Question: please answer as soon as possible for upvote QUESTION #2 (10 MARKS) X Ltd. and Y Ltd. formed a joint venture called XY Inc. on

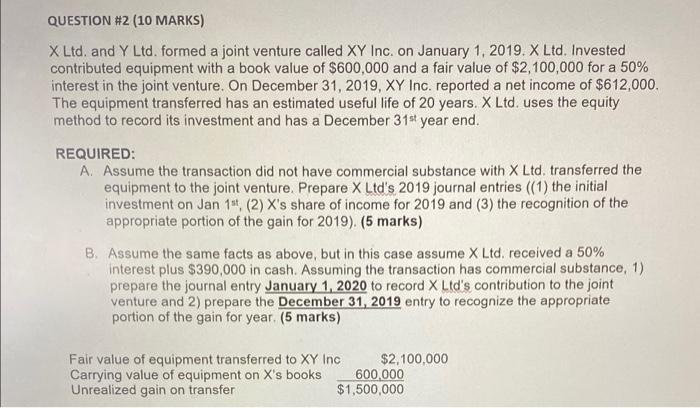

QUESTION #2 (10 MARKS) X Ltd. and Y Ltd. formed a joint venture called XY Inc. on January 1, 2019. X Ltd. Invested contributed equipment with a book value of $600,000 and a fair value of $2,100,000 for a 50% interest in the joint venture. On December 31, 2019, XY Inc. reported a net income of $612,000. The equipment transferred has an estimated useful life of 20 years. X Ltd. uses the equity method to record its investment and has a December 31st year end. REQUIRED: A. Assume the transaction did not have commercial substance with X Ltd. transferred the equipment to the joint venture. Prepare X Ltd's 2019 journal entries (1) the initial investment on Jan 15, (2) X's share of income for 2019 and (3) the recognition of the appropriate portion of the gain for 2019). (5 marks) B. Assume the same facts as above, but in this case assume X Ltd. received a 50% interest plus $390,000 in cash. Assuming the transaction has commercial substance, 1) prepare the journal entry January 1, 2020 to record X Ltd's contribution to the joint venture and 2) prepare the December 31, 2019 entry to recognize the appropriate portion of the gain for year. (5 marks) Fair value of equipment transferred to XY Inc $2,100,000 Carrying value of equipment on X's books 600.000 Unrealized gain on transfer $1,500,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts