Question: please answer as much as possible and I will give u a like!!! thankyou (b) Apple Bank is planning to issue 5% annual coupon bonds

please answer as much as possible and I will give u a like!!! thankyou

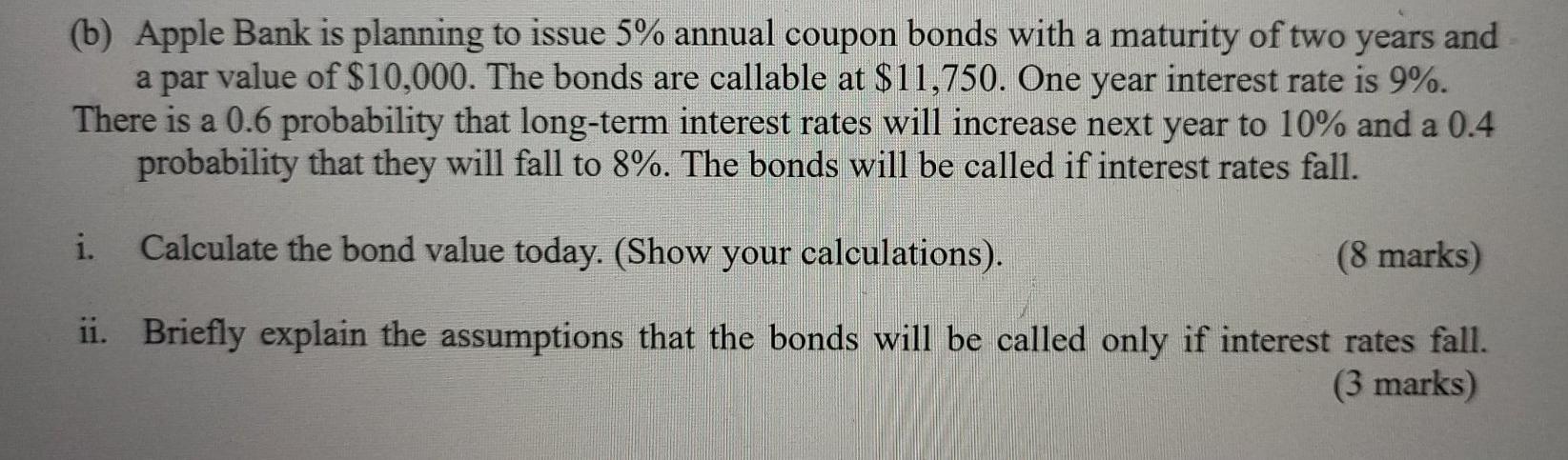

(b) Apple Bank is planning to issue 5% annual coupon bonds with a maturity of two years and a par value of $10,000. The bonds are callable at $11,750. One year interest rate is 9%. There is a 0.6 probability that long-term interest rates will increase next year to 10% and a 0.4 probability that they will fall to 8%. The bonds will be called if interest rates fall. i. Calculate the bond value today. (Show your calculations). (8 marks) ii. Briefly explain the assumptions that the bonds will be called only if interest rates fall

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts