Question: Please answer asap! :) Acton Company has two products: A and B. The annual production and sales of Product A is 800 units and of

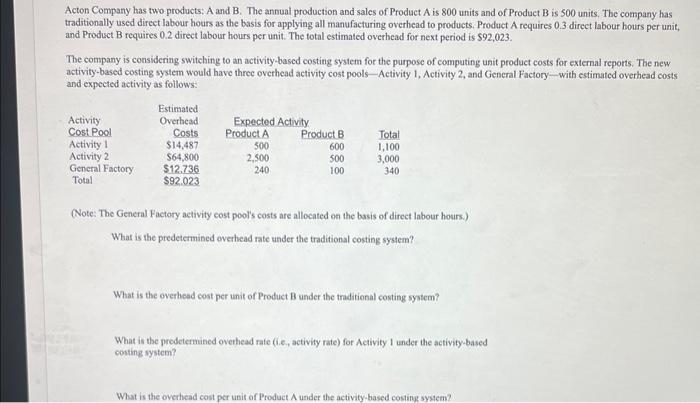

Acton Company has two products: A and B. The annual production and sales of Product A is 800 units and of Product B is 500 units, The company has traditionally used direet labour hours as the basis for applying all manufacturing overhead to products. Product A requires 0.3 direct labour bours per unit, and Prodsct B requires 0.2 direct labour hours per unit. The total estimated overhead for next period is $92,023. The company is considering switching to an activity-based costing system for the purpose of compating unit product costs for external reports. The new activity-based costing system would have threc overhead activity cost pools -Activity 1, Activity 2, and General Factory - with estimated overhead costs and expected activity as follows (Note: The General Factory activity cost pool's costs are allocated on the basis of direct labour hours.) What is the predetermined ovethead rate under the traditional costing system? What is the overbead cost per unit of Product B under the traditional costing system? What is the predetemined overhead rate (i.e, activity rate) for Activity 1 under the activity-based coting system? What is the overhead cost per unit of Product A under the activity-based costing sysem

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts