Question: please answer as much as possible and I will give you a like!!! thankyou Question 2 (17 marks) a. LKD's bond currently sells for $834,

please answer as much as possible and I will give you a like!!! thankyou

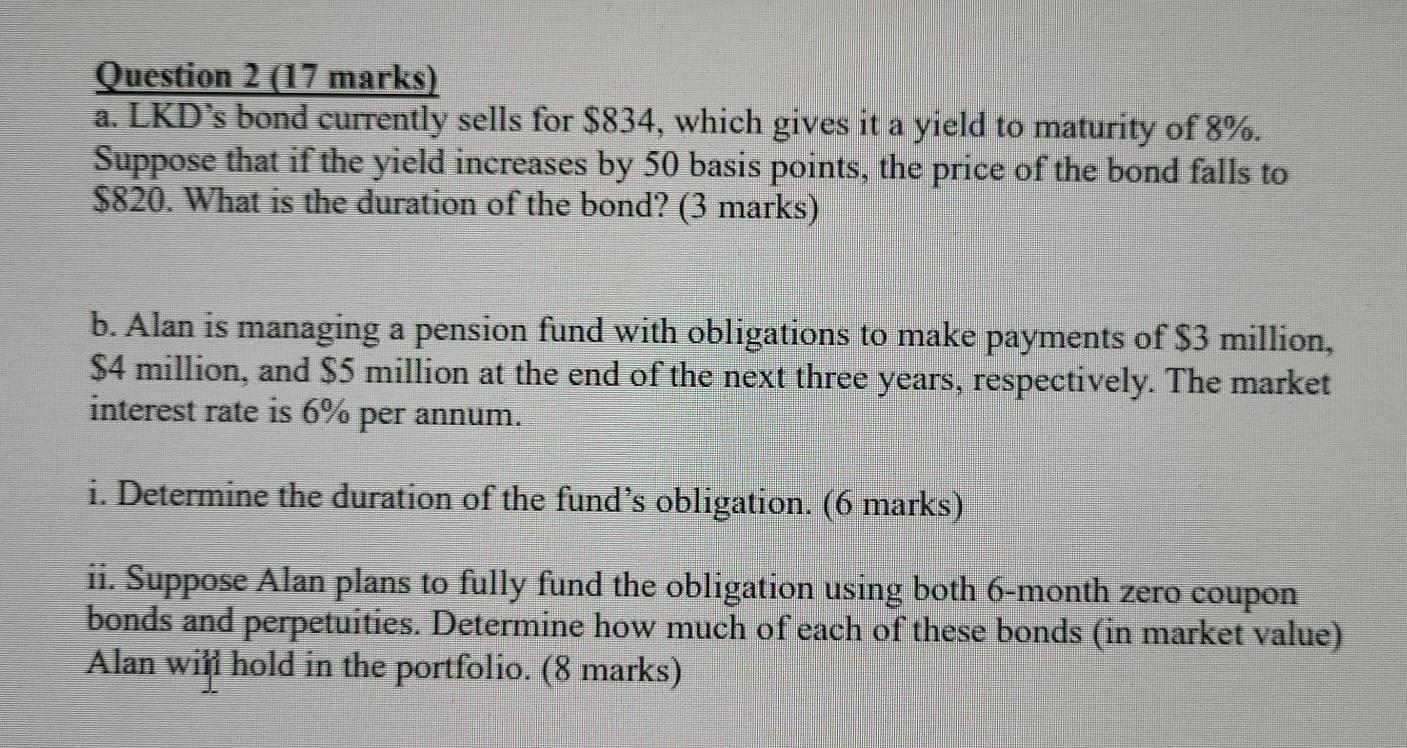

Question 2 (17 marks) a. LKD's bond currently sells for $834, which gives it a yield to maturity of 8%. Suppose that if the yield increases by 50 basis points, the price of the bond falls to $820. What is the duration of the bond? (3 marks) b. Alan is managing a pension fund with obligations to make payments of $3 million, $4 million, and $5 million at the end of the next three years, respectively. The market interest rate is 6% per annum. i. Determine the duration of the fund's obligation. (6 marks) ii. Suppose Alan plans to fully fund the obligation using both 6-month zero coupon bonds and perpetuities. Determine how much of each of these bonds (in market value) Alan will hold in the portfolio. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts