Question: Please answer as soon as possible 6.) a) Explain three methods for making simple post-horizon forecasts, and how they relate to each other. (9 marks)

Please answer as soon as possible

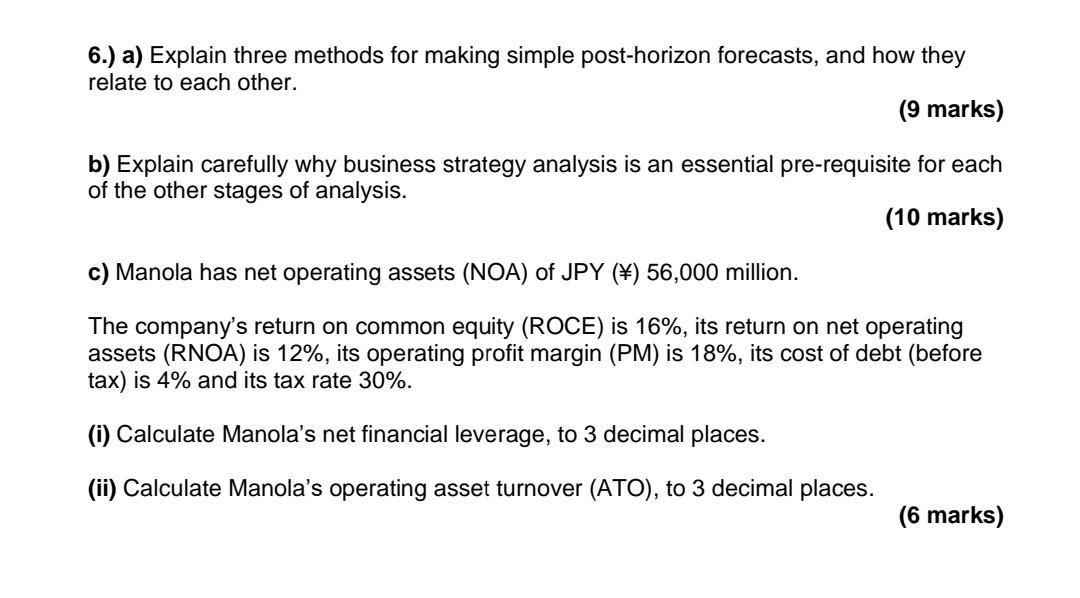

6.) a) Explain three methods for making simple post-horizon forecasts, and how they relate to each other. (9 marks) b) Explain carefully why business strategy analysis is an essential pre-requisite for each of the other stages of analysis. (10 marks) c) Manola has net operating assets (NOA) of JPY () 56,000 million. The company's return on common equity (ROCE) is 16%, its return on net operating assets (RNOA) is 12%, its operating profit margin (PM) is 18%, its cost of debt (before tax) is 4% and its tax rate 30%. (i) Calculate Manola's net financial leverage, to 3 decimal places. (ii) Calculate Manola's operating asset turnover (ATO), to 3 decimal places. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts