Question: please answer as soon as possible I will thumbs up instantly Target Corporation issues a 20-year $6,000,000 bond on January 1, 20xx with a 8%

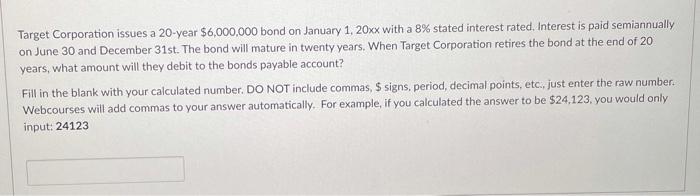

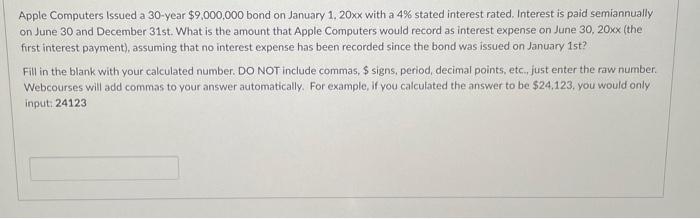

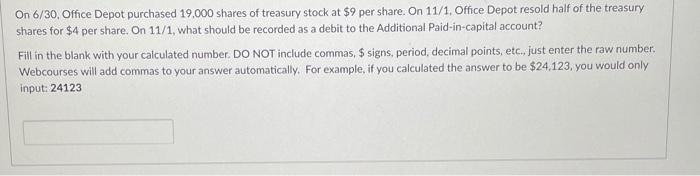

Target Corporation issues a 20-year $6,000,000 bond on January 1, 20xx with a 8% stated interest rated. Interest is paid semiannually on June 30 and December 31st. The bond will mature in twenty years. When Target Corporation retires the bond at the end of 20 years, what amount will they debit to the bonds payable account? Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc., just enter the raw number Webcourses will add commas to your answer automatically. For example, if you calculated the answer to be $24,123, you would only input: 24123 Apple Computers issued a 30-year $9,000,000 bond on January 1, 20xx with a 4% stated interest rated. Interest is paid semiannually on June 30 and December 31st. What is the amount that Apple Computers would record as interest expense on June 30, 20xx (the first interest payment), assuming that no interest expense has been recorded since the bond was issued on January 1st? Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc., just enter the raw number, Webcourses will add commas to your answer automatically. For example, if you calculated the answer to be $24,123, you would only input: 24123 On 6/30, Office Depot purchased 19,000 shares of treasury stock at $9 per share. On 11/1. Office Depot resold half of the treasury shares for $4 per share. On 11/1, what should be recorded as a debit to the Additional Paid-in-capital account? Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc., just enter the raw number Webcourses will add commas to your answer automatically. For example, if you calculated the answer to be $24,123, you would only input: 24123

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts