Question: Please answer as quickly as possible and correctly and I will give a thumbs up all steps do NOT have to be shown as long

Please answer as quickly as possible and correctly and I will give a thumbs up all steps do NOT have to be shown as long as the final answer is correct, thank you.

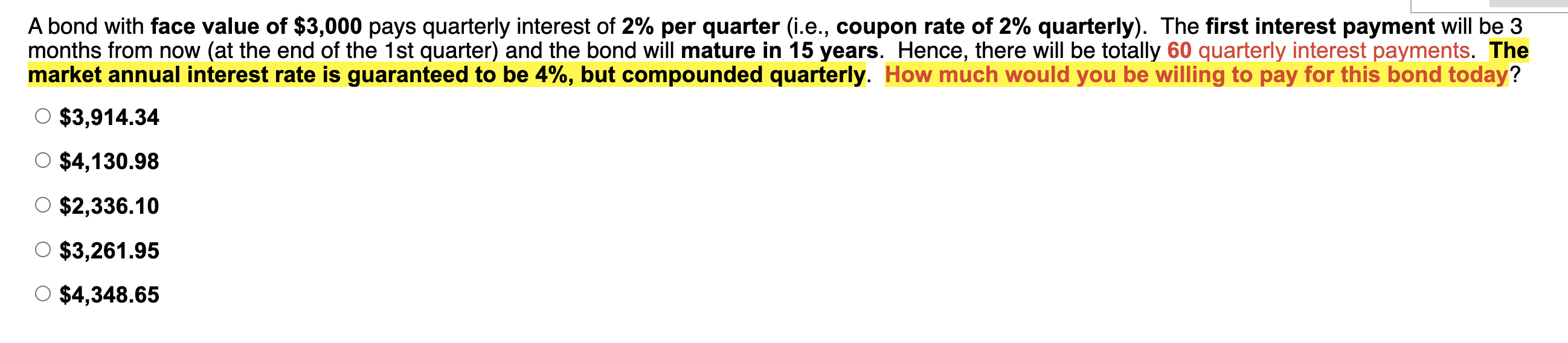

A bond with face value of $3,000 pays quarterly interest of 2% per quarter (i.e., coupon rate of 2% quarterly). The first interest payment will be 3 months from now (at the end of the 1 st quarter) and the bond will mature in 15 years. Hence, there will be totally 60 quarterly interest payments. The market annual interest rate is guaranteed to be 4%, but compounded quarterly. How much would you be willing to pay for this bond today? $3,914.34 $4,130.98 $2,336.10 $3,261.95 $4,348.65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts