Question: please answer as quick as possible Dextra Computing sells merchandise for $8,000 cash on September 30 (cost of merchandise is $5,600 ). Dextra collects 2%

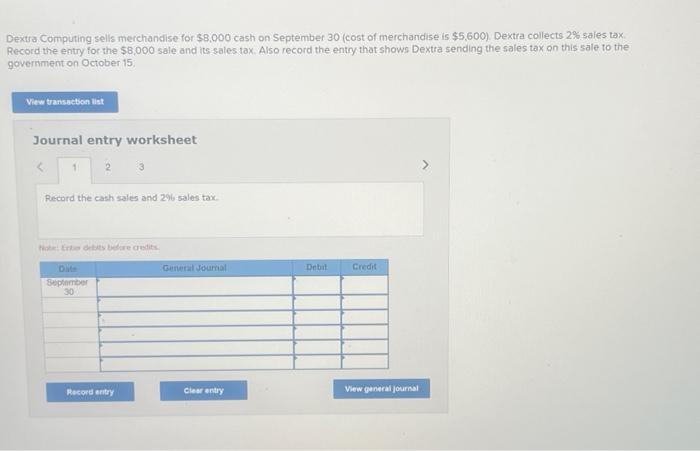

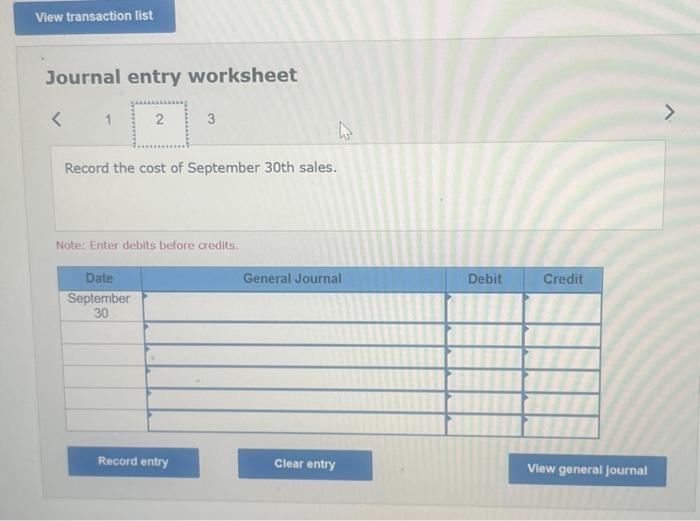

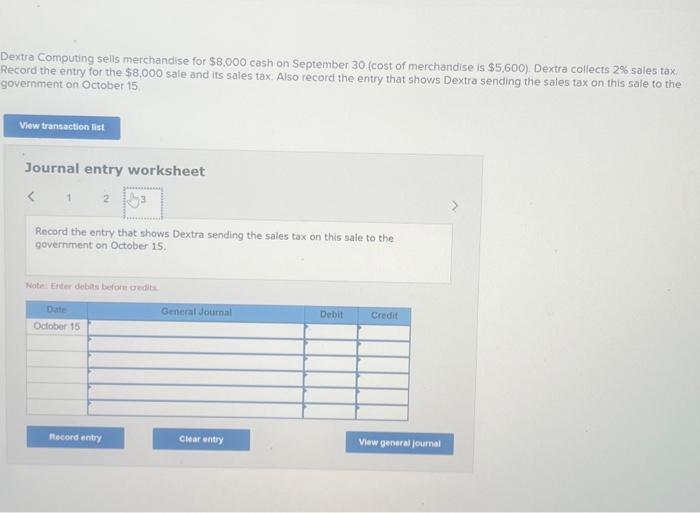

Dextra Computing sells merchandise for $8,000 cash on September 30 (cost of merchandise is $5,600 ). Dextra collects 2% sales tax. Record the entry for the $8,000 sale and its sales tax. Also record the entry that shows. Dextra sending the sales tax on this sale to the governinent on October 15 . Journal entry worksheet Record the cash sales and 296 sales tax. there firde detes belare credits. Journal entry worksheet Record the cost of September 30th sales. Note: Enter debits before credits. Dextra Computing sells merchandise for $8.000 cash on September 30 (cost of merchandise is $5,600 ). Dextra collects 2% sales tax. fecord the entry for the $8,000 sale and its sales tax. Also record the entry that shows Dextra sending the sales tax on this sale to the overnment on October 15 Journal entry worksheet Record the entry that shows Dextra sending the sales tax on this sale to the government on October 15. Note Eter debas before gedits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts