Question: Please answer as soon as possible Assuming all else equal and based on the assumptions below: How much less would your take home annual pay

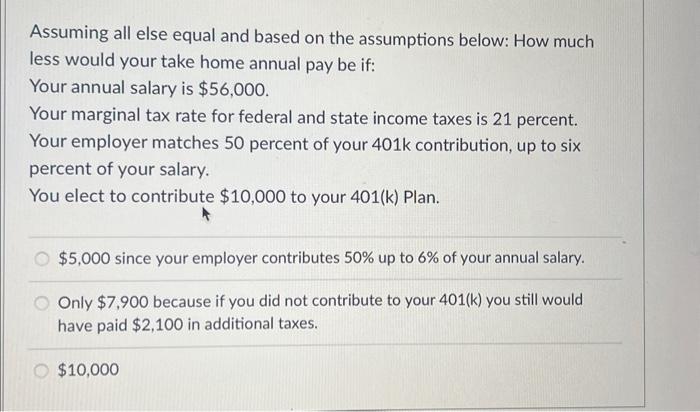

Assuming all else equal and based on the assumptions below: How much less would your take home annual pay be if: Your annual salary is $56,000. Your marginal tax rate for federal and state income taxes is 21 percent. Your employer matches 50 percent of your 401k contribution, up to six percent of your salary. You elect to contribute $10,000 to your 401(k) Plan. $5,000 since your employer contributes 50% up to 6% of your annual salary. Only $7,900 because if you did not contribute to your 401(k) you still would have paid $2,100 in additional taxes. $10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts