Question: Please answer as soon as posible . Question 10 6 pts Financial managers are responsible for evaluating the company's capital project/budgeting opportunities. Which of the

Please answer as soon as posible .

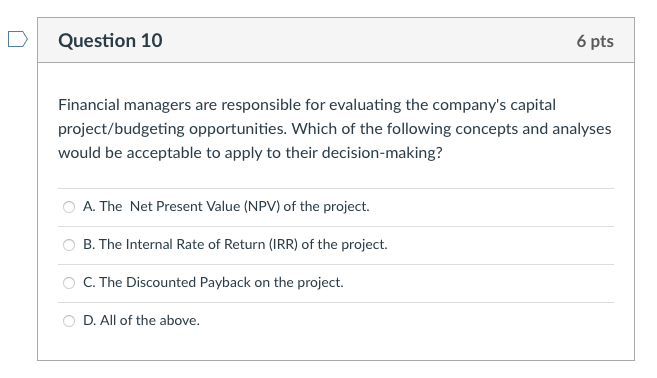

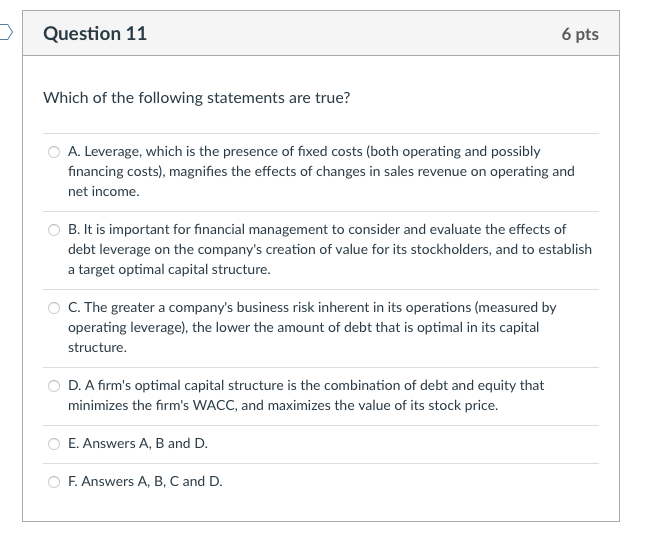

Question 10 6 pts Financial managers are responsible for evaluating the company's capital project/budgeting opportunities. Which of the following concepts and analyses would be acceptable to apply to their decision-making? A. The Net Present Value (NPV) of the project. B. The Internal Rate of Return (IRR) of the project. C. The Discounted Payback on the project. D. All of the above. Question 11 6 pts Which of the following statements are true? A. Leverage, which is the presence of fixed costs (both operating and possibly financing costs), magnifies the effects of changes in sales revenue on operating and net income. OB. It is important for financial management to consider and evaluate the effects of debt leverage on the company's creation of value for its stockholders, and to establish a target optimal capital structure. C. The greater a company's business risk inherent in its operations (measured by operating leverage), the lower the amount of debt that is optimal in its capital structure. D. A firm's optimal capital structure is the combination of debt and equity that minimizes the firm's WACC, and maximizes the value of its stock price. E. Answers A, B and D. O F. Answers A, B, C and D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts