Question: Please answer as many questions as possible, i ran out of questions. please label all answers. This is all the information i was given. Just

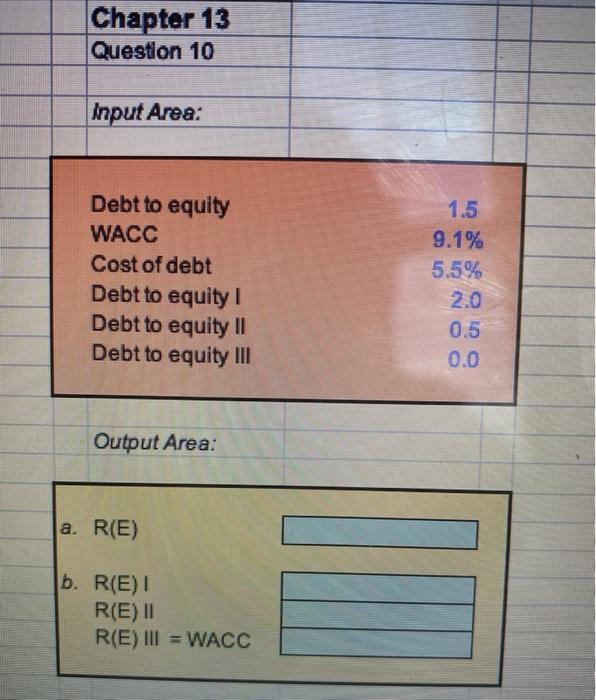

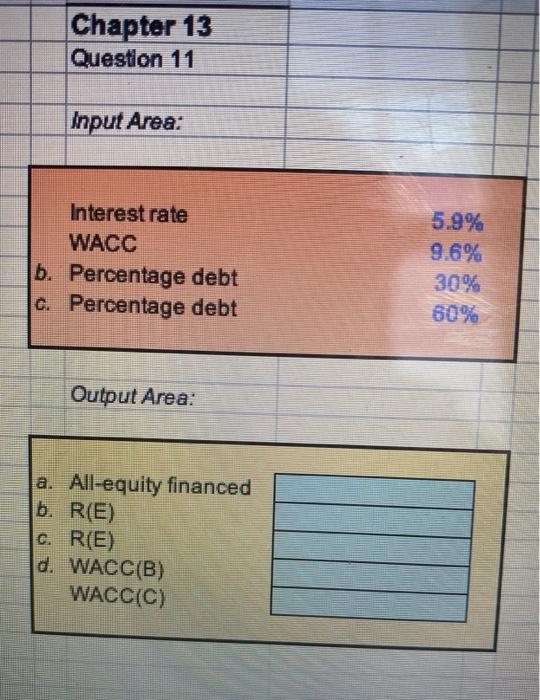

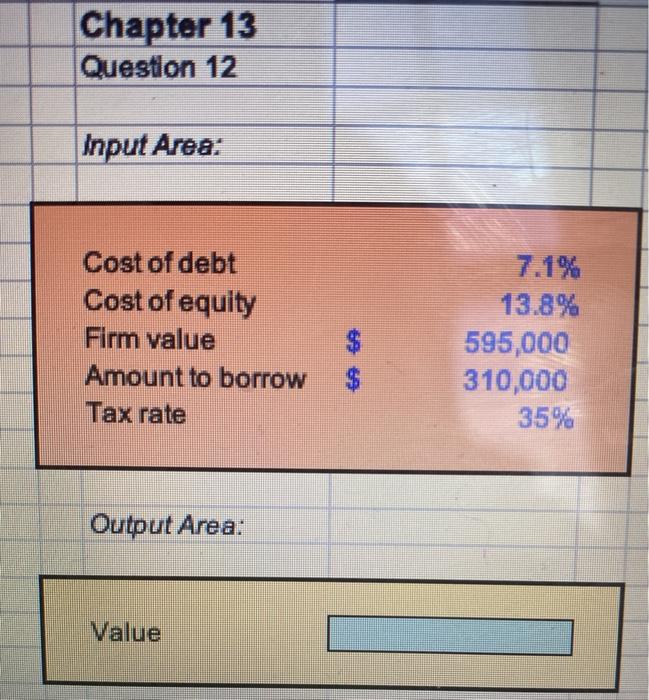

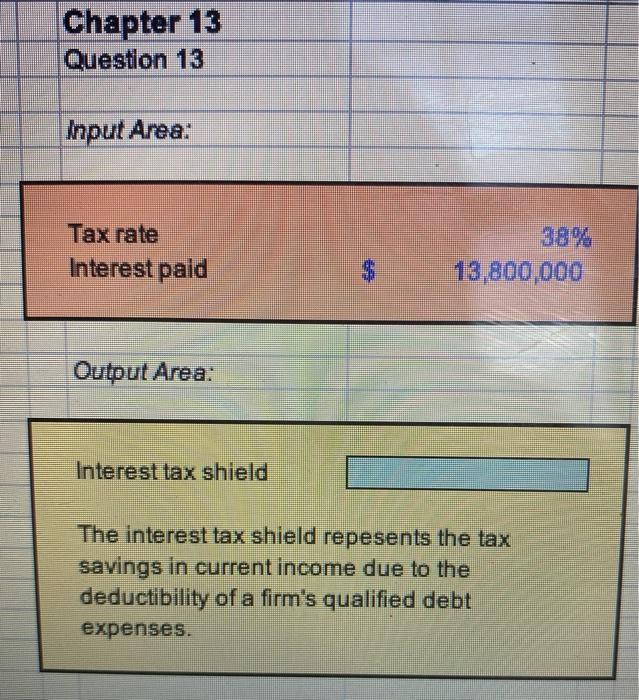

Chapter 13 Question 10 Input Area: Debt to equity WACC Cost of debt Debt to equity! Debt to equity II Debt to equity III 1.5 9.1% 5.5% 2.0 0.5 0.0 Output Area: a. R(E) b. R(E) R(E) II R(E) III = WACC Chapter 13 Question 11 Input Area: Interest rate WACC b. Percentage debt C. Percentage debt 5.9% 9.6% 30% 60% Output Area: a. All-equity financed b. R(E) c. R(E) d. WACC(B) WACC(C) Chapter 13 Question 12 Input Area: Cost of debt Cost of equity Firm value Amount to borrow Tax rate 69 69 7.1% 13.8% 595,000 310,000 35% Output Area: Value Chapter 13 Question 13 Input Area: Tax rate Interest paid 13,800,000 Output Area: Interest tax shield The interest tax shield repesents the tax savings in current income due to the deductibility of a firm's qualified debt expenses. Chapter 13 insert answers into light blue cells Input boxes in tan Output boxes in yellow Given data in blue Calculations in red Answers in green

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts