Question: Please answer as per question with memo included in it. Use cca rate in points or do it the way u find it easy, but

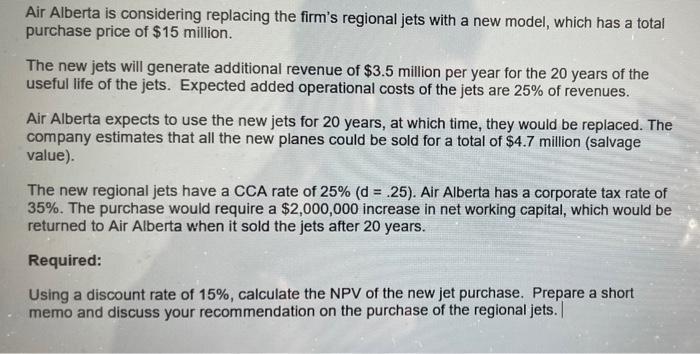

Air Alberta is considering replacing the firm's regional jets with a new model, which has a total purchase price of $15 million. The new jets will generate additional revenue of $3.5 million per year for the 20 years of the useful life of the jets. Expected added operational costs of the jets are 25% of revenues. Air Alberta expects to use the new jets for 20 years, at which time, they would be replaced. The company estimates that all the new planes could be sold for a total of $4.7 million (salvage value). The new regional jets have a CCA rate of 25%(d=.25). Air Alberta has a corporate tax rate of 35%. The purchase would require a $2,000,000 increase in net working capital, which would be returned to Air Alberta when it sold the jets after 20 years. Required: Using a discount rate of 15%, calculate the NPV of the new jet purchase. Prepare a short memo and discuss your recommendation on the purchase of the regional jets. |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts