Question: PLEASE ANSWER AS SOON AS POSSIBLE PLEASEE!! Why is the aging method, used to calculate the allowance for doubtful accounts, preferable to using a single

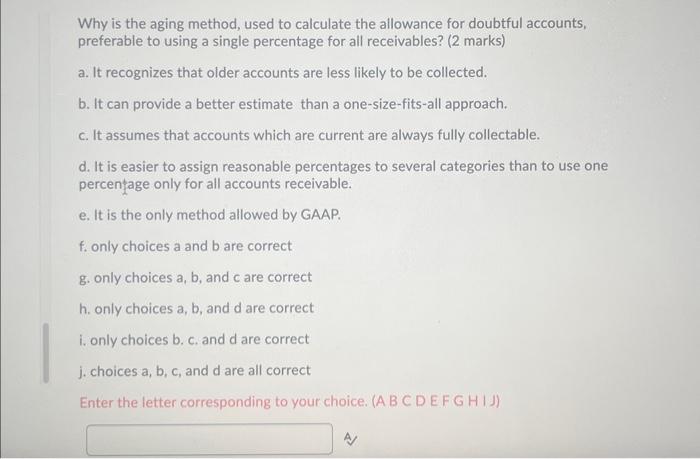

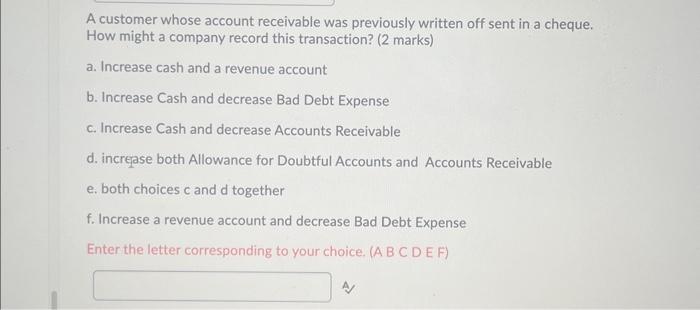

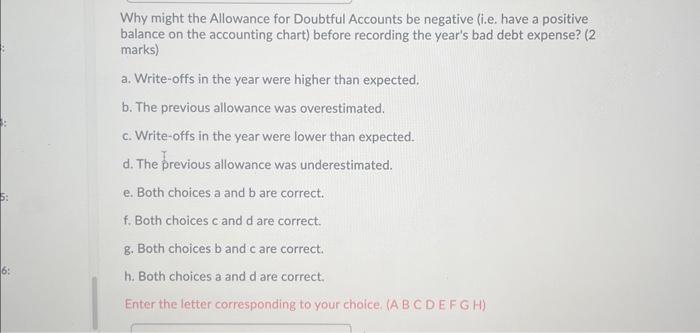

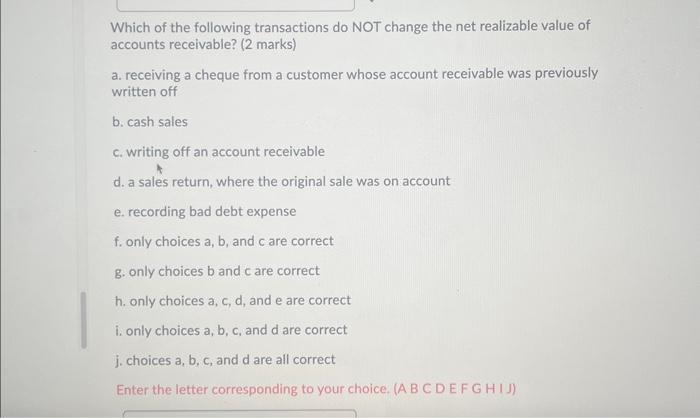

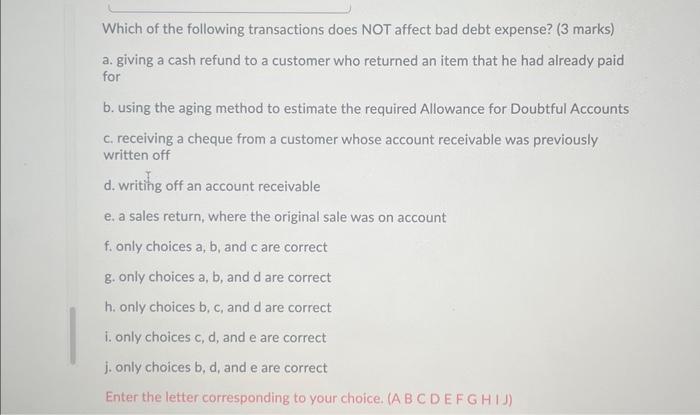

Why is the aging method, used to calculate the allowance for doubtful accounts, preferable to using a single percentage for all receivables? ( 2 marks) a. It recognizes that older accounts are less likely to be collected. b. It can provide a better estimate than a one-size-fits-all approach. c. It assumes that accounts which are current are always fully collectable. d. It is easier to assign reasonable percentages to several categories than to use one percenfage only for all accounts receivable. e. It is the only method allowed by GAAP. f. only choices a and b are correct g. only choices a,b, and c are correct h. only choices a,b, and d are correct i. only choices b. c. and d are correct j. choices a, b, c, and d are all correct Enter the letter corresponding to your choice. (A B C D E FG HIJ) A customer whose account receivable was previously written off sent in a cheque. How might a company record this transaction? (2 marks) a. Increase cash and a revenue account b. Increase Cash and decrease Bad Debt Expense c. Increase Cash and decrease Accounts Receivable d. increqase both Allowance for Doubtful Accounts and Accounts Receivable e. both choices c and d together f. Increase a revenue account and decrease Bad Debt Expense Enter the letter corresponding to your choice. (A B C DE F) Why might the Allowance for Doubtful Accounts be negative (i.e. have a positive balance on the accounting chart) before recording the year's bad debt expense? ( 2 marks) a. Write-offs in the year were higher than expected. b. The previous allowance was overestimated. c. Write-offs in the year were lower than expected. d. The previous allowance was underestimated. e. Both choices a and b are correct. f. Both choices c and d are correct. g. Both choices b and c are correct. h. Both choices a and d are correct. Enter the letter corresponding to your choice. (A B C D E F G H) Which of the following transactions do NOT change the net realizable value of accounts receivable? ( 2 marks) a. receiving a cheque from a customer whose account receivable was previously written off b. cash sales c. writing off an account receivable d. a sales return, where the original sale was on account e. recording bad debt expense f. only choices a, b, and c are correct g. only choices b and c are correct h. only choices a, c, d, and e are correct i. only choices a, b, c, and d are correct j. choices a, b, c, and d are all correct Enter the letter corresponding to your choice. (A B C D E FG H I J) Which of the following transactions does NOT affect bad debt expense? ( 3 marks) a. giving a cash refund to a customer who returned an item that he had already paid for b. using the aging method to estimate the required Allowance for Doubtful Accounts c. receiving a cheque from a customer whose account receivable was previously written off d. writing off an account receivable e. a sales return, where the original sale was on account f. only choices a,b, and c are correct g. only choices a, b, and d are correct h. only choices b,c, and d are correct i. only choices c,d, and e are correct j. only choices b, d, and e are correct Enter the letter corresponding to your choice. (A BC D E FG H I J)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts