Question: please answer as soon as please B6. Assume there is a semi-annual corporate bond with a 12% coupon interest rate, matures in 14 years and

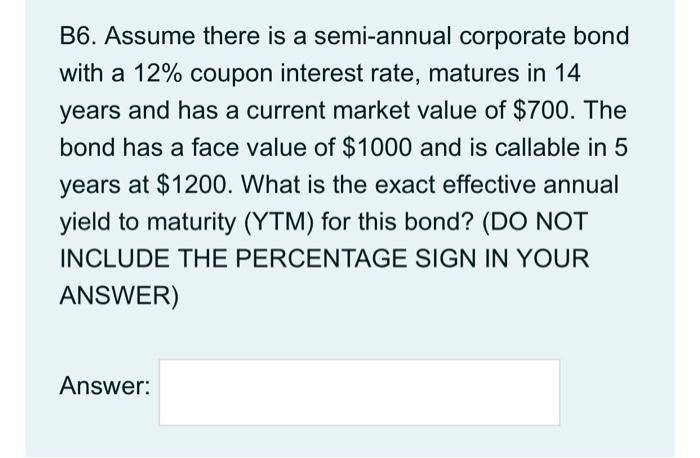

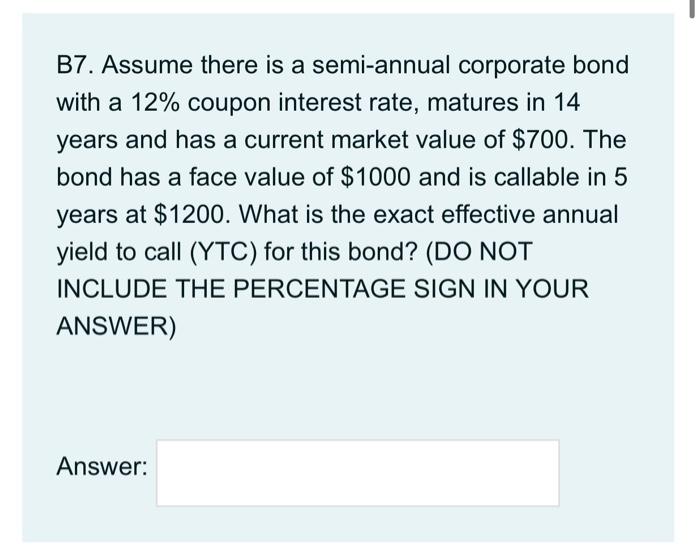

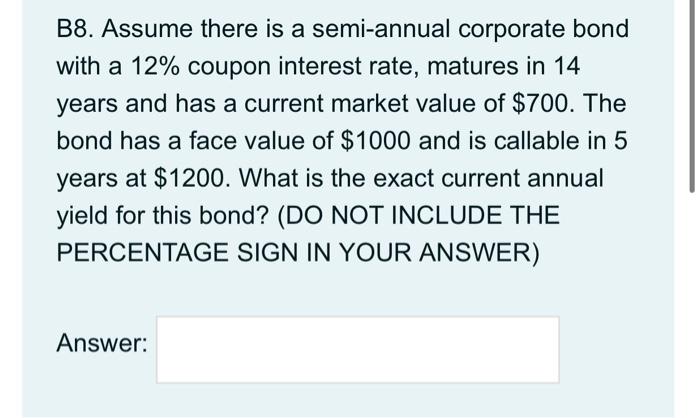

B6. Assume there is a semi-annual corporate bond with a 12% coupon interest rate, matures in 14 years and has a current market value of $700. The bond has a face value of $1000 and is callable in 5 years at $1200. What is the exact effective annual yield to maturity (YTM) for this bond? (DO NOT INCLUDE THE PERCENTAGE SIGN IN YOUR ANSWER) Answer: B7. Assume there is a semi-annual corporate bond with a 12% coupon interest rate, matures in 14 years and has a current market value of $700. The bond has a face value of $1000 and is callable in 5 years at $1200. What is the exact effective annual yield to call (YTC) for this bond? (DO NOT INCLUDE THE PERCENTAGE SIGN IN YOUR ANSWER) Answer: B8. Assume there is a semi-annual corporate bond with a 12% coupon interest rate, matures in 14 years and has a current market value of $700. The bond has a face value of $1000 and is callable in 5 years at $1200. What is the exact current annual yield for this bond? (DO NOT INCLUDE THE PERCENTAGE SIGN IN YOUR ANSWER) Answer: b9. Clarify and explain what impact does the number of years until maturity has on the yield to maturity and on the current yield. 1 A B I UNH III QE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts