Question: PLEASE ANSWER ASAP all answers are either true or false Discussion Question 3-1 (LO. 1) Janice is the sole owner of Catbird Company. In the

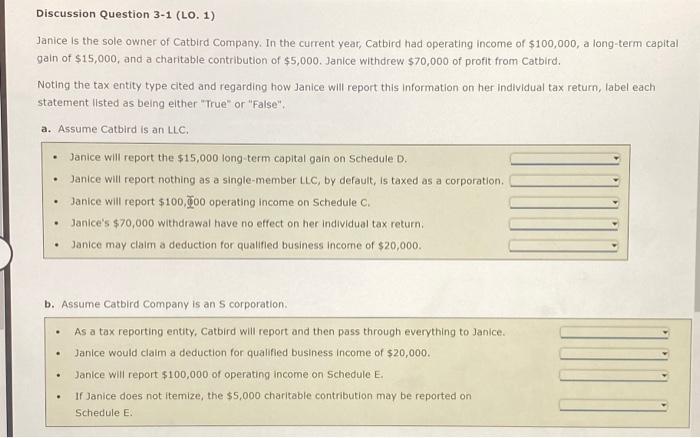

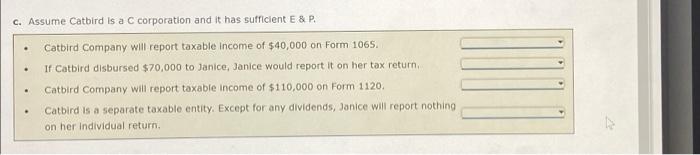

Discussion Question 3-1 (LO. 1) Janice is the sole owner of Catbird Company. In the current year, Catbird had operating income of $100,000, a long-term capital gain of $15,000, and a charitable contribution of $5,000. Janice withdrew $70,000 of profit from Catbird. Noting the tax entity type cited and regarding how Janice will report this information on her Individual tax return, label each statement listed as being either "True" or "False", a. Assume Catbird is an LLC. . Janice will report the $15,000 long-term capital gain on Schedule D. Janice will report nothing as a single-member LLC, by default, Is taxed as a corporation. Janice will report $100.000 operating income on Schedule C. Janice's $70,000 withdrawal have no effect on her individual tax return. Janice may claim a deduction for qualified business Income of $20,000. . . b. Assume Catbird Company is an s corporation: As a tax reporting entity, Catbird will report and then pass through everything to Janice. Janice would claim a deduction for qualified business income of $20,000. Janice will report $100,000 of operating income on Schedule E. In Janice does not itemize, the $5,000 charitable contribution may be reported on Schedule E. C. Assume Catbird is a C corporation and it has sufficient E & P. . . Catbird Company will report taxable income of $40,000 on Form 1065 If Catbird disbursed $70,000 to Janice, Janice would report it on her tax return Catbird Company will report taxable income of $110,000 on Form 1120. Catbird is a separate taxable entity. Except for any dividends, Janice will report nothing on her Individual return

Step by Step Solution

There are 3 Steps involved in it

To answer the questions accurately Ill analyze each statement based on the assumed tax entity type and the US tax rules related to each a Assume Catbi... View full answer

Get step-by-step solutions from verified subject matter experts