Question: Please answer as quickly and precisely as possible. Suppose that you are an analyst at a global investment bank. A client (Diane McLean) has recently

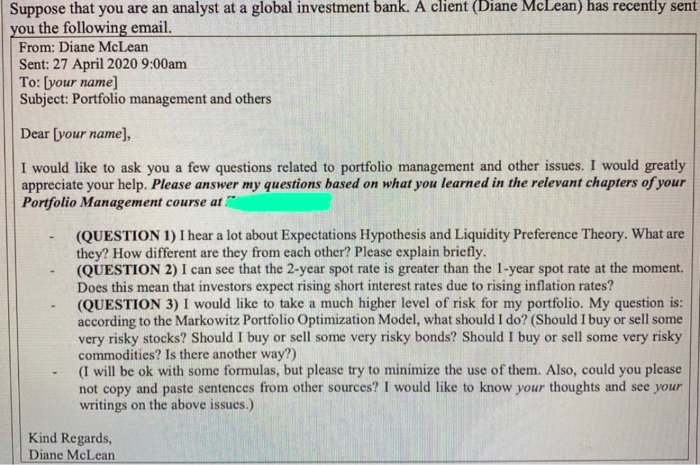

Suppose that you are an analyst at a global investment bank. A client (Diane McLean) has recently sent you the following email. From: Diane McLean Sent: 27 April 2020 9:00am To: [your name] Subject: Portfolio management and others Dear [your name], I would like to ask you a few questions related to portfolio management and other issues. I would greatly appreciate your help. Please answer my questions based on what you learned in the relevant chapters of your Portfolio Management course at (QUESTION 1) I hear a lot about Expectations Hypothesis and Liquidity Preference Theory. What are they? How different are they from each other? Please explain briefly. (QUESTION 2) I can see that the 2-year spot rate is greater than the 1-year spot rate at the moment. Does this mean that investors expect rising short interest rates due to rising inflation rates? (QUESTION 3) I would like to take a much higher level of risk for my portfolio. My question is: according to the Markowitz Portfolio Optimization Model, what should I do? (Should I buy or sell some very risky stocks? Should I buy or sell some very risky bonds? Should I buy or sell some very risky commodities? Is there another way?) (I will be ok with some formulas, but please try to minimize the use of them. Also, could you please not copy and paste sentences from other sources? I would like to know your thoughts and see your writings on the above issues.) Kind Regards, Diane McLean

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts