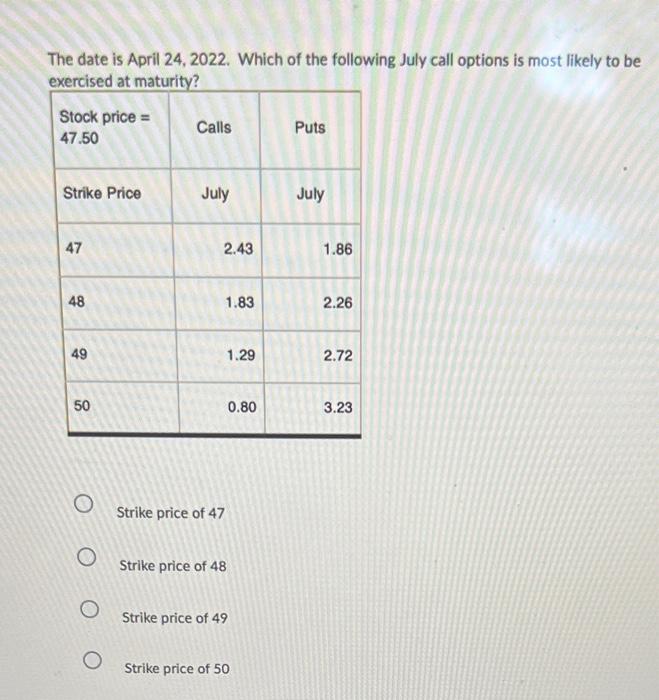

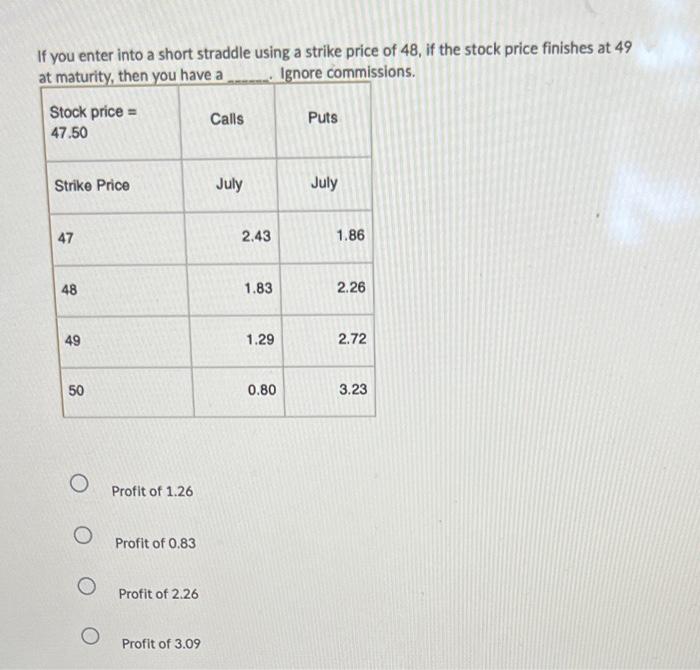

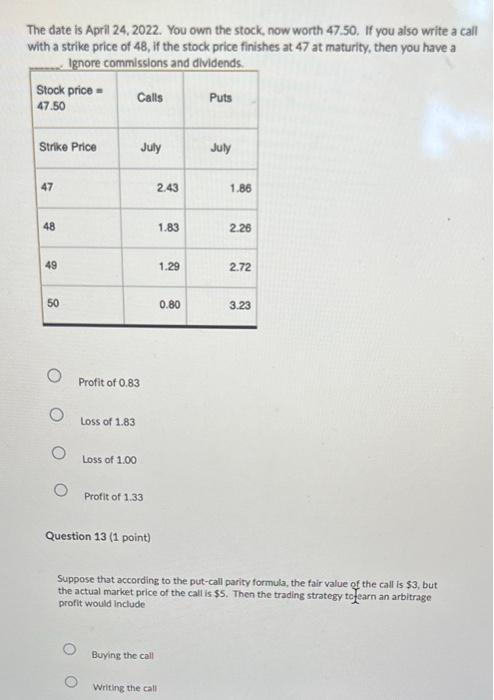

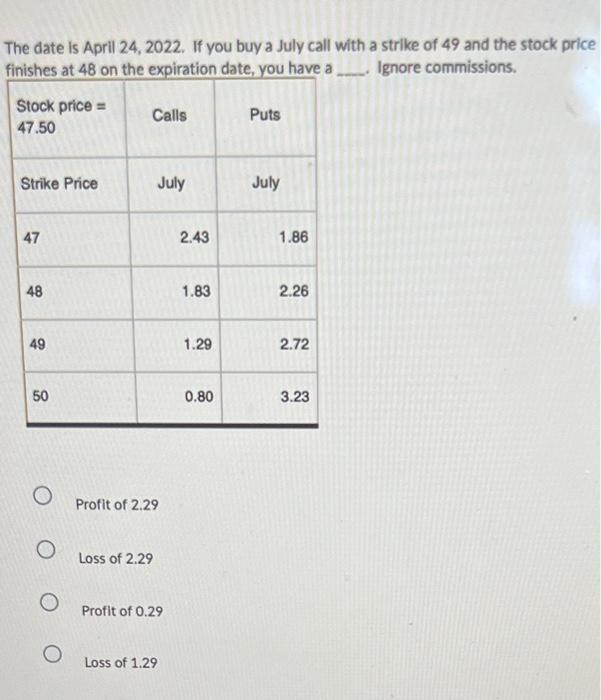

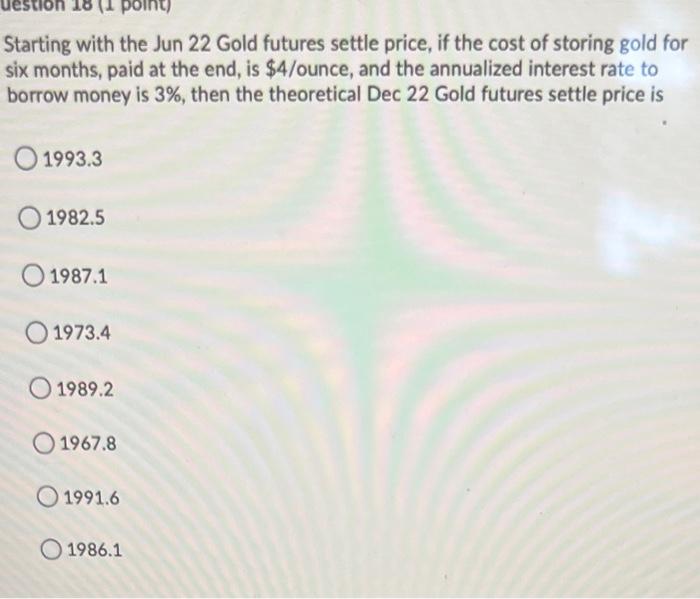

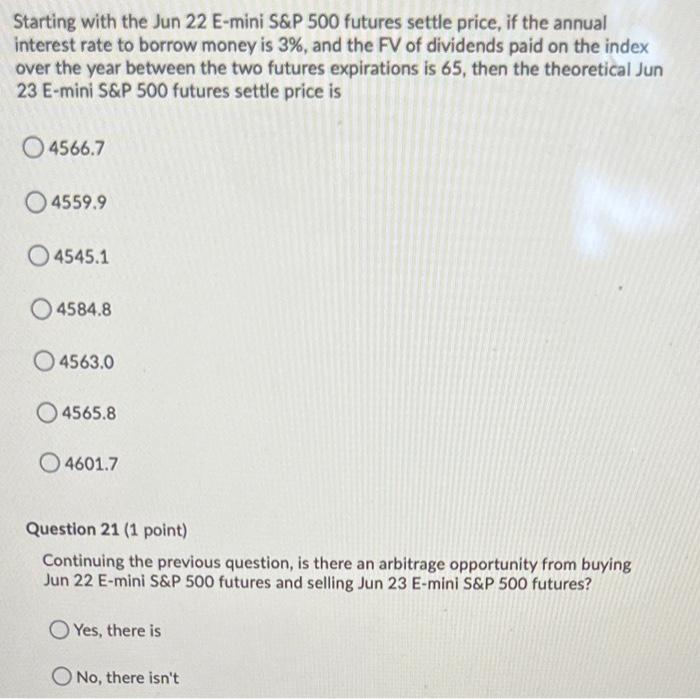

The date is April 24, 2022. Which of the following July call options is most likely to be exercised at maturity? Stock price = Calls Puts 47.50 Strike Price July July 47 2.43 1.86 48 1.83 2.26 49 1.29 2.72 50 0.80 3.23 O Strike price of 47 O Strike price of 48 Strike price of 49 O Strike price of 50 If you enter into a short straddle using a strike price of 48, if the stock price finishes at 49 at maturity, then you have a Ignore commissions. Stock price = Calls Puts 47.50 Strike Price July July 47 2.43 1.86 48 1.83 2.26 49 1.29 2.72 50 0.80 3.23 O Profit of 1.26 Profit of 0.83 Profit of 2.26 O Profit of 3.09 The date is April 24, 2022. You own the stock, now worth 47.50. If you also write a call with a strike price of 48, if the stock price finishes at 47 at maturity, then you have a Ignore commissions and dividends. Stock price Puts 47.50 Calls Strike Price July July 47 2.43 1.86 48 1.83 2.26 49 1.29 2.72 50 0.80 3.23 Profit of 0.83 O Loss of 1.83 Loss of 1.00 Profit of 1.33 Question 13 (1 point) Suppose that according to the put-call parity formula, the fair value of the call is $3, but the actual market price of the call is $5. Then the trading strategy to earn an arbitrage profit would include Buying the call Writing the call The date Is April 24, 2022. If you buy a July call with a strike of 49 and the stock price finishes at 48 on the expiration date, you have a Ignore commissions. Stock price = Calls Puts 47.50 Strike Price July July 47 2.43 1.86 48 1.83 2.26 49 1.29 2.72 50 0.80 3.23 Profit of 2.29 O Loss of 2.29 Profit of 0.29 O Loss of 1.29 (1 point) Starting with the Jun 22 Gold futures settle price, if the cost of storing gold for six months, paid at the end, is $4/ounce, and the annualized interest rate to borrow money is 3%, then the theoretical Dec 22 Gold futures settle price is O 1993.3 1982.5 1987.1 1973.4 1989.2 1967.8 1991.6 O 1986.1 Starting with the Jun 22 E-mini S&P 500 futures settle price, if the annual interest rate to borrow money is 3%, and the FV of dividends paid on the index over the year between the two futures expirations is 65, then the theoretical Jun 23 E-mini S&P 500 futures settle price is 04566.7 4559.9 O4545.1 O4584.8 O4563.0 4565.8 O 4601.7 Question 21 (1 point) Continuing the previous question, is there an arbitrage opportunity from buying Jun 22 E-mini S&P 500 futures and selling Jun 23 E-mini S&P 500 futures? Yes, there is O No, there isn't

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts