Question: Please answer ASAP! a Altro Energy plc (Altro) is a power generation company operating in the UK. It operates in two distinct sectors, its Renewable

Please answer ASAP!

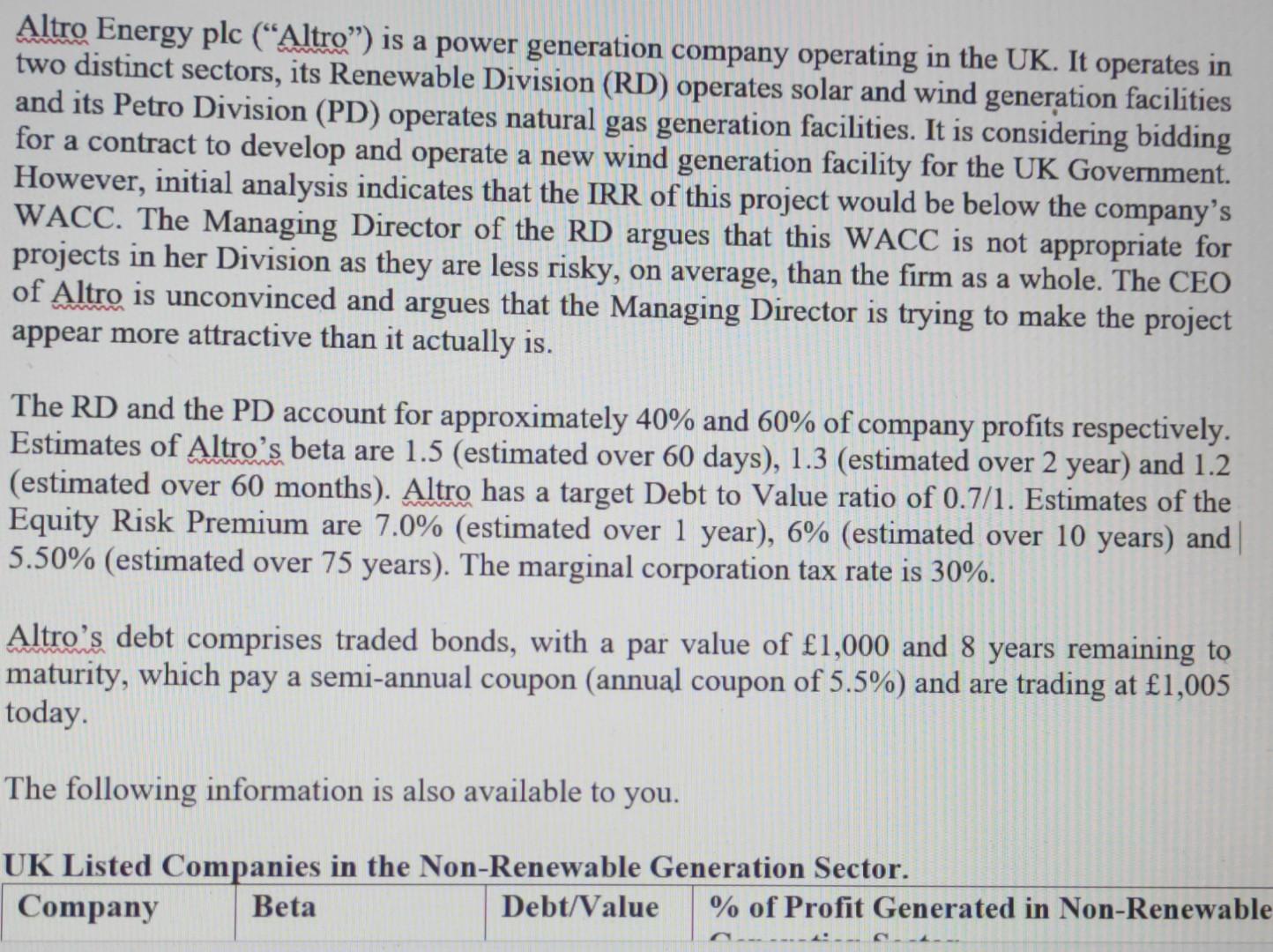

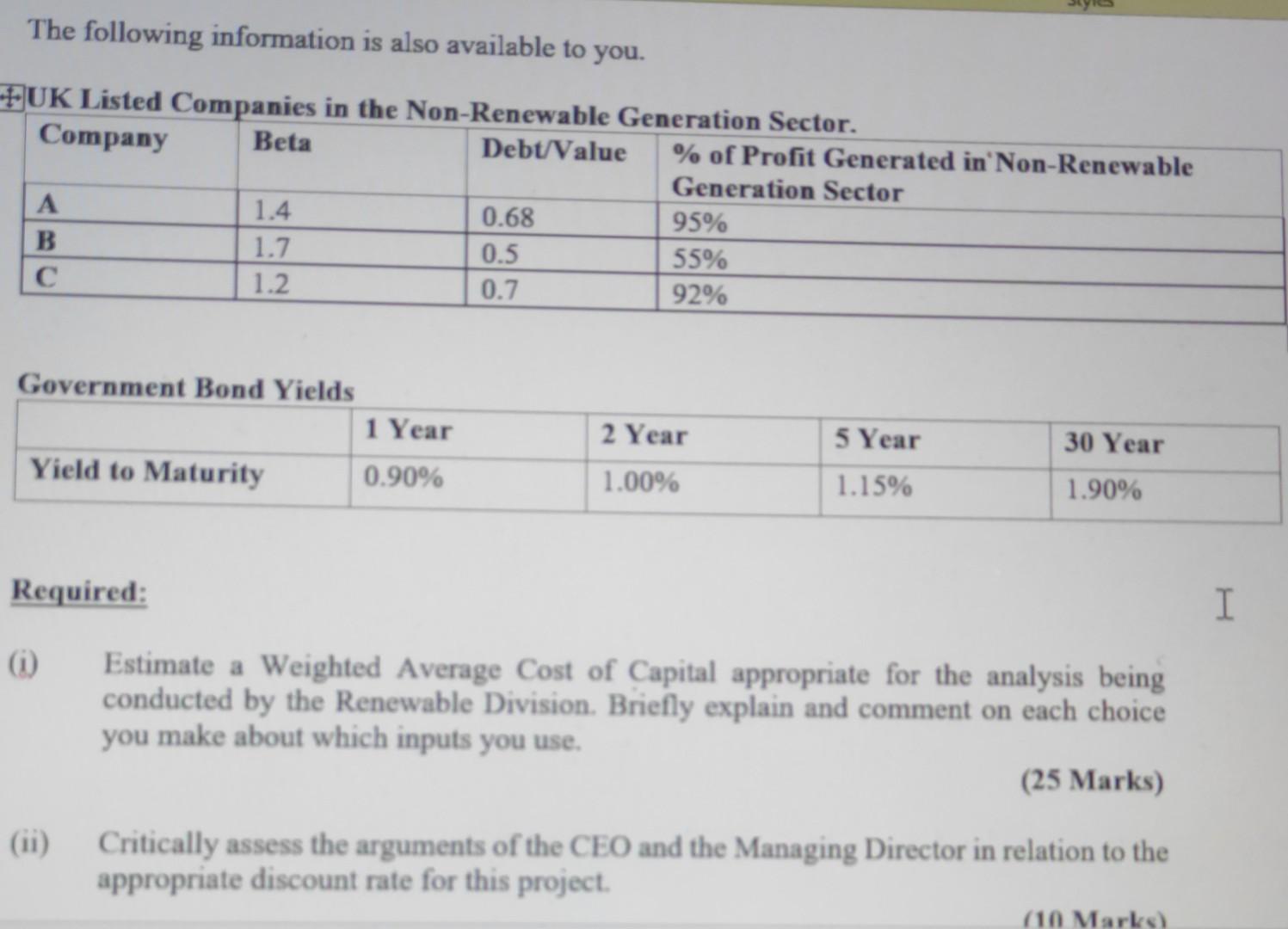

a Altro Energy plc (Altro") is a power generation company operating in the UK. It operates in two distinct sectors, its Renewable Division (RD) operates solar and wind generation facilities and its Petro Division (PD) operates natural gas generation facilities. It is considering bidding for a contract to develop and operate a new wind generation facility for the UK Government. However, initial analysis indicates that the IRR of this project would be below the company's WACC. The Managing Director of the RD argues that this WACC is not appropriate for projects in her Division as they are less risky, on average, than the firm as a whole. The CEO of Altro is unconvinced and argues that the Managing Director is trying to make the project appear more attractive than it actually is. The RD and the PD account for approximately 40% and 60% of company profits respectively. Estimates of Altro's beta are 1.5 (estimated over 60 days), 1.3 (estimated over 2 year) and 1.2 (estimated over 60 months). Altro has a target Debt to Value ratio of 0.7/1. Estimates of the Equity Risk Premium are 7.0% (estimated over 1 year), 6% (estimated over 10 years) and 5.50% (estimated over 75 years). The marginal corporation tax rate is 30%. Altro's debt comprises traded bonds, with a par value of 1,000 and 8 years remaining to maturity, which pay a semi-annual coupon (annual coupon of 5.5%) and are trading at 1,005 today The following information is also available to you. UK Listed Companies in the Non-Renewable Generation Sector. Company Beta Debt/Value % of Profit Generated in Non-Renewable The following information is also available to you. *UK Listed Companies in the Non-Renewable Generation Sector. Company Beta Debt/Value % of Profit Generated in Non-Renewable Generation Sector A 1.4 0.68 95% B 1.7 0.5 55% 0.7 92% NN 1.2 Government Bond Yields 1 Year 2 Year 30 Year Yield to Maturity 0.90% 5 Year 1.15% 1.00% 1.90% Required: I Estimate a Weighted Average Cost of Capital appropriate for the analysis being conducted by the Renewable Division. Briefly explain and comment on each choice you make about which inputs you use. (25 Marks) Critically assess the arguments of the CEO and the Managing Director in relation to the appropriate discount rate for this project. (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts