Question: please answer as soon as possible or thumbs up instantly thank you On December 1st, Orkin Pest Control received cash from a customer in the

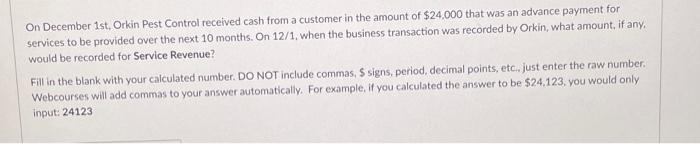

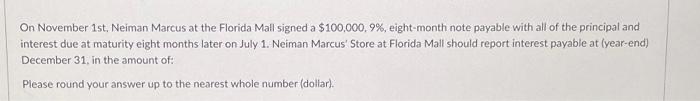

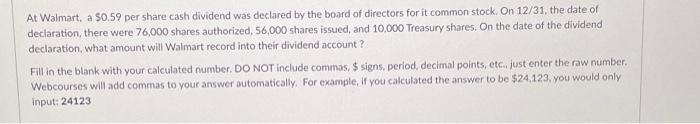

On December 1st, Orkin Pest Control received cash from a customer in the amount of $24,000 that was an advance payment for services to be provided over the next 10 months. On 12/1, when the business transaction was recorded by Orkin, what amount, if any, would be recorded for Service Revenue? Fill in the blank with your calculated number. DO NOT include commas, S signs, period, decimal points, etc., just enter the raw number Webcourses will add commas to your answer automatically. For example, if you calculated the answer to be $24.123, you would only input: 24123 On November 1st. Neiman Marcus at the Florida Mall signed a $100,000,9%, eight-month note payable with all of the principal and interest due at maturity eight months later on July 1. Neiman Marcus' Store at Florida Mall should report interest payable at (year-end) December 31, in the amount of: Please round your answer up to the nearest whole number (dollar). At Walmart. a $0.59 per share cash dividend was declared by the board of directors for it common stock. On 12/31, the date of declaration, there were 76,000 shares authorized, 56,000 shares issued, and 10,000 Treasury shares. On the date of the dividend declaration, what amount will Walmart record into their dividend account? Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc. just enter the raw number Webcourses will add commas to your answer automatically. For example, if you calculated the answer to be $24,123, you would only Input: 24123

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts