Question: Please answer as many as you can, I'd really appreciate it! The questions begin on page 2, 3, 4, and 5! Thanks in advance! You

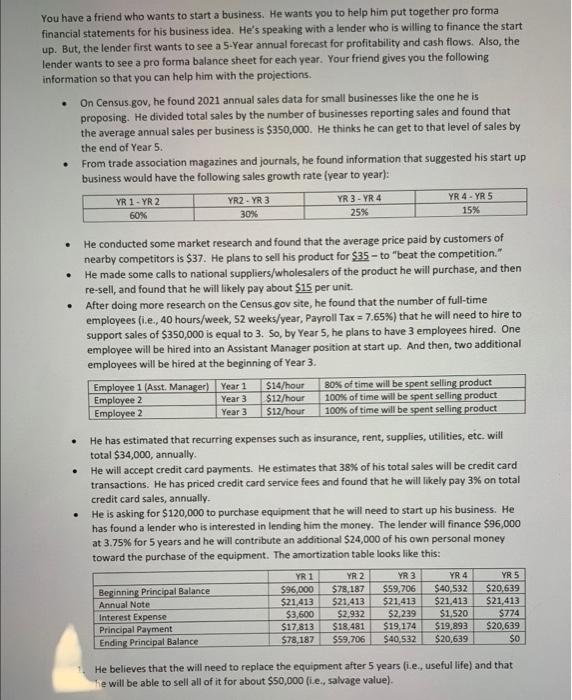

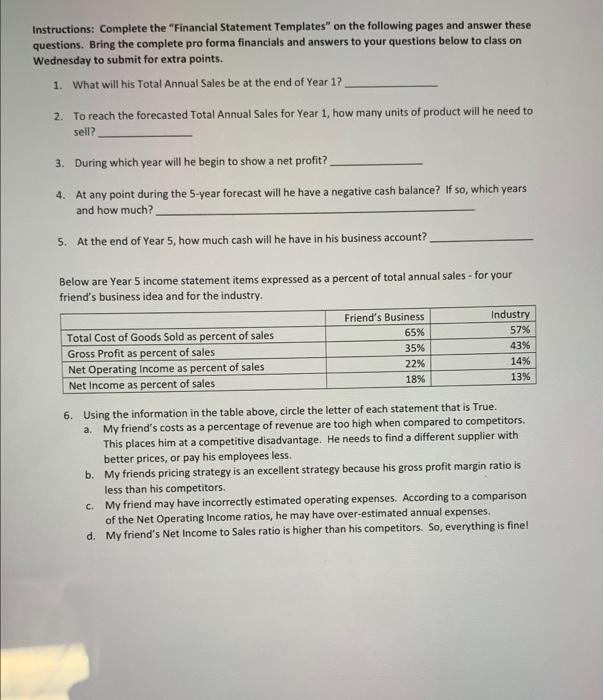

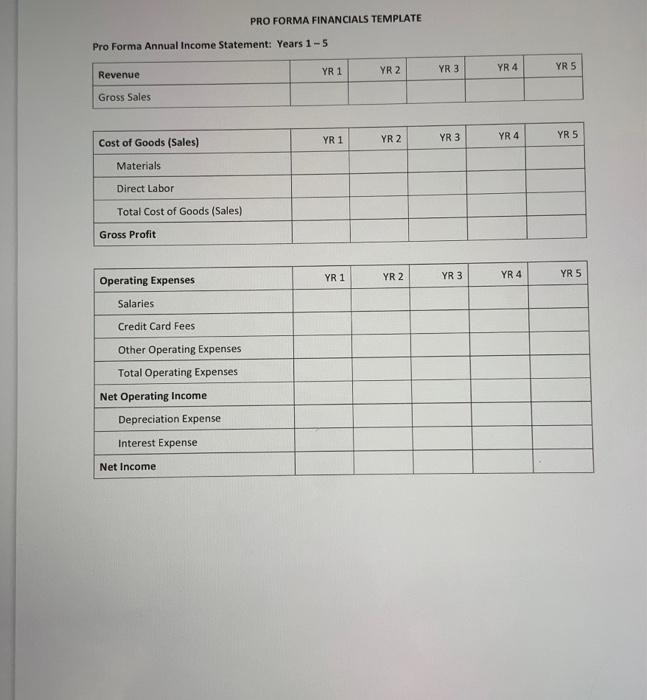

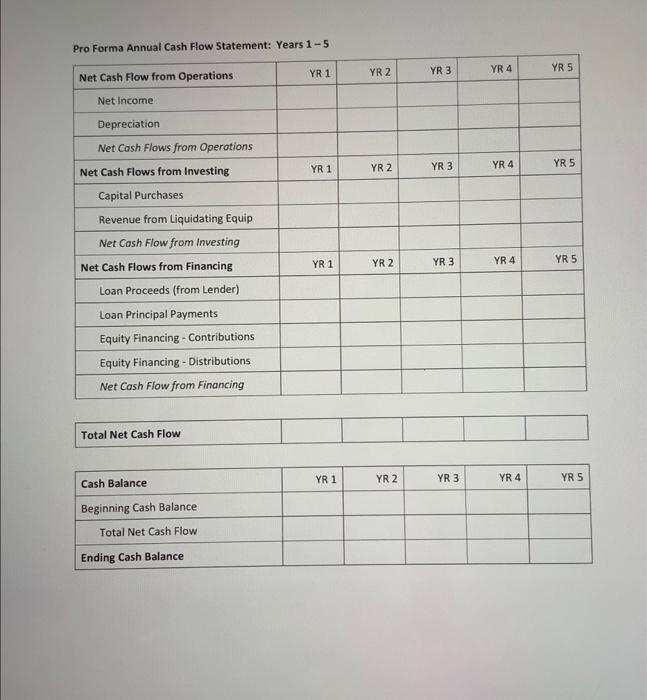

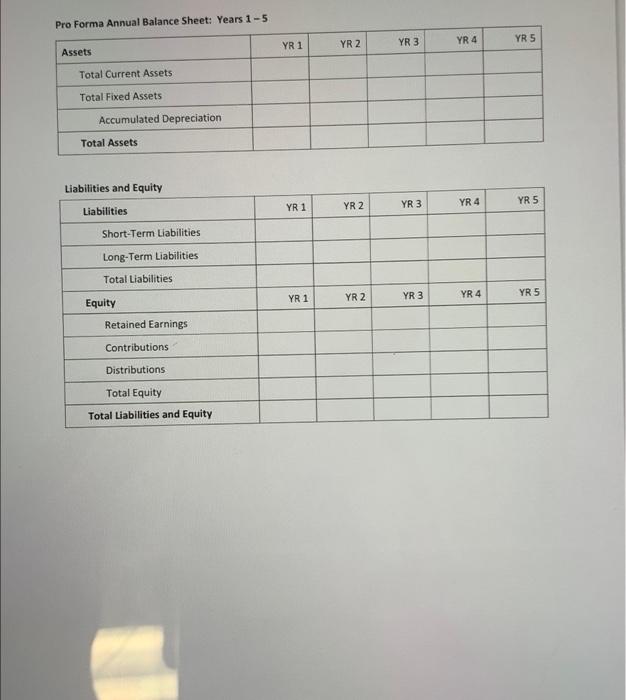

You have a friend who wants to start a business. He wants you to help him put together pro forma financial statements for his business idea. He's speaking with a lender who is willing to finance the start up. But, the lender first wants to see a 5-Year annual forecast for profitability and cash flows. Also, the lender wants to see a pro forma balance sheet for each year. Your friend gives you the following information so that you can help him with the projections. On Census.gov, he found 2021 annual sales data for small businesses like the one he is proposing. He divided total sales by the number of businesses reporting sales and found that the average annual sales per business is $350,000. He thinks he can get to that level of sales by the end of Year 5. From trade association magazines and journals, he found information that suggested his start up business would have the following sales growth rate (year to year): . YR 1 - YR2 60% YR2 - YR 3 30% YR 3 - YR 4 25% YR 4 - YR 5 15% He conducted some market research and found that the average price paid by customers of nearby competitors is $37. He plans to sell his product for $35 - to "beat the competition." He made some calls to national suppliers/wholesalers of the product he will purchase, and then re-sell, and found that he will likely pay about $15 per unit. After doing more research on the Census gov site, he found that the number of full-time employees (i.e., 40 hours/week, 52 weeks/year, Payroll Tax = 7.65%) that he will need to hire to support sales of $350,000 is equal to 3. So, by Year 5, he plans to have 3 employees hired. One employee will be hired into an Assistant Manager position at start up. And then, two additional employees will be hired at the beginning of Year 3. Employee 1 (Asst. Manager) Year 1 $14/hour 80% of time will be spent selling product Employee 2 Year 3 $12/hour 100% of time will be spent selling product Employee 2 Year 3 $12/hour 100% of time will be spent selling product He has estimated that recurring expenses such as insurance, rent, supplies, utilities, etc. will total $34,000, annually He will accept credit card payments. He estimates that 38% of his total sales will be credit card transactions. He has priced credit card service fees and found that he will likely pay 3% on total credit card sales, annually. He is asking for $120,000 to purchase equipment that he will need to start up his business. He has found a lender who is interested in lending him the money. The lender will finance $96,000 at 3.75% for 5 years and he will contribute an additional $24,000 of his own personal money toward the purchase of the equipment. The amortization table looks like this: . Beginning Principal Balance Annual Note Interest Expense Principal Payment Principal Balance YR 1 $96.000 $21,413 $3,600 $17,813 $78,187 YR 2 $78,187 $21,413 $2,932 $18,481 $59,706 YR 3 $59,706 $21.413 $2,239 $19,174 $40,532 YR 4 $40,532 $21,413 $1,520 $19,893 $20,639 YR 5 $20.639 $21,413 $774 $20,639 $0 He believes that the will need to replace the equipment after 5 years i.e., useful life) and that he will be able to sell all of it for about $50,000 (ie, salvage value) Instructions: Complete the "Financial Statement Templates on the following pages and answer these questions. Bring the complete pro forma financials and answers to your questions below to class on Wednesday to submit for extra points. 1. What will his Total Annual Sales be at the end of Year 1? 2. To reach the forecasted Total Annual Sales for Year 1, how many units of product will he need to sell? 3. During which year will he begin to show a net profit? 4. At any point during the 5-year forecast will he have a negative cash balance? If so, which years and how much? 5. At the end of Year 5, how much cash will he have in his business account? Below are Year 5 income statement items expressed as a percent of total annual sales - for your friend's business idea and for the industry. Friend's Business Industry Total Cost of Goods Sold as percent of sales 65% 57% Gross Profit as percent of sales 35% 43% Net Operating Income as percent of sales 22% 14% Net Income as percent of sales 18% 13% 6. Using the information in the table above, circle the letter of each statement that is True a. My friend's costs as a percentage of revenue are too high when compared to competitors. This places him at a competitive disadvantage. He needs to find a different supplier with better prices, or pay his employees less. b. My friends pricing strategy is an excellent strategy because his gross profit margin ratio is less than his competitors. c. My friend may have incorrectly estimated operating expenses. According to a comparison of the Net Operating Income ratios, he may have over-estimated annual expenses. d. My friend's Net Income to Sales ratio is higher than his competitors. So, everything is fine! PRO FORMA FINANCIALS TEMPLATE Pro Forma Annual Income Statement: Years 1-5 YR 1 YR 2 YR 3 YR 4 YR 5 Revenue Gross Sales YR 1 YR 2 YR 3 YR 4 YRS Cost of Goods (Sales) Materials Direct Labor Total Cost of Goods (Sales) Gross Profit YR 1 YR 2 YR 3 YR 4 YR 5 Operating Expenses Salaries Credit Card Fees Other Operating Expenses Total Operating Expenses Net Operating Income Depreciation Expense Interest Expense Net Income Pro Forma Annual Cash Flow Statement: Years 1-5 YR 1 YR 2 YR 3 YR 4 YRS YR 2 YR 1 YR 5 YR 4 YR 3 Net Cash Flow from Operations Net Income Depreciation Net Cash Flows from Operations Net Cash Flows from Investing Capital Purchases Revenue from Liquidating Equip Net Cash Flow from Investing Net Cash Flows from Financing Loan Proceeds (from Lender) Loan Principal Payments Equity Financing - Contributions Equity Financing - Distributions Net Cash Flow from Financing YR 1 YR 2 YR 3 YR 4 YR 5 Total Net Cash Flow YR 1 YR 2 YR 3 YR 4 Cash Balance YR 5 Beginning Cash Balance Total Net Cash Flow Ending Cash Balance Pro Forma Annual Balance Sheet: Years 1-5 YR 1 YR 2 YR 3 YRS YR 4 Assets Total Current Assets Total Fixed Assets Accumulated Depreciation Total Assets Liabilities and Equity Liabilities YR 2 YR 1 YR 3 YR 4 YR 5 Short-Term Liabilities Long-Term Liabilities Total Liabilities YR 2 YR 1 YR 3 YR 4 YR 5 Equity Retained Earnings Contributions Distributions Total Equity Total Liabilities and Equity You have a friend who wants to start a business. He wants you to help him put together pro forma financial statements for his business idea. He's speaking with a lender who is willing to finance the start up. But, the lender first wants to see a 5-Year annual forecast for profitability and cash flows. Also, the lender wants to see a pro forma balance sheet for each year. Your friend gives you the following information so that you can help him with the projections. On Census.gov, he found 2021 annual sales data for small businesses like the one he is proposing. He divided total sales by the number of businesses reporting sales and found that the average annual sales per business is $350,000. He thinks he can get to that level of sales by the end of Year 5. From trade association magazines and journals, he found information that suggested his start up business would have the following sales growth rate (year to year): . YR 1 - YR2 60% YR2 - YR 3 30% YR 3 - YR 4 25% YR 4 - YR 5 15% He conducted some market research and found that the average price paid by customers of nearby competitors is $37. He plans to sell his product for $35 - to "beat the competition." He made some calls to national suppliers/wholesalers of the product he will purchase, and then re-sell, and found that he will likely pay about $15 per unit. After doing more research on the Census gov site, he found that the number of full-time employees (i.e., 40 hours/week, 52 weeks/year, Payroll Tax = 7.65%) that he will need to hire to support sales of $350,000 is equal to 3. So, by Year 5, he plans to have 3 employees hired. One employee will be hired into an Assistant Manager position at start up. And then, two additional employees will be hired at the beginning of Year 3. Employee 1 (Asst. Manager) Year 1 $14/hour 80% of time will be spent selling product Employee 2 Year 3 $12/hour 100% of time will be spent selling product Employee 2 Year 3 $12/hour 100% of time will be spent selling product He has estimated that recurring expenses such as insurance, rent, supplies, utilities, etc. will total $34,000, annually He will accept credit card payments. He estimates that 38% of his total sales will be credit card transactions. He has priced credit card service fees and found that he will likely pay 3% on total credit card sales, annually. He is asking for $120,000 to purchase equipment that he will need to start up his business. He has found a lender who is interested in lending him the money. The lender will finance $96,000 at 3.75% for 5 years and he will contribute an additional $24,000 of his own personal money toward the purchase of the equipment. The amortization table looks like this: . Beginning Principal Balance Annual Note Interest Expense Principal Payment Principal Balance YR 1 $96.000 $21,413 $3,600 $17,813 $78,187 YR 2 $78,187 $21,413 $2,932 $18,481 $59,706 YR 3 $59,706 $21.413 $2,239 $19,174 $40,532 YR 4 $40,532 $21,413 $1,520 $19,893 $20,639 YR 5 $20.639 $21,413 $774 $20,639 $0 He believes that the will need to replace the equipment after 5 years i.e., useful life) and that he will be able to sell all of it for about $50,000 (ie, salvage value) Instructions: Complete the "Financial Statement Templates on the following pages and answer these questions. Bring the complete pro forma financials and answers to your questions below to class on Wednesday to submit for extra points. 1. What will his Total Annual Sales be at the end of Year 1? 2. To reach the forecasted Total Annual Sales for Year 1, how many units of product will he need to sell? 3. During which year will he begin to show a net profit? 4. At any point during the 5-year forecast will he have a negative cash balance? If so, which years and how much? 5. At the end of Year 5, how much cash will he have in his business account? Below are Year 5 income statement items expressed as a percent of total annual sales - for your friend's business idea and for the industry. Friend's Business Industry Total Cost of Goods Sold as percent of sales 65% 57% Gross Profit as percent of sales 35% 43% Net Operating Income as percent of sales 22% 14% Net Income as percent of sales 18% 13% 6. Using the information in the table above, circle the letter of each statement that is True a. My friend's costs as a percentage of revenue are too high when compared to competitors. This places him at a competitive disadvantage. He needs to find a different supplier with better prices, or pay his employees less. b. My friends pricing strategy is an excellent strategy because his gross profit margin ratio is less than his competitors. c. My friend may have incorrectly estimated operating expenses. According to a comparison of the Net Operating Income ratios, he may have over-estimated annual expenses. d. My friend's Net Income to Sales ratio is higher than his competitors. So, everything is fine! PRO FORMA FINANCIALS TEMPLATE Pro Forma Annual Income Statement: Years 1-5 YR 1 YR 2 YR 3 YR 4 YR 5 Revenue Gross Sales YR 1 YR 2 YR 3 YR 4 YRS Cost of Goods (Sales) Materials Direct Labor Total Cost of Goods (Sales) Gross Profit YR 1 YR 2 YR 3 YR 4 YR 5 Operating Expenses Salaries Credit Card Fees Other Operating Expenses Total Operating Expenses Net Operating Income Depreciation Expense Interest Expense Net Income Pro Forma Annual Cash Flow Statement: Years 1-5 YR 1 YR 2 YR 3 YR 4 YRS YR 2 YR 1 YR 5 YR 4 YR 3 Net Cash Flow from Operations Net Income Depreciation Net Cash Flows from Operations Net Cash Flows from Investing Capital Purchases Revenue from Liquidating Equip Net Cash Flow from Investing Net Cash Flows from Financing Loan Proceeds (from Lender) Loan Principal Payments Equity Financing - Contributions Equity Financing - Distributions Net Cash Flow from Financing YR 1 YR 2 YR 3 YR 4 YR 5 Total Net Cash Flow YR 1 YR 2 YR 3 YR 4 Cash Balance YR 5 Beginning Cash Balance Total Net Cash Flow Ending Cash Balance Pro Forma Annual Balance Sheet: Years 1-5 YR 1 YR 2 YR 3 YRS YR 4 Assets Total Current Assets Total Fixed Assets Accumulated Depreciation Total Assets Liabilities and Equity Liabilities YR 2 YR 1 YR 3 YR 4 YR 5 Short-Term Liabilities Long-Term Liabilities Total Liabilities YR 2 YR 1 YR 3 YR 4 YR 5 Equity Retained Earnings Contributions Distributions Total Equity Total Liabilities and Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts