Question: please answer asap and i will leave a thumb up ! ! ! Problem 1 ( 3 0 points ) : ( Box method )

please answer asap and i will leave a thumb up Problem points: Box method

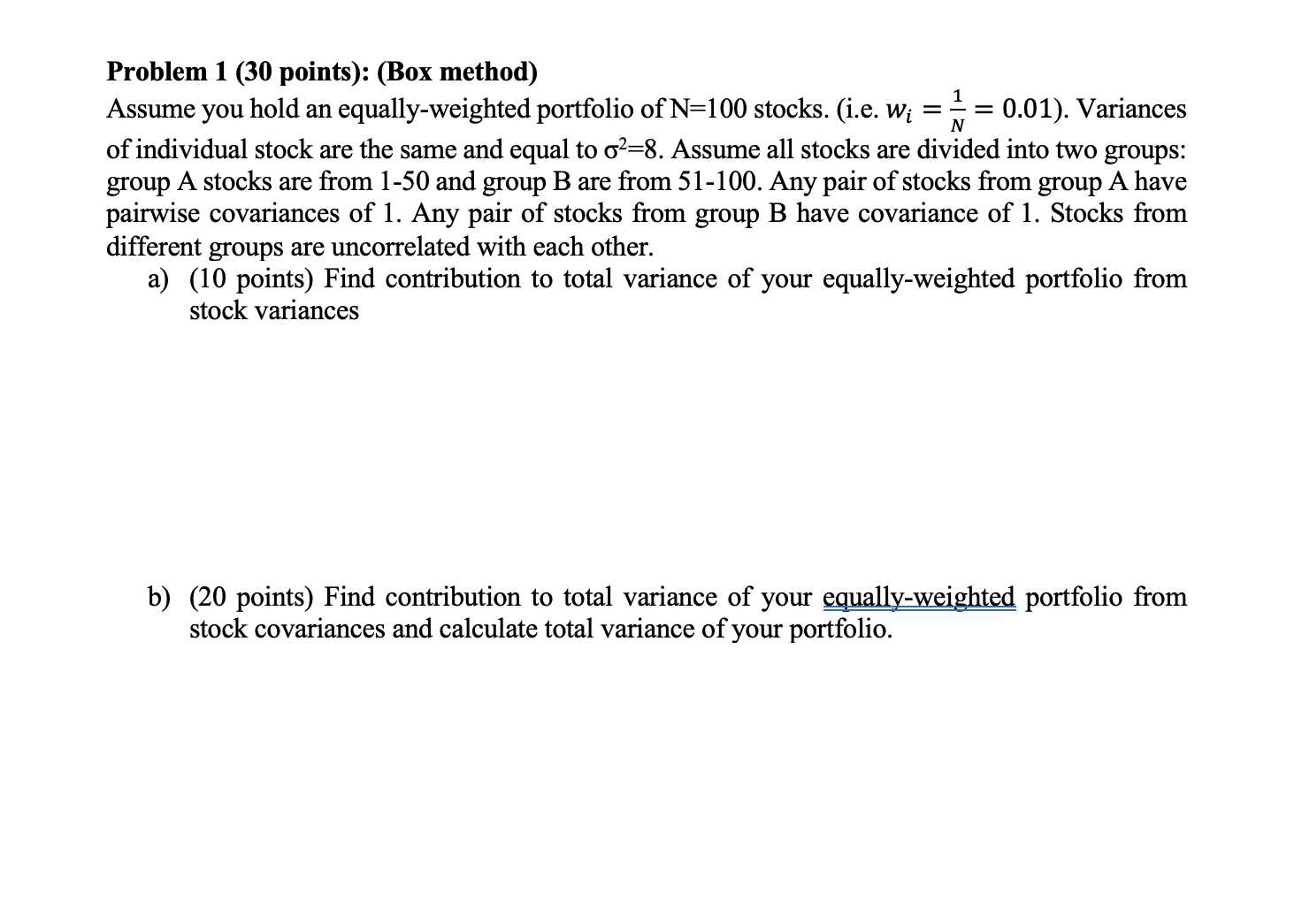

Assume you hold an equallyweighted portfolio of mathrmN stocks. ie wifracN Variances of individual stock are the same and equal to sigma Assume all stocks are divided into two groups: group A stocks are from and group B are from Any pair of stocks from group A have pairwise covariances of Any pair of stocks from group B have covariance of Stocks from different groups are uncorrelated with each other.

a points Find contribution to total variance of your equallyweighted portfolio from stock variances

b points Find contribution to total variance of your equallyweighted portfolio from stock covariances and calculate total variance of your portfolio.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock