Question: Please answer asap and explain! WIll give thumbs up XY7 company in the US has an account receivable (A/R.due in 90 days. X12,000,000, from a

Please answer asap and explain! WIll give thumbs up

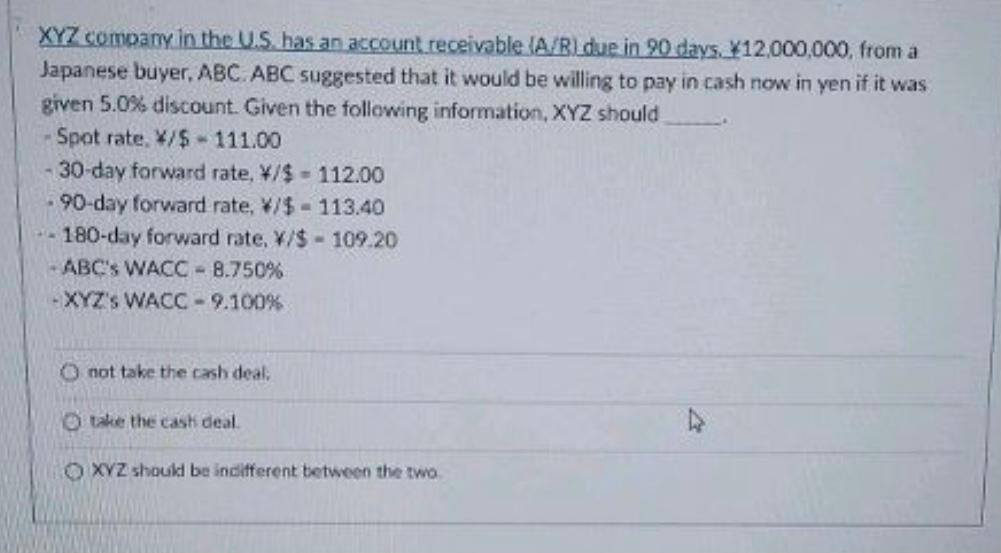

XY7 company in the US has an account receivable (A/R.due in 90 days. X12,000,000, from a Japanese buyer, ABC ABC suggested that it would be willing to pay in cash now in yen if it was given 5.0% discount. Given the following information, XYZ should Spot rate. W/$ - 111.00 30-day forward rate, W/$ - 112.00 . 90-day forward rate, /$ - 113.40 - 180-day forward rate, X/$ - 109.20 - ABC's WACC -8.750% -XYZ'S WACC -9.100% not take the cash deals take the cast deal XYZ should be indifferent between the two

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock