Question: please answer asap! 3. Orange, Inc. (a C corp.) distributes machinery (FMV - $200,000; basis $80,000) to Christina (an individual shareholder) in retum for 100

please answer asap!

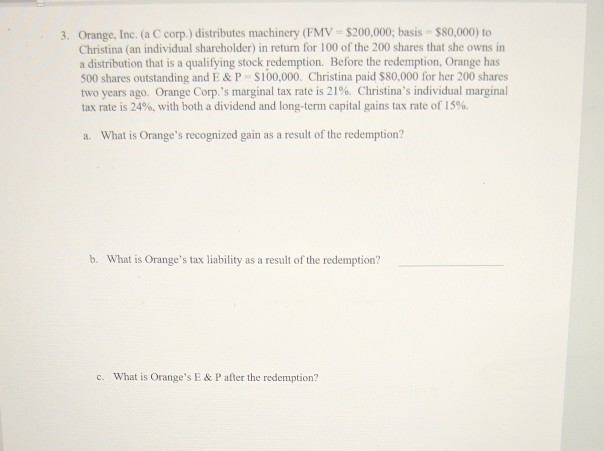

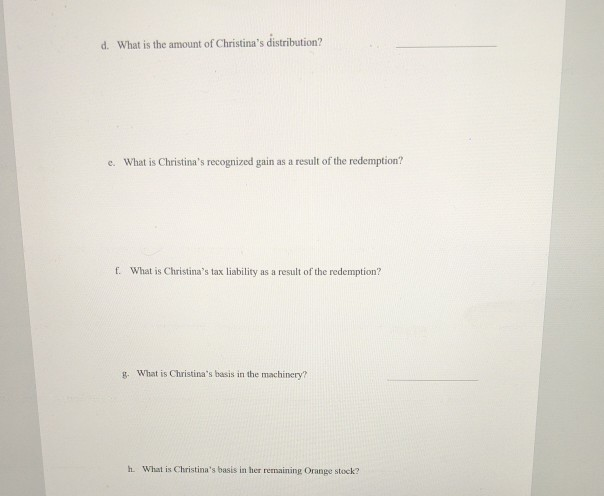

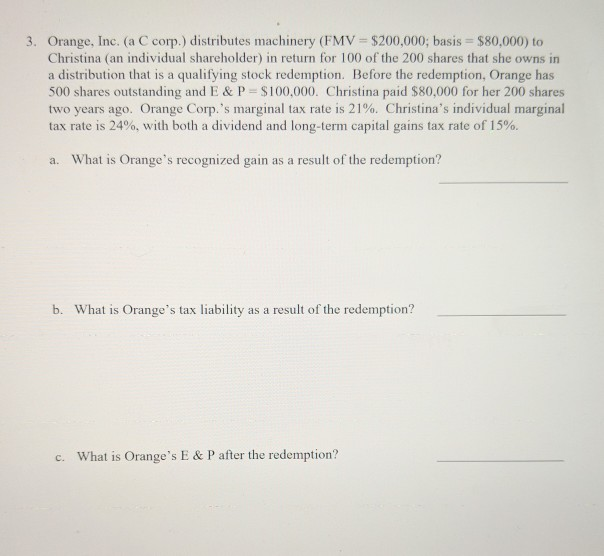

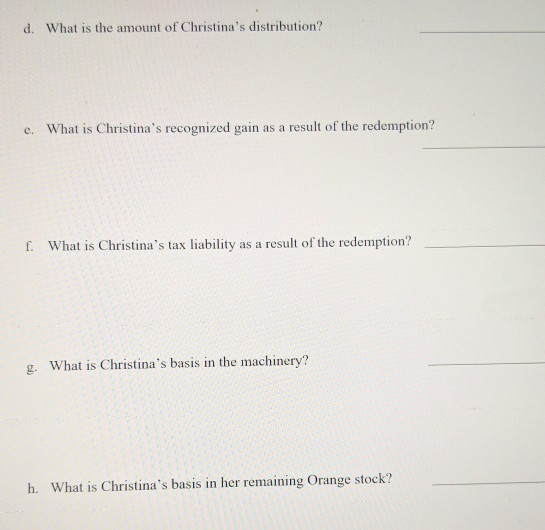

3. Orange, Inc. (a C corp.) distributes machinery (FMV - $200,000; basis $80,000) to Christina (an individual shareholder) in retum for 100 of the 200 shares that she owns in a distribution that is a qualifying stock redemption. Before the redemption, Orange has 500 shares outstanding and E&P S100,000. Christina paid $80,000 for her 200 shares two years ago. Orange Corp's marginal tax rate is 21%, Christina's individual marginal tax rate is 24%, with both a dividend and long-term capital gains tax rate of 15% a. What is Orange's recognized gain as a result of the redemption? b. What is Orange's tax liability as a result of the redemption? c. What is Orange's E&P after the redemption? d. What is the amount of Christina's distribution? e. What is Christina's recognized gain as a result of the redemption? f. What is Christina's tax liability as a result of the redemption? 5. What is Christina's basis in the machinery? h. What is Christina's basis in her remaining Orange stock? 3. Orange, Inc. (a C corp.) distributes machinery (FMV = $200,000; basis = $80,000) to Christina (an individual shareholder) in return for 100 of the 200 shares that she owns in a distribution that is a qualifying stock redemption. Before the redemption, Orange has 500 shares outstanding and E & P = $100,000. Christina paid $80,000 for her 200 shares two years ago. Orange Corp.'s marginal tax rate is 21%. Christina's individual marginal tax rate is 24%, with both a dividend and long-term capital gains tax rate of 15%. a. What is Orange's recognized gain as a result of the redemption? b. What is Orange's tax liability as a result of the redemption? c. What is Orange's E & P after the redemption? d. What is the amount of Christina's distribution? e. What is Christina's recognized gain as a result of the redemption? f. What is Christina's tax liability as a result of the redemption? g. What is Christina's basis in the machinery? h. What is Christina's basis in her remaining Orange stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts