Question: PLEASE ANSWER AS QUICKLY AS POSSIBLE! QUESTION USING PROVIDED INFORMATION: IF UNITS SOLD ARE 8000, WHAT SALES PRICE WILL GENERATE -0- PROFIT? A B C

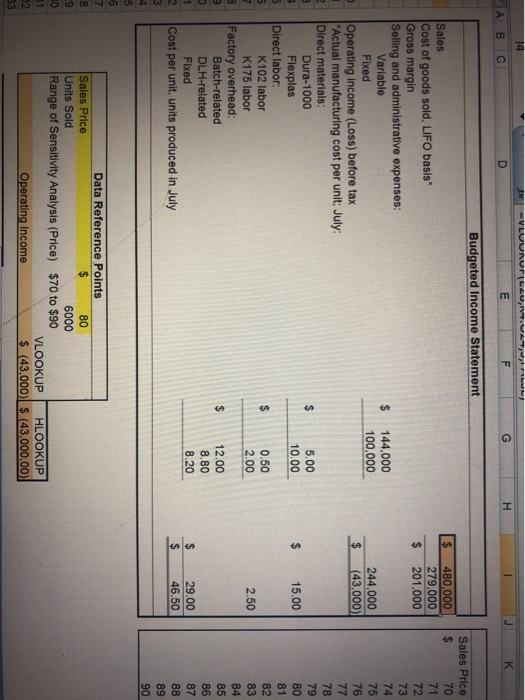

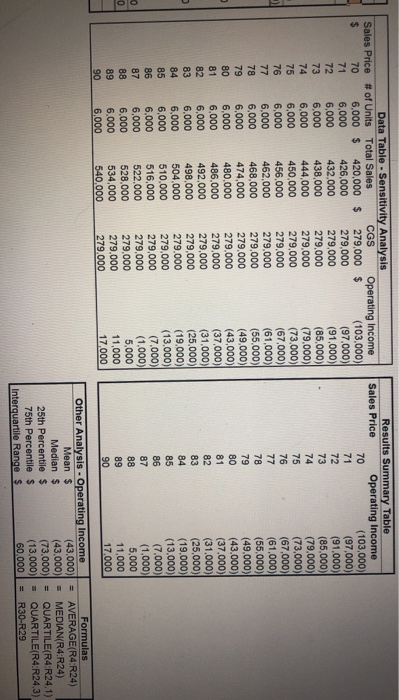

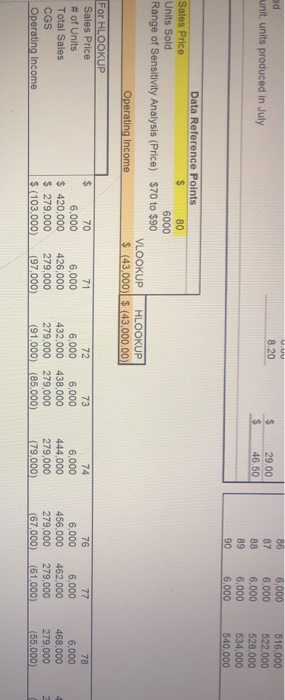

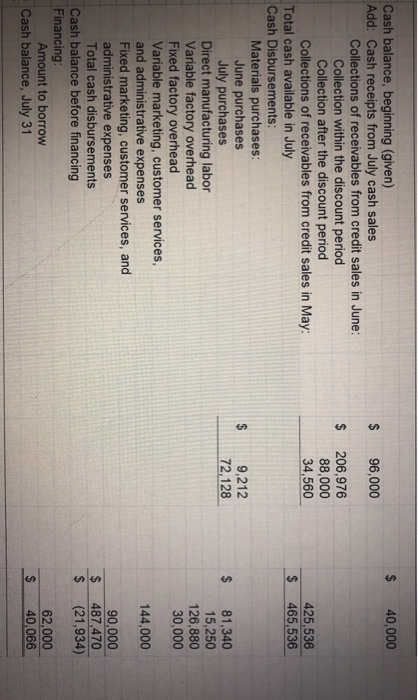

A B C Budgeted Income Statement Sales Price 70 71 72 73 74 75 $ 480,000$ Sales Cost of goods sold, LIFO basis Gross margin Selling and administrative expenses 279,000 $ 201,000 Variable Fixed $144.000 100,000 244,000 $ (43,000) Operating income (Loss) before tax Actual manufacturing cost per unit; July: Direct materials: 78 79 80 81 82 83 84 85 86 87 Dura-1000 Flexplas s 5.00 10.00 $ 15.00 Direct labor K102 labor K175 labor $0.50 2.00 2.50 Factory overhead: Batch-related DLH-related Fixed $12.00 8.80 8.20 $29.00 $ 46.50 Cost per unit, units produced in July 89 90 Data Reference Points Sales Price Units Sold Range of Sensitivity Analysis (Price) 80 6000 $70 to $90 VLOOKUP HLOOKUP (43,000 $ (43,000.00) Operating Income 29.00 S 46.50 8.20 87 6,000 88 6,000 528,000 89 6,000 534,000 90 6,000 522,000 unit, units produced in July 540,000 Data Reference Points Sales Price Units Sol Range of Sensitivity Analysis (Price) 80 6000 $70 to $90 VLOOKUP HLOOKUP $ (43,000)l $ (43.000.00 Operating Income $ 70 78 6,000 Sales Price # of Units Total Sales CGS Operating Income 71 6,000 6,000 s 420,000 426,000 74 6,000 444.000 $ 279,000 279,000 279,000 279,000 279,000 S (103.000) (97,000) (91,000) (85,000) (79,000) 6,000 6,000 456,000 462.000 8,000 279,000 279,000 279,000 67000) (61,000) (55 000) 6,000 6,000 432,000 438,000 sad 250 980 000 000 000-170 3 5 9 0 4 1560 8123 4 5 0 8-2 6-4 0 2 2 6 083 in actpr ess eue ses aseu cooc te JJ

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts