Question: Please answer asap a. Indicate whether the following statements are True or False regarding tax planning opportunities and parent-subsidiary liquidations. Whether 5 332 applies depends

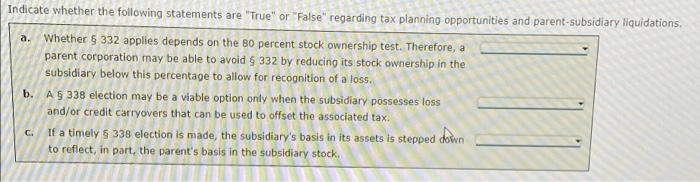

a. Indicate whether the following statements are "True" or "False" regarding tax planning opportunities and parent-subsidiary liquidations. Whether 5 332 applies depends on the 80 percent stock ownership test. Therefore, a parent corporation may be able to avoid 332 by reducing its stock ownership in the subsidiary below this percentage to allow for recognition of a loss. b. A 338 election may be a viable option only when the subsidiary possesses loss and/or credit carryovers that can be used to offset the associated tax. If a timely $ 338 election is made, the subsidiary's basis in its assets is stepped down to reflect, in part, the parent's basis in the subsidiary stock. C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts