Question: please answer as soon as possible a. DEFINE an Initial Public Offering (IPO). b. OUTLINE the TWO KEY ADVANTAGES of an IPO. c. OUTLINE the

please answer as soon as possible

a. DEFINE an Initial Public Offering (IPO).

b. OUTLINE the TWO KEY ADVANTAGES of an IPO.

c. OUTLINE the TWO KEY DISADVANTAGES of an IPO.

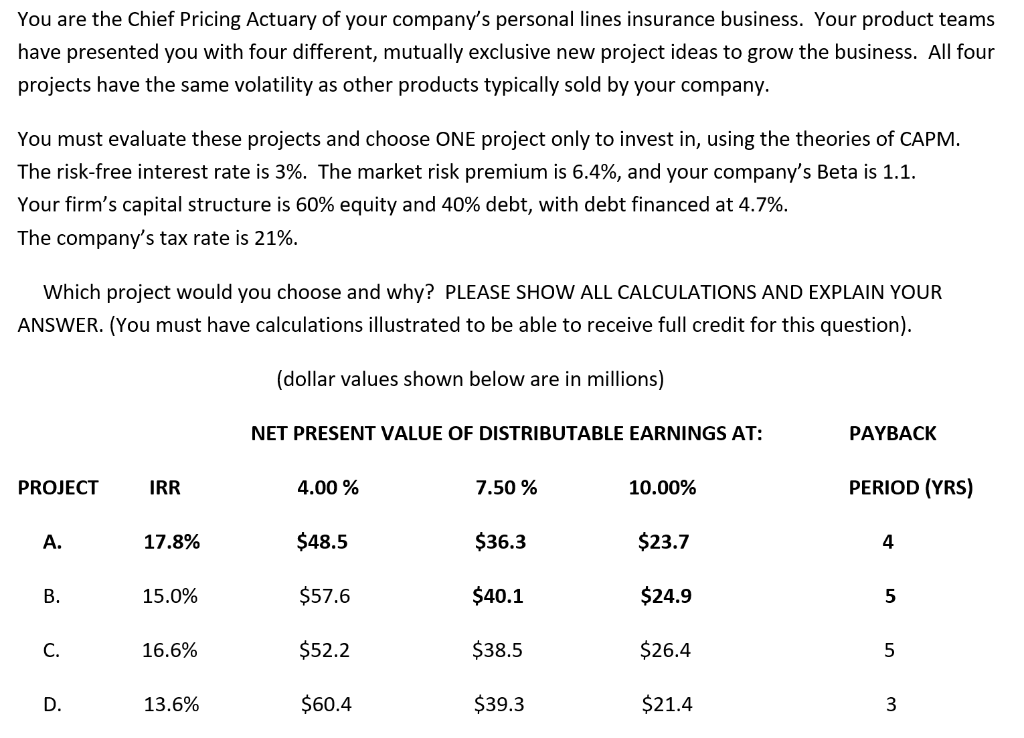

You are the Chief Pricing Actuary of your company's personal lines insurance business. Your product teams have presented you with four different, mutually exclusive new project ideas to grow the business. All four projects have the same volatility as other products typically sold by your company. You must evaluate these projects and choose ONE project only to invest in, using the theories of CAPM. The risk-free interest rate is 3%. The market risk premium is 6.4%, and your company's Beta is 1.1. Your firm's capital structure is 60% equity and 40% debt, with debt financed at 4.7%. The company's tax rate is 21%. Which project would you choose and why? PLEASE SHOW ALL CALCULATIONS AND EXPLAIN YOUR ANSWER. (You must have calculations illustrated to be able to receive full credit for this question). (dollar values shown below are in millions) NET PRESENT VALUE OF DISTRIBUTABLE EARNINGS AT: PAYBACK PROJECT IRR 4.00% 7.50 % 10.00% PERIOD (YRS) A. 17.8% $48.5 $36.3 $23.7 $57.6 $40.1 $24.9 B. c. D. 15.0% 16.6% 13.6% $52.2 $38.5 $26.4 $60.4 $39.3 $21.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts