Question: please answer as soon as possible The information necessary for preparing the 2021 year-end adjusting entries for Bearcat Personal Training Academy appears below. Bearcat's fiscal

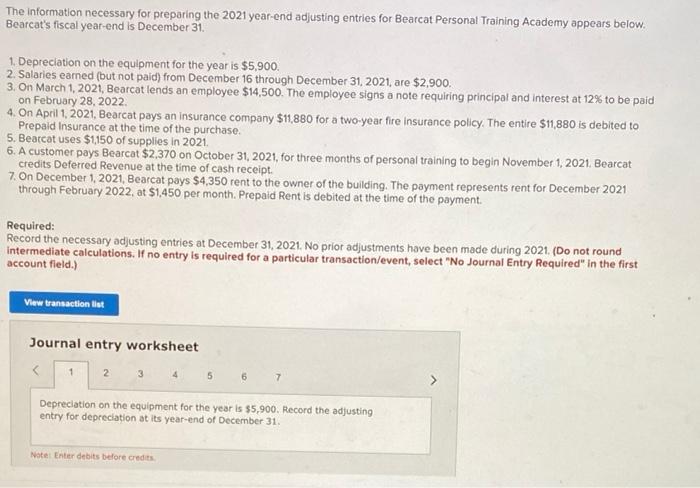

The information necessary for preparing the 2021 year-end adjusting entries for Bearcat Personal Training Academy appears below. Bearcat's fiscal year-end is December 31. 1. Depreciation on the equipment for the year is $5,900. 2. Salaries earned (but not paid) from December 16 through December 31, 2021, are $2,900. 3. On March 1, 2021 , Bearcat lends an employee $14,500. The employee signs a note requiring principal and interest at 12% to be paid on February 28, 2022 4. On April 1, 2021, Bearcat pays an insurance company $11,880 for a two-year fire insurance policy. The entire $11,880 is debited to Prepaid Insurance at the time of the purchase. 5. Bearcat uses $1,150 of supplies in 2021. 6. A customer pays Bearcat $2,370 on October 31, 2021, for three months of personal training to begin November 1, 2021. Bearcat credits Deferred Revenue at the time of cash receipt. 7. On December 1, 2021, Bearcat pays $4,350 rent to the owner of the building. The payment represents rent for December 2021 through February 2022, at $1,450 per month. Prepaid Rent is debited at the time of the payment Required: Record the necessary adjusting entries at December 31, 2021. No prior adjustments have been made during 2021. (Do not round intermediate calculations. If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Depreciation on the equipment for the year is $5.900. Record the adjusting entry for depreciation at its year-end of December 31. Note Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts