Question: please answer as soon as possible 4 15 3. Serendipity, Inc., usesa job order costing system. Overhead allocation rate is based on direct manufacturing labor

please answer as soon as possible

please answer as soon as possible

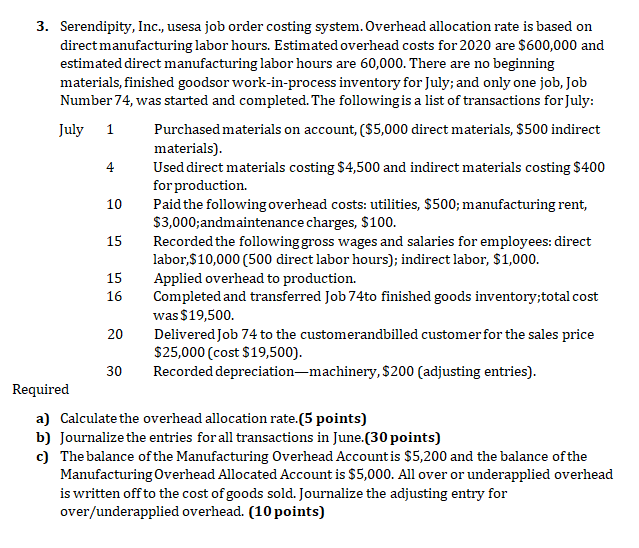

4 15 3. Serendipity, Inc., usesa job order costing system. Overhead allocation rate is based on direct manufacturing labor hours. Estimated overhead costs for 2020 are $600,000 and estimated direct manufacturing labor hours are 60,000. There are no beginning materials, finished goodsor work-in-process inventory for July; and only one job, Job Number 74, was started and completed. The following is a list of transactions for July: July 1 Purchased materials on account, ($5,000 direct materials, $500 indirect materials). Used direct materials costing $4,500 and indirect materials costing $400 for production. 10 Paid the followingoverhead costs: utilities, $500; manufacturing rent, $3,000;andmaintenance charges, $100. Recorded the following gross wages and salaries for employees: direct labor, $10,000 (500 direct labor hours); indirect labor, $1,000. 15 Applied overhead to production. Completed and transferred Job 74to finished goods inventory;total cost was $19,500. 20 Delivered Job 74 to the customerandbilled customer for the sales price $25,000 (cost $19,500). 30 Recorded depreciation-machinery, $200 (adjusting entries). Required a) Calculate the overhead allocation rate.(5 points) b) Journalize the entries for all transactions in June (30 points) c) The balance of the Manufacturing Overhead Account is $5,200 and the balance of the Manufacturing Overhead Allocated Account is $5,000. All over or underapplied overhead is written off to the cost of goods sold. Journalize the adjusting entry for over/underapplied overhead. (10 points) 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts