Question: Please answer as quickly as possible. I only have a two hour window. Kentucky Hardware Company (KHC) is considering an investment project that requires a

Please answer as quickly as possible. I only have a two hour window.

Kentucky Hardware Company (KHC) is considering an investment project that requires a new machine for producing special tools. This new machine costs $800,000 and will be depreciated over five years on a straight-line basis toward zero salvage value. KHC paid a consulting company $50,000 last year to help them decide whether there is sufficient demand for the special tools. In addition to the investment on the machine, KHC invests $30,000 in net working capital. KHC also has estimated the performance of the new machine and believes that the new machine will produce $450,000 per year in sales, $200,000 per year in cost of goods sold, and $30,000 per year in administrative expenses. The company pays $45,000 in interest expenses annually and has average tax rate 35%.

In order to get an estimate of cost of capital, KHC collect the following information.

Debt: 10,000 6.4% coupon bonds outstanding, $1,000 par value, 25 years to maturity, selling for 110.69% of par; the bonds make semiannual payments.

Common stock: 495,000 shares outstanding, selling for $63 per share; the beta is 1.05; KHCs most recent dividend was $2.73 per share, and dividends are expected to grow at an annual rate of 5% indefinitely.

Preferred stock: 35,000 shares outstanding, selling for $72 per share; the preferred stock dividend is $3.5 per share.

Market: 8.8% market risk premium and 0.75% risk-free rate.

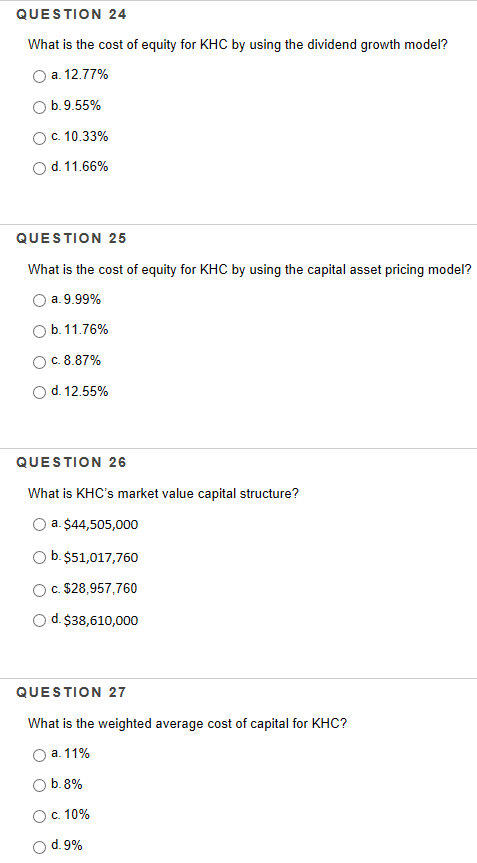

QUESTION 24 What is the cost of equity for KHC by using the dividend growth model? a. 12.77% b. 9.55% C. 10.33% d. 1 1 .66% QUESTION 25 What is the cost of equity for KHC by using the capital asset pricing model? a. 9.99% b. 1 1.76% C. 8.87% d. 12.55% QUESTION 26 What is KHC's market value capital structure? 0 a. $44,505,000 O b. $51,017,760 C. $28,957,760 O d. $38,610,000 QUESTION 27 What is the weighted average cost of capital for KHC? a. 11% b. 8% Og 1096 d. 9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts